A) $24,000

B) $52,000

C) $70,000

D) $94,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the number of units sold is the same every month,the profit from these units will be the same every month if

A) absorption costing is used.

B) variable costing is used.

C) production is greater than sales.

D) sales is greater than production.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maple Corp.has a selling price of $20,variable costs of $15 per unit,and fixed costs of $25,000.Maple expects profit of $300,000 at its anticipated level of production.What is Maple's unit contribution margin?

A) $5

B) $10

C) $27.50

D) $20

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Holly,which uses the high-low method,had an average cost per unit of $10 at its lowest level of activity when sales equaled 10,000 units and an average cost per unit of $6.50 at its highest level of activity when sales equaled 20,000 units.Holly would estimate fixed costs as

A) $70,000.

B) $16.50.

C) $8.25.

D) $100,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

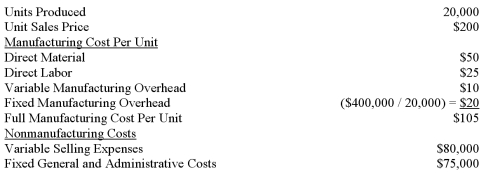

Flint Enterprises had the following cost and production information for April: Inventory increased by 3,000 units during April.What is Flint Enterprise's income under absorption costing?

A) $1,400,000

B) $1,460,000

C) $1,745,000

D) $1,785,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Relevant range

A) is the range of activity over which our assumptions about cost behavior are true.

B) only applies to fixed costs.

C) is defined as total sales minus break-even sales.

D) increases in total as the activity level increases.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A mixed cost has either fixed and variable components,but not both.Mixed costs have both a fixed and a variable component.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Total contribution margin is defined as

A) selling price times units sold.

B) cost to produce times units sold.

C) total sales revenues less total variable costs.

D) total variable costs less fixed costs.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Citrus,Inc.used the high-low method to estimate that its fixed costs are $210,000.At its low level of activity,100,000 units,average cost was $2.60 per unit.What would Citrus predict its average cost per unit to be when production is 200,000 units?

A) $1.05

B) $1.55

C) $2.60

D) $5.20

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Full absorption costing divides fixed overhead between Cost of Goods Sold and period expenses.Full absorption costing divides fixed overhead between Cost of Goods Sold and inventories.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Total contribution margin is equal to

A) total sales less fixed costs.

B) fixed costs plus profits.

C) variable costs plus profits.

D) total sales less profits.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Contribution margin is equal to sales revenue less gross margin.Contribution margin is equal to sales revenue minus variable costs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

R-square tells managers how much of the variability in activity is caused by variability in cost.R-square tells managers how much of the variability in cost is explained by activity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A fixed cost will stay constant on a per unit basis as the volume increases.Fixed costs stay constant in total.On a per unit basis,they decrease as volume increases.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cardinal uses the high-low method of estimating costs.Cardinal had total costs of $25,000 at its lowest level of activity,when 5,000 units were sold.When,at its highest level of activity,sales equaled 10,000 units,total costs were $39,000.Cardinal would estimate variable cost per unit as

A) $7.00.

B) $4.55.

C) $2.80.

D) $5.26.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The relevant range is the range in which costs remain variable.The relevant range is the range of activity over which we expect our assumptions about cost behavior to hold true.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Variable costing uses a contribution margin income statement.This is one of the key aspects of variable costing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Knox Corp has a selling price of $20,variable costs of $14 per unit,and fixed costs of $25,000.If Knox sells 12,000 units,the contribution margin ratio will equal

A) $60,000.

B) 30%.

C) 70%.

D) 10.4%.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

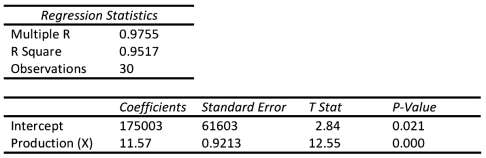

Star,Inc.used Excel to run a least-squares regression analysis,which resulted in the following output: What total cost would Star predict for a month in which production is 2,000 units?

A) $23,140

B) $63,446

C) $175,003

D) $198,143

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cost that changes,in total,in direct proportion to changes in activity levels is a(n)

A) absorption cost.

B) contribution margin.

C) fixed cost.

D) variable cost.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 100

Related Exams