A) $72,000

B) $72,200

C) $75,000

D) $77,800

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Oxford Co.has a material standard of 2.1 pounds per unit of output.Each pound has a standard price of $10 per pound.During February,Oxford Co.paid $57,220 for 4,840 pounds,which were used to produce 2,400 units.What is the direct materials price variance?

A) $6,820 unfavorable

B) $8,820 unfavorable

C) $8,820 favorable

D) $6,820 favorable

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scarlett Company has a direct material standard of 3 gallons of input at a cost of $5 per gallon.During July,Scarlett Company purchased and used 7,500 gallons.The direct materials quantity variance was $750 unfavorable and the direct materials price variance was $3,000 favorable.How many units were produced?

A) 2,450 units

B) 2,500 units

C) 7,350 units

D) 7,500 units

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Beech has budgeted fixed overhead of $202,500 based on budgeted production of 13,500 units.During July,14,100 units were produced and $214,200 was spent on fixed overhead.What is the fixed overhead volume variance?

A) $11,700 unfavorable

B) $1,800 unfavorable

C) $1,800 favorable

D) $9,000 favorable

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

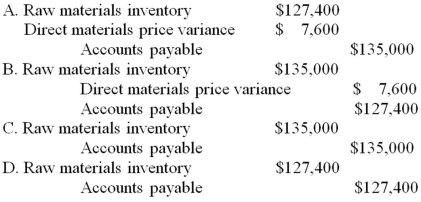

Tulip Inc.uses standard costing,and its manufacturing standards are as follows: 2 pounds of materials at $13 per pound,and 3 hours of labor at $10 per hour.Budgeted production last period was 5,000 units,and actual production was 4,800 units.Last period,Tulip purchased and used 9,800 pounds of materials for $135,000,and used 15,000 labor hours,costing $145,000.What is the journal entry to record the purchase of materials?

A) Option A

B) Option B

C) Option C

D) Option D

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Warner Co.has budgeted fixed overhead of $150,000.Practical capacity is 6,000 units,and budgeted production is 5,000 units.During February,4,800 units were produced and $155,600 was spent on fixed overhead.What is the total fixed overhead capacity variance?

A) $5,000 unfavorable

B) $5,600 unfavorable

C) $25,000 unfavorable

D) $30,000 unfavorable

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Oxford Co.has a material standard of 2.1 pounds per unit of output.Each pound has a standard price of $10 per pound.During February,Oxford Co.paid $57,220 for 4,840 pounds,which were used to produce 2,400 units.What is the direct materials quantity variance?

A) $2,000 unfavorable

B) $2,000 favorable

C) $6,820 favorable

D) $6,820 unfavorable

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Madrid Co.has a direct labor standard of 4 hours per unit of output.Each employee has a standard wage rate of $11 per hour.During February,Madrid Co.paid $99,500 to employees for 9,150 hours worked.2,400 units were produced during February.What is the flexible budget amount for direct labor?

A) $26,400

B) $99,500

C) $100,650

D) $105,600

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Standard cost systems depend on which two types of standards?

A) quantity and price

B) quantity and efficiency

C) rate and price

D) rate and spending

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The production manager is typically responsible for the direct material quantity variance.How direct materials are used is the responsibility of the production manager.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The direct material quantity variance is the difference between the actual quantity and the standard quantity of materials multiplied by the actual price.The quantity variance is the difference between the actual quantity and the standard quantity of materials multiplied by the standard price.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The standard labor rate is

A) the expected hourly cost of labor,excluding employee taxes and benefits.

B) the expected hourly cost of labor,including employee taxes and benefits.

C) the amount of time that workers should take to produce a single unit of product.

D) the amount of time that workers should take to produce a single unit of product times the expected hourly cost of labor.

F) A) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Warner Co.has budgeted fixed overhead of $150,000.Practical capacity is 6,000 units,and budgeted production is 5,000 units.During February,4,800 units were produced and $155,600 was spent on fixed overhead.What is the budgeted fixed overhead rate based on practical capacity?

A) $31.12

B) $31.25

C) $30.00

D) $25.00

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Delaware Corp.prepared a master budget that included $21,360 for direct materials,$33,600 for direct labor,$18,000 for variable overhead,and $46,440 for fixed overhead.Delaware Corp.planned to sell 4,000 units during the period,but actually sold 4,300 units.How much would direct labor cost be on a flexible budget for the period based on actual sales?

A) $14,448

B) $31,256

C) $33,600

D) $36,120

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Raven applies overhead based on direct labor hours.The variable overhead standard is 2 hours at $11 per hour.During July,Raven spent $116,700 for variable overhead.8,890 labor hours were used to produce 4,700 units.How much is variable overhead on the flexible budget?

A) $56,400

B) $97,790

C) $103,400

D) $116,700

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Whitman has a direct labor standard of 2 hours per unit of output.Each employee has a standard wage rate of $22.50 per hour.During July,Whitman paid $94,750 to employees for 4,445 hours worked.2,350 units were produced during July.What is the direct labor rate variance?

A) $11,000.00 favorable

B) $5,737.50 favorable

C) $5,262.50 favorable

D) $10,525.00 unfavorable

F) A) and B)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Raven applies overhead based on direct labor hours.The variable overhead standard is 2 hours at $11 per hour.During July,Raven spent $116,700 for variable overhead.8,890 labor hours were used to produce 4,700 units.What is the variable overhead efficiency variance?

A) $5,610 favorable

B) $46,090 favorable

C) $18,910 favorable

D) $18,910 unfavorable

F) A) and C)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Delaware Corp.prepared a master budget that included $21,360 for direct materials,$33,600 for direct labor,$18,000 for variable overhead,and $46,440 for fixed overhead.Delaware Corp.planned to sell 4,000 units during the period,but actually sold 4,300 units.How much would total costs be on a flexible budget for the period based on actual sales?

A) $111,070

B) $119,400

C) $124,872

D) $128,355

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fletcher has budgeted fixed overhead of $135,000 based on budgeted production of 9,000 units.During July,9,400 units were produced and $142,800 was spent on fixed overhead.What is the fixed overhead spending variance?

A) $7,800 unfavorable

B) $1,800 unfavorable

C) $1,800 favorable

D) $6,000 favorable

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Swan Company has a direct labor standard of 15 hours per unit of output.Each employee has a standard wage rate of $14 per hour.During March,employees worked 13,100 hours.The direct labor rate variance was $9,170 favorable,the direct labor efficiency variance was $15,400 unfavorable.What was the actual payroll?

A) $183,400

B) $168,000

C) $174,230

D) $192,570

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 100

Related Exams