A) the number of activities.

B) nonmanufacturing costs.

C) the number of units produced.

D) the number of cost drivers.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

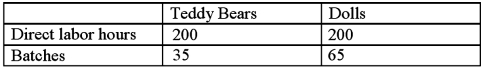

Yallow,Inc.manufactures teddy bears and dolls.Currently,Yallow makes 2,000 teddy bears each month.Each teddy bear uses $2.00 in direct materials and $0.50 in direct labor.Yallow uses two activities in manufacturing the teddy bears: Sewing and Processing.The cost associated with Sewing is $15,000 a month,allocated on the basis of direct labor hours.The cost associated with Processing is $10,000 a month,allocated on the basis of batches.Usage of the activity drivers are as follows: What is the total manufacturing cost for one teddy bear?

A) $2.50

B) $4.50

C) $7.00

D) $8.00

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is activity based management related to activity based costing?

A) Activity based management is another term for activity based costing.

B) Activity based management is used when activity based costing is not feasible.

C) Activity based management bases improvements to operations and reductions in costs on activity based costing data.

D) Activity based management is not related to activity based costing.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The activity-rate method involves

A) dividing the total activity driver by the total activity cost.

B) calculating the proportion of each activity driver used by each product.

C) calculating an activity rate that is similar to the predetermined overhead rate.

D) multiplying the total activity cost by the total activity driver.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

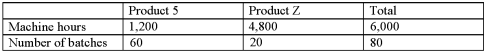

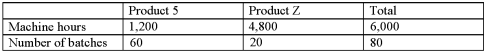

Jefferson,Inc.produces two different products (Product 5 and Product Z) using two different activities: Machining,which uses machine hours as an activity driver,and Inspection,which uses number of batches as an activity driver.The cost of Machining is $500,000,while the cost of Inspection is $30,000.Usage of the activity drivers are as follows: What proportion of Inspection activity is used by Product 5?

A) 25%

B) 33%

C) 67%

D) 75%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jefferson,Inc.produces two different products (Product 5 and Product Z) using two different activities: Machining,which uses machine hours as an activity driver,and Inspection,which uses number of batches as an activity driver.The cost of Machining is $500,000,while the cost of Inspection is $30,000.Usage of the activity drivers are as follows: What proportion of Machining activity is used by Product Z?

A) 25%

B) 33%

C) 67%

D) 80%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Volume-based cost systems tend to

A) Under-cost low-volume products and under-cost high-volume products.

B) Under-cost low-volume products and over-cost high-volume products.

C) Over-cost low-volume products and under-cost high-volume products.

D) Over-cost low-volume products and over-cost high-volume products.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cottonwood,Inc.produces two different products (Standard and Luxury) using two different activities: Machining,which uses machine hours as an activity driver,and Inspection,which uses number of batches as an activity driver.The cost of Machining is $500,000,while the cost of Inspection is $30,000.Standard uses 30% of total machine hours and 70% of total batches.What is the total activity cost assigned to Luxury?

A) $7,500

B) $171,000

C) $375,000

D) $359,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best defines a batch-level activity?

A) An activity that is performed for a specific customer

B) An activity that is performed to support a specific product line

C) An activity that is performed for each individual unit

D) An activity that is performed for a group of units all at once

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When target costing is used,the target cost is determined by

A) finding the difference between the market price and the amount of profit needed to satisfy stakeholders.

B) adding the cost of direct materials,direct labor,and activity costs of a product.

C) subtracting all nonvalue-added costs from total manufacturing costs of a product.

D) adding the manufacturing and nonmanufacturing costs of the product.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

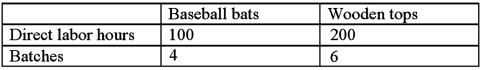

Parker Woodworks manufactures baseball bats and wooden tops.Currently,Parker makes 5,000 baseball bats each month.Each bat uses $1.00 in direct materials and $0.50 in direct labor.Parker uses two activities in manufacturing the baseball bats: Cutting and Finishing.The cost associated with Cutting is $7,500 a month,allocated on the basis of direct labor hours.The cost associated with Finishing is $12,000 a month,allocated on the basis of batches.Usage of the activity drivers are as follows: What is the total manufacturing cost for one baseball bat?

A) $1.46

B) $1.50

C) $2.96

D) $3.94

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which type of quality cost would a firm most want to eliminate or reduce as much as possible?

A) Prevention costs

B) Appraisal or inspection costs

C) Internal failure costs

D) External failure costs

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jackson,Inc.produces two different products (Product 5 and Product Z) using two different activities: Machining,which uses machine hours as an activity driver,and Inspection,which uses number of batches as an activity driver.The cost of Machining is $500,000,while the cost of Inspection is $30,000.Product 5 uses 20% of total machine hours and 75% of total batches.What is the total Machining cost assigned to Product 5?

A) $7,500

B) $22,500

C) $100,000

D) $375,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Activity based costing systems include non-volume-based cost drivers.ABC systems should also include measures that capture factors other than volume,or non-volume based cost drivers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The first step in ABC is to calculate a manufacturing overhead rate.The first step in ABC is to identify the activities required to make the product or provide the service,so indirect costs can be assigned to them.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An activity that is performed for each individual unit is a ___________ level activity.

A) batch

B) facility

C) product

D) unit

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yuma,Inc.manufactures teddy bears and dolls.Currently,Yuma makes 2,000 teddy bears each month.Each teddy bear uses $2.00 in direct materials and $0.50 in direct labor.Yuma uses two activities in manufacturing the teddy bears: Sewing and Processing.The cost associated with Sewing is $15,000 a month,allocated on the basis of direct labor hours.The cost associated with Processing is $10,000 a month,allocated on the basis of batches.Teddy bears use 1/2 of the direct labor hours,and 35% of total batches.What is the total manufacturing cost for one teddy bear?

A) $2.50

B) $4.50

C) $7.00

D) $8.00

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Each individual indirect cost should be assigned to one activity when forming activity cost pools.Some costs will need to be allocated among several activities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

GG's Personal Training Services is owned by Gina Garfield.Gina provides personal training and coaching to individuals or small groups using the local fitness facility and pool.Gina rents the group training room at the local fitness facility or the pool for scheduled classes.For one-on-one training,she meets clients at the fitness facility where she is a member.Gina is currently learning Zumba and plans to offer a Zumba class in the group training room on Wednesday mornings starting next month.To advertise this class and all her other services,Gina developed a company Facebook page.The development of the Facebook page is considered a ___________ activity for GG's.

A) facility-level

B) service-level

C) group-level

D) customer-level

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a type of quality cost?

A) Development costs

B) Prevention costs

C) Internal failure costs

D) Appraisal or inspection costs

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 104

Related Exams