A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most common method for disposing of over- or underapplied overhead is to

A) recalculate the overhead rate for the period.

B) recalculate the overhead rate for the next period.

C) make a direct adjustment to Work in Process Inventory.

D) make a direct adjustment to Cost of Goods SolD.The most common method for disposing of the balance in Manufacturing Overhead is to make a direct adjustment to Cost of Goods Sold.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

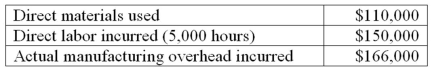

Ragtime Company had the following information for the year: Ragtime Company used a predetermined overhead rate of $35 per direct labor hour for the year.Assume the only inventory balance is an ending Work in Process Inventory balance of $17,000.What was cost of goods manufactured?

A) $260,000

B) $426,000

C) $435,000

D) $418,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following represents the accumulated costs of jobs as yet incomplete?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Process costing averages the total cost of the process over the number of units produced.Process costing breaks the production process down into its basic steps,or processes,and then averages the total cost of the process over the number of units produced.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cost of goods sold is the amount of cost transferred

A) out of Finished Goods Inventory and into Cost of Goods Sold.

B) out of Work in Process Inventory and into Cost of Goods Sold.

C) out of Work in Process Inventory and into Manufacturing Overhead.

D) out of Work in Process Inventory and into Finished Goods Inventory.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be used to transfer the cost of completed goods during the period?

A) Credit to Raw Materials Inventory

B) Credit to Work in Process Inventory

C) Debit to Manufacturing Overhead

D) Credit to Manufacturing Overhead

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When direct materials are used in production,which of the following accounts is debited?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following types of firms would most likely use job order costing?

A) Happy-Oh Cereal Company

B) Huey,Lewey & Dewie,Attorneys

C) SoooSweet Beverage

D) C-5 Cement Company

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a characteristic of a manufacturing environment that would use job order costing?

A) Standardized production process

B) Continuous manufacturing

C) Homogenous products

D) Differentiated products

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

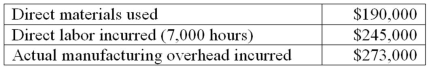

Sawyer Company had the following information for the year: Sawyer Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours.Assume the only inventory balance is an ending Finished Goods Inventory balance of $9,000.What was adjusted cost of goods sold?

A) $715,000

B) $708,000

C) $706,000

D) $699,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead was estimated to be $250,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $225,000,and actual direct labor hours were 19,000.To dispose of the balance in the Manufacturing Overhead account,which of the following would be correct?

A) Manufacturing Overhead would be credited for $12,500

B) Manufacturing Overhead would be credited for $25,000

C) Manufacturing Overhead would be debited for $12,500

D) Manufacturing Overhead would be debited for $25,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 101 - 112 of 112

Related Exams