A) 63,200 pounds

B) 62,400 pounds

C) 56,800 pounds

D) 50,400 pounds

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

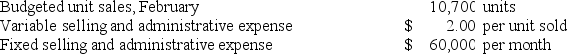

Yerkey Corporation makes one product and has provided the following information to help prepare the master budget:  The estimated selling and administrative expense for February is closest to:

The estimated selling and administrative expense for February is closest to:

A) $81,400

B) $21,400

C) $54,270

D) $60,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The number of units to be produced in a period can be determined by adding the expected sales to the desired ending inventory and then deducting the beginning inventory.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rokosz Corporation makes one product and it provided the following information to help prepare the master budget for the next four months of operations: a. The budgeted selling price per unit is $104. Budgeted unit sales for October, November, December, and January are 6,900, 7,100, 11,300, and 15,300 units, respectively. All sales are on credit. B. Regarding credit sales, 30% are collected in the month of the sale and 70% in the following month. C. The ending finished goods inventory equals 20% of the following month's sales. D. The ending raw materials inventory equals 30% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.00 per pound. E. The direct labor wage rate is $23.00 per hour. Each unit of finished goods requires 2.5 direct labor-hours. If 60,500 pounds of raw materials are required for production in December, then the budgeted cost of raw material purchases for November is closest to:

A) $91,880

B) $139,520

C) $79,400

D) $115,700

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

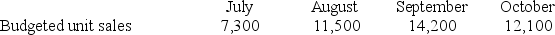

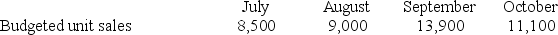

Corvi Corporation produces and sells one product. The budgeted selling price per unit is $126. Budgeted unit sales are shown below:  All sales are on credit with 40% collected in the month of the sale and 60% in the following month. The expected cash collections for August is closest to:

All sales are on credit with 40% collected in the month of the sale and 60% in the following month. The expected cash collections for August is closest to:

A) $551,880

B) $579,600

C) $919,800

D) $1,131,480

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Bandeiras Corporation, a merchandising firm, has budgeted its activity for December according to the following information: Sales at $550,000, all for cash. Merchandise inventory on November 30 was $300,000. The cash balance at December 1 was $25,000. Selling and administrative expenses are budgeted at $60,000 for December and are paid in cash. Budgeted depreciation for December is $35,000. The planned merchandise inventory on December 31 is $270,000. The cost of goods sold is 75% of the sales price. All purchases are paid for in cash. There is no interest expense or income tax expense. The budgeted cash disbursements for December are:

A) $382,500

B) $442,500

C) $472,500

D) $477,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

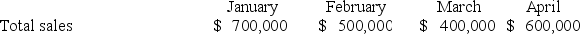

All of Pocast Corporation's sales are on account. Sixty percent of the credit sales are collected in the month of sale, 30% in the month following sale, and 10% in the second month following sale. The following are budgeted sales data for the company:  Cash receipts in April are expected to be:

Cash receipts in April are expected to be:

A) $530,000

B) $360,000

C) $460,000

D) $410,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

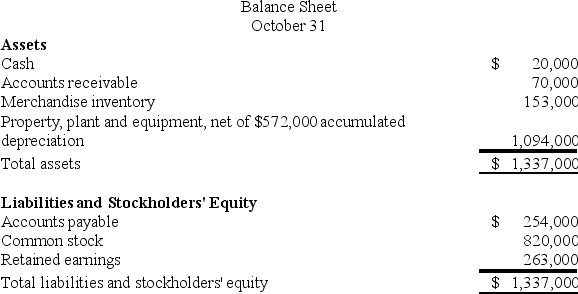

Bramble Corporation is a small wholesaler of gourmet food products. Data regarding the store's operations follow: Sales are budgeted at $340,000 for November, $320,000 for December, and $310,000 for January.

Collections are expected to be 80% in the month of sale and 20% in the month following the sale.

The cost of goods sold is 75% of sales.

The company would like to maintain ending merchandise inventories equal to 60% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase.

Other monthly expenses to be paid in cash are $24,000.

Monthly depreciation is $15,000.

Ignore taxes.

