B) False

Correct Answer

verified

Correct Answer

verified

True/False

In general,P/E ratios are fairly consistent across industries,regardless of the goods or services sold.Industry P/E ratios vary considerably.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

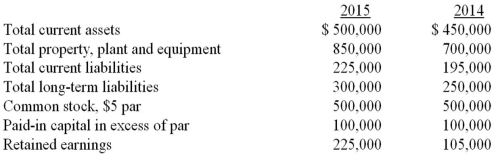

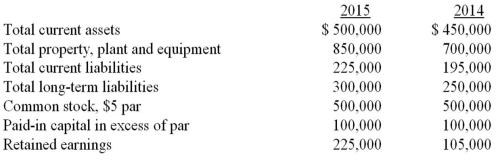

Use the information above to answer the following question.Which of the following is closest to the company's current ratio for 2015?

A) 2.22

B) 2.26

C) 2.57

D) 6.0

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has current assets of $450,000 and a current ratio is 2.5.Assume that the company prepays rent for 9 months in the amount of $20,000.The current ratio after this transaction is closest to

A) 2.39.

B) 2.61.

C) 2.5.

D) 2.81.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a common size balance sheet,each item on the balance sheet is expressed as a percentage of:

A) Total assets.

B) Total liabilities.

C) Net income.

D) Total stockholders' equity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company had current assets of $550,000 and a current ratio of 2.0.The current assets consist of Cash of $50,000,Short-term investments of $150,000,Accounts receivable of $50,000,and Inventory of $300,000.Which of the following is closest to the company's quick ratio?

A) 2.0

B) 1.82

C) 0.53

D) 0.91

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you wish to examine how one aspect of a business is doing relative to other aspects of the business at the current time,you are most likely to use:

A) time-series analysis.

B) ratio analysis.

C) horizontal analysis.

D) cross-sectional analysis.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Vertical analysis is the comparison of a company's financial information over time.Vertical analysis focuses on important relationships within the same financial statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net income was $418,600 in 2014 and $364,000 in 2013.The year-to-year percentage change in net income is closest to:

A) 15%.

B) 55%.

C) 87%.

D) 13%.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is calculated by dividing net sales by average total assets?

A) Net profit margin.

B) Fixed asset turnover.

C) Asset turnover ratio.

D) Current ratio.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding trend analysis is true?

A) Time-series analysis is an example of trend analysis.

B) Trend data are always in dollars.

C) Trend analysis is also known as vertical analysis.

D) Common-size analysis is an example of trend analysis.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which type of analysis could reveal that a company is relying heavily on debt financing?

A) Common size statements.

B) Horizontal analysis.

C) The asset turnover ratio.

D) Trend analysis.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

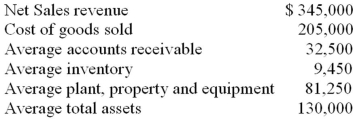

The following information is available for a company for the current year: Use the information above to answer the following question.Which of the following is closest to the company's accounts receivable turnover ratio for the current year?

A) 10.62

B) 4.0

C) 4.3

D) 6.31

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is closest to the company's debt-to-assets ratio for 2014?

A) 0.39

B) 0.61

C) 0.35

D) 0

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company that has a current ratio less than one cannot cover:

A) current liabilities with its current cash flow.

B) current expenses with its current sales revenue.

C) expenses with its current revenues.

D) current liabilities with its current assets.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a profitability ratio?

A) Return on equity (ROE) .

B) Earnings per share.

C) Asset turnover.

D) Days to sell.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a profitability measure?

A) Net income/Net sales

B) Total assets/Total stockholders' equity

C) Total liabilities/Total stockholders' equity

D) Cost of goods sold/Average inventory

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's sales in 2013 are $200,000 and in 2014 sales are $285,000.The percentage change is:

A) 42.5%.

B) 70%.

C) 29.8%.

D) 130%.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has earnings per share of $1.20,it paid a dividend of $.50 per share,and the market price of the company's stock is $45 per share.The price/earnings ratio is closest to:

A) 37.50.

B) 64.29.

C) 2.40.

D) 2.0.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the current accounting period,revenue from credit sales is $671,000.The accounts receivable balance is $51,480 at the beginning of the period and $52,200 at the end of the period.Which of the following statements is true?

A) The receivables turnover ratio is 12.9.

B) On average,it takes 12.9 days to collect payment from credit customers.

C) The receivables turnover ratio is 28.3.

D) On average,the company sells its inventory every 28.3 days.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 110

Related Exams