A) $42,000.

B) $43,000.

C) $63,000.

D) $1,000.

E) $41,000.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following transactions or events should be reported as a source of cash from operating activities when using the direct method?

A) Credit sales.

B) Cash collections from customers.

C) Depreciation expense.

D) Cash received from the sale of a building.

E) Cash received from the sale of treasury stock.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Essay

For each of the following separate cases,use the information provided to calculate the missing cash inflow or cash outflow using the direct method.

Correct Answer

verified

Correct Answer

verified

True/False

When preparing the operating activities section of the statement of cash flows using the indirect method,a decrease in accounts receivable is subtracted from net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

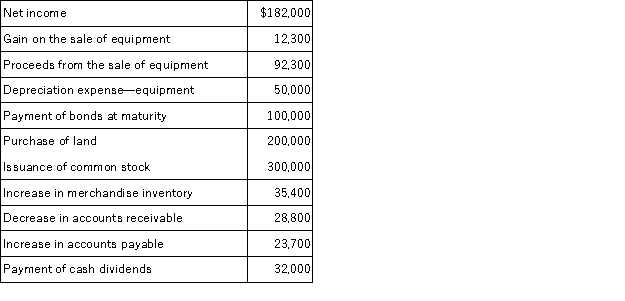

Northington,Inc.is preparing the company's statement of cash flows for the fiscal year just ended.Using the following information,determine the amount of cash flows from operating activities using the indirect method:

A) $332,200.

B) $236,800.

C) $261,400.

D) $186,800.

E) $189,400.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A cash-based measure to help business decision makers estimate the amount and timing of cash flows is the cash flow on total assets ratio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The statement of cash flows explains how transactions and events impact the end-of-period cash balance to produce the end-of-period net income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Financing activities include receiving cash from issuing debt and receiving cash dividends from investments in other companies' stocks.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When preparing the operating activities section of the statement of cash flows using the indirect method,depreciation is subtracted from net income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The primary purpose of the statement of cash flows is to report all major cash receipts (inflows)and cash payments (outflows)during a period.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Use the following company information to prepare a schedule of significant noncash investing and financing activities: (a)Sold a building with a book value of $300,000 for $225,000 cash and sold land with a book value of $40,000 for $65,000 cash. (b)Issued 15,000 shares of $10 par value common stock in exchange for equipment with a market value of $175,000. (c)Retired a $100,000,8% bond by issuing another $100,000,7% bond issue. (d)Acquired land by issuing a twenty-year,5%,$73,000 note payable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's Inventory balance at 12/31/16 was $188,000 and $200,000 at 12/31/15.Its Accounts Payable balance at 12/31/16 was $84,000 and $80,000 at 12/31/15,and its cost of goods sold for 2016 was $720,000.The company's total amount of cash payments for merchandise in 2016 equals:

A) $704,000.

B) $712,000.

C) $720,000.

D) $728,000.

E) $736,000.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

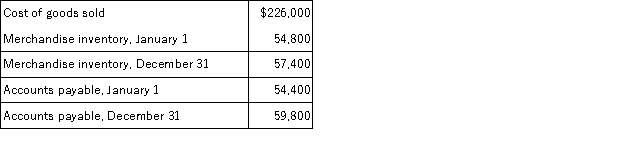

Use the following information about the current year's operations of a company to calculate the cash paid for merchandise.

A) $218,000.

B) $223,200.

C) $220,000.

D) $228,800.

E) $234,000.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When using the indirect method to calculate and report net cash provided or used by operating activities,which of the following is subtracted from net income?

A) Decrease in income taxes payable.

B) Depreciation expense.

C) Amortization of intangible assets.

D) Bad debts expense.

E) Decrease in merchandise inventory.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The indirect method for the preparation of the operating activities section of the statement of cash flows:

A) Separately lists each major item of operating cash receipts.

B) Separately lists each major item of operating cash payments.

C) Reports net income and then adjusts it for items necessary to determine net cash provided or used by operating activities.

D) Is required if the company is a merchandiser.

E) Must not be used in all circumstances.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

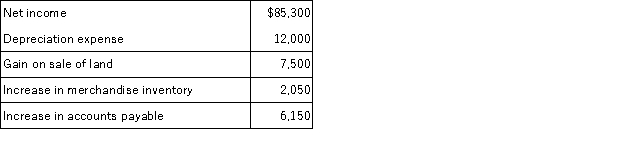

Use the following information and the indirect method to calculate the net cash provided or used by operating activities:

A) $69,900.

B) $108,900.

C) $93,900.

D) $85,700.

E) $81,600.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A purchase of land in exchange for shares of stock is disclosed at the bottom of the statement of cash flows or in a note to the statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's income statement showed the following: net income,$134,000;depreciation expense,$30,000;and gain on sale of plant assets,$4,000.An examination of the company's current assets and current liabilities showed the following changes as a result of operating activities: accounts receivable decreased $9,400;merchandise inventory increased $18,000;prepaid expenses increased $6,200;accounts payable increased $3,400.Calculate the net cash provided or used by operating activities.

A) $156,600.

B) $141,000.

C) $96,600.

D) $148,600.

E) $88,600.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Since it is recommended by the FASB,the direct method of preparing the statement of cash flows is most frequently used.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When preparing a statement of cash flows using the indirect method,which of the following is correct?

A) Proceeds from the sale of equipment should be added to net income in the operating activities section.

B) A loss on the sale of land should be added to net income in the operating activities section.

C) The declaration of a cash dividend should be a use of cash in the financing activities section.

D) The issuance of a stock dividend should be a use of cash in the financing activities section.

E) The purchase of land and a building by issuing a long-term note payable should be a source of cash in the financing activities section.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 194

Related Exams