A) $80,800.

B) $100,000.

C) $95,200.

D) $119,200.

E) $124,000.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Investments in equity securities where the investor has a significant,but not controlling influence,are accounted for using the _______________ method.

Correct Answer

verified

Correct Answer

verified

True/False

Short-term investments are intended to be converted into cash within the longer of one year or the current operating cycle of the business,and are readily convertible to cash.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The controlling investor is called the:

A) Owner.

B) Subsidiary.

C) Parent.

D) Investee.

E) Senior entity.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

An investor presumed to have significant influence owns as least 20% but not more than 50% of another company's voting stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 4,Year 1,Barber Company purchased 5,000 shares of Convell Company for $59,500 plus a broker's fee of $1,000.Convell Company has a total of 25,000 shares of common stock outstanding and it is presumed the Barber Company will have a significant influence over Convell.During each of the next two years,Convell declared and paid cash dividends of $0.85 per share,and its net income was $72,000 and $67,000 for Year 1 and Year 2,respectively.What is the book value of Barber's investment in Convell at the end of Year 2?

A) $60,500.

B) $79,800.

C) $52,000.

D) $88,300.

E) $87,300.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marshall Company sold supplies in the amount of €25,000 (euros) to a French company when the exchange rate was $1.21 per euro.At the time of payment,the exchange rate decreased to $0.82.Marshall must record a:

A) gain of $9,750.

B) gain of $20,500.

C) loss of $9,750.

D) loss of $20,500.

E) neither a gain nor loss.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On March 15,Alan Company purchased 10,000 shares of Cameo Corp.stock for $35,000.The investment is classified as available-for-sale securities.On June 30,the stock had a fair value of $34,000.Alan should do which of the following?

A) Record a decrease to the Fair value Adjustment-AFS account.

B) Record an increase to the Unrealized Loss-Equity account.

C) Report a decrease in the Gain on Sale of Investment income statement account.

D) Report an increase in the asset section of the balance sheet.

E) Record an increase to the Unrealized Gain-Income account.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Essay

A company that is a controlling investor in another company is known as the __________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Roe Corporation owns 2,000 shares of WRJ Corporation stock.WRJ Corporation has 25,000 shares of stock outstanding.WRJ paid $4 per share in cash dividends to its stockholders.The entry to record the receipt of these dividends is:

A) Debit Cash,$8,000;credit Long-Term Investments,$8,000.

B) Debt Long-Term Investment,$8,000;credit Cash,$8,000.

C) Debit Cash,$8,000;credit Dividend Revenue,$8,000.

D) Debit Unrealized Gain-Equity,$8,000;credit Cash,$8,000.

E) Debit Cash,$8,000;credit Unrealized Gain-Equity,$8,000.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Canberry Corporation had net income of $80,000,beginning total assets of $640,000 and ending total assets of $580,000.Its return on total assets is:

A) 13.1%

B) 12.5%

C) 13.8%

D) 800%

E) 725%

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investments in trading securities:

A) Include only equity securities.

B) Are reported as current assets.

C) Include only debt securities.

D) Are reported at their cost,no matter what their market value.

E) Are long-term investments.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

If a U.S.company makes a credit sale to a foreign company,the sales price must be translated into dollars as of the date of _____________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

McVeigh Corp.owns 40% of Gondor Company's common stock.McVeigh received $41,200 in cash dividends from Gondor.The entry to record this transaction should include a:

A) Debit to Dividends for $103,000.

B) Credit to Long-Term Investments for $41,200.

C) Debit to Dividend Revenue for $41,200.

D) Credit to Long-Term Investments for $103,000.

E) Credit to Cash for $41,200.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company had net income of $2,660,000,net sales of $25,000,000,and average total assets of $8,000,000.Its return on total assets equals:

A) 3.01%.

B) 10.64%.

C) 32.00%.

D) 33.25%.

E) 300.75%.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

A company reported net income of $225,000,net sales of $2,500,000,and average total assets of $2,100,000 for the current year.Calculate this company's profit margin,total asset turnover,and return on total assets.

Correct Answer

verified

Correct Answer

verified

True/False

Long-term investments include investments in land or other assets not used in a company's operations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The currency in which a company presents its financial statements is known as the:

A) Multinational currency.

B) Price-level-adjusted currency.

C) Specific currency.

D) Reporting currency.

E) Historical cost currency.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

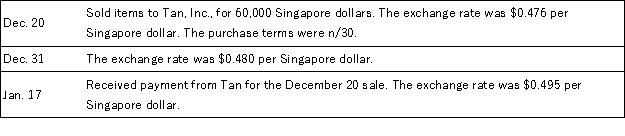

FreshFoods,Inc.sells American gourmet foods to merchandisers in Singapore.Prepare the journal entries for FreshFoods,to record the following transactions.Include any year-end adjustments.

Correct Answer

verified

Correct Answer

verified

True/False

The price of one currency stated in terms of another currency is called a foreign exchange rate.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 188

Related Exams