A) A decrease in supplies.

B) An increase in prepaid insurance.

C) A decrease in wages payable.

D) An increase in property,plant and equipment.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not true?

A) The statement of cash flows does not replace the income statement.

B) The statement of cash flows provides details as to how cash changed during a period.

C) The statement of cash flows provides information about cash receipts and cash payments over a period of time.

D) The statement of cash flows measures profitability.

F) None of the above

Correct Answer

verified

D

Correct Answer

verified

True/False

If a company is to succeed over the long-term,a positive cash flow from operating activities is necessary.An established,healthy company has positive cash flows from operating activities which are sufficient to pay for replacement of current productive assets and provide additional cash flows for business growth.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company issues $1 million of new stock and pays $200,000 in cash dividends during the year.In addition,the company took advantage of falling interest rates to borrow $1.5 million in a new bond issue and paid off existing bonds with a face value of $2 million.The company bought 500 of another company's $1,000 bonds at a $100,000 premium.The net cash flow from financing activities is:

A) An inflow of $500,000.

B) An outflow of $200,000.

C) An outflow of $100,000.

D) An inflow of $300,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

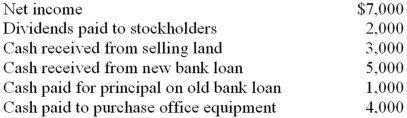

Use the information above to answer the following question.The company would report net cash provided by (used in) financing activities of:

A) $(2,500) .

B) $2,000.

C) $5,000.

D) $6,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Supplemental disclosures required by companies using the indirect method include all of the following except:

A) cash paid for interest.

B) cash paid for income tax.

C) cash paid for dividends.

D) noncash investing and financing activities.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

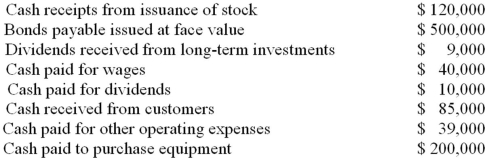

Flynn Corporation had the following cash flows for the current year.The company uses the direct method in preparing the statement of cash flows.Use the information above to answer the following question.What is the net cash flows provided by (used in) financing activities?

A) $620,000

B) $410,000

C) $610,000

D) $490,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the indirect method is used,details from which of the following balance sheet accounts are used in calculating both operating and financing cash flows?

A) Bonds payable.

B) Taxes payable.

C) Retained earnings.

D) Contributed capital.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

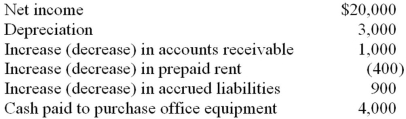

Consider the following information: The company would report net cash provided by operating activities of:

A) $17,500.

B) $18,500.

C) $21,500.

D) $23,300.

F) None of the above

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) GAAP classifies dividends paid as a financing activity,but IFRS allows them to be classified as either an operating or financing activity.

B) GAAP allows interest paid to be classified as either an operating or financing activity,but IFRS requires that it be classified as a financing activity.

C) GAAP classifies dividends received as an investing activity,but IFRS allows them to be classified as either an operating or investing activity.

D) GAAP classifies interest received as either an operating or investing activity,but IFRS requires it to be classified as an investing activity.

F) B) and C)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

When a company uses the direct method to determine the cash flows from operating activities,cash flows from operating activities will:

A) be identical to the amount reported using the indirect method.

B) be larger if there is a net cash inflow and smaller if there is a net cash outflow compared to the amount reported using the indirect method.

C) always be larger than the amount reported using the indirect method.

D) be larger if there is a net cash outflow and smaller if there is a net cash inflow compared to the amount reported using the indirect methoD.The direct method and the indirect method produce the same result for net cash provided by or used in operating activities.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a company uses the indirect method to prepare its statement of cash flows.If inventory decreases and unearned revenue increases during an accounting period,what does the company do with the changes in these accounts to calculate cash flows from operating activities?

A) Both are added to net income.

B) The change in inventory is added to net income;the change in unearned revenue is subtracted.

C) Both are subtracted from net income.

D) The change in unearned revenue is added to net income;the change in inventory is subtracteD.Using the indirect method,both decreases in current assets and increases in current liabilities are added to net income to convert to cash flows from operating activities.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not true?

A) The statement of cash flows can be used to assess the likelihood of a company paying dividends.

B) Net cash flow is the best measure of profitability since it doesn't rely on estimates.

C) A company can have positive net income but at the same time have negative cash flow.

D) The statement of cash flows is the only financial statement that reports business activities.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When preparing the operating activities section of the statement of cash flows using the indirect method,an increase in income taxes payable is added to net income.To convert net income to cash flows from operating activities,an increase in income taxes payable means that income tax expense on the income statement is greater than the amount of cash paid for income taxes;therefore,the increase should be added to net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following journal entries would have an effect on cash from operating activities?

A) Recording bad debts.

B) Recording depreciation.

C) Recording loss on sale of investment.

D) Recording cash paid for interest on long-term note payable.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

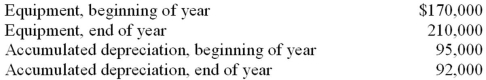

Equipment with a cost of $10,000 and a book value of $3,000 was sold during the year for cash of $9,000.Additional equipment was purchased during the year for cash.Use the information above to answer the following question.What was the amount of cash paid for purchases of equipment during the year?

A) $40,000

B) $43,000

C) $50,000

D) $31,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be classified as an operating activity on the statement of cash flows using the direct method?

A) Cash dividends paid to stockholders.

B) Cash received from selling equipment.

C) Cash paid to retire bonds payable at maturity.

D) Cash received from accounts receivable collections.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The statement of cash flows explains the difference between the beginning and ending balances of cash and cash equivalents.The statement of cash flows explains the change in cash and cash equivalents from operating,investing and financing activities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash and cash equivalents include:

A) assets that have stable long-term value.

B) assets that are short-term,highly liquid,and are purchased by the entity within three months of maturity.

C) assets that consistently grow in value over the long run.

D) assets that are expected to be used up within a year.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company's cost of goods sold is $158,000 for the period,beginning and ending inventory balances are $18,000 and $13,000,respectively,and the beginning and ending accounts payable balances are $19,000 and $7,500,respectively,the cash paid to suppliers is:

A) $157,000.

B) $163,500.

C) $164,500.

D) $151,500.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 138

Related Exams