The cost of December merchandise purchases would be:

The cost of December merchandise purchases would be:

A) $255,000

B) $139,500

C) $235,500

D) $240,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Petrini Corporation makes one product and it provided the following information to help prepare the master budget for the next four months of operations: a. The budgeted selling price per unit is $110. Budgeted unit sales for January, February, March, and April are 7,500, 10,600, 12,000, and 11,700 units, respectively. All sales are on credit. B.Regarding credit sales, 30% are collected in the month of the sale and 70% in the following month. C. The ending finished goods inventory equals 30% of the following month's sales. D.The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $4.00 per pound. E. Regarding raw materials purchases, 40% are paid for in the month of purchase and 60% in the following month. F. The direct labor wage rate is $23.00 per hour. Each unit of finished goods requires 2.6 direct labor-hours. G. Manufacturing overhead is entirely variable and is $8.00 per direct labor-hour. H. The variable selling and administrative expense per unit sold is $1.70. The fixed selling and administrative expense per month is $70,000. The estimated cost of goods sold for February is closest to:

A) $1,066,360

B) $220,480

C) $930,680

D) $845,880

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is NOT correct concerning the Cash Budget?

A) It is not necessary to prepare any other budgets before preparing the Cash Budget.

B) The Cash Budget should be prepared before the Budgeted Income Statement.

C) The Cash Budget should be prepared before the Budgeted Balance Sheet.

D) The Cash Budget builds on earlier budgets and schedules as well as additional data.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

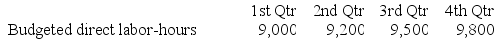

The direct labor budget of Faver Corporation for the upcoming year contains the following details concerning budgeted direct labor-hours.

The company's variable manufacturing overhead rate is $4.00 per direct labor-hour, and the company's fixed manufacturing overhead is $60,000 per quarter. The only noncash item included in the fixed manufacturing overhead is depreciation which is $20,000 per quarter.

Required:

Prepare Faver Corporation's manufacturing overhead budget for the upcoming fiscal year. Show both manufacturing overhead expense and cash disbursements for manufacturing overhead.

The company's variable manufacturing overhead rate is $4.00 per direct labor-hour, and the company's fixed manufacturing overhead is $60,000 per quarter. The only noncash item included in the fixed manufacturing overhead is depreciation which is $20,000 per quarter.

Required:

Prepare Faver Corporation's manufacturing overhead budget for the upcoming fiscal year. Show both manufacturing overhead expense and cash disbursements for manufacturing overhead.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The LFH Corporation makes and sells a single product, Product T. Each unit of Product T requires 1.5 direct labor-hours at a rate of $10.50 per direct labor-hour. The direct labor workforce is fully adjusted each month to the required workload. LFH Corporation needs to prepare a Direct Labor Budget for the second quarter of next year. The company has budgeted to produce 28,000 units of Product T in June. The finished goods inventories on June 1 and June 30 were budgeted at 800 and 600 units, respectively. Budgeted direct labor costs for June would be:

A) $294,000

B) $441,000

C) $444,150

D) $437,850

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In a production budget, if the number of units in finished goods inventory at the end of the period is less than the number of units in finished goods inventory at the beginning of the period, then the expected number of units sold is less than the number of units to be produced during the period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

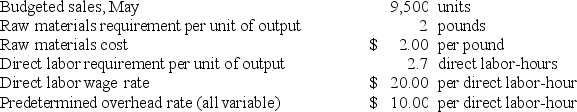

Gusler Corporation makes one product and has provided the following information:  The estimated cost of goods sold for May is closest to:

The estimated cost of goods sold for May is closest to:

A) $807,500

B) $256,500

C) $646,000

D) $551,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The selling and administrative expense budget lists all costs of production other than direct materials and direct labor.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The manufacturing overhead budget at Franklyn Corporation is based on budgeted direct labor-hours. The direct labor budget indicates that 4,400 direct labor-hours will be required in January. The variable overhead rate is $1.30 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $60,280 per month, which includes depreciation of $17,160. All other fixed manufacturing overhead costs represent current cash flows. The January cash disbursements for manufacturing overhead on the manufacturing overhead budget should be:

A) $5,720

B) $43,120

C) $48,840

D) $66,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Um Corporation has provided the following information concerning its raw materials purchases. The budgeted cost of raw materials purchases in November is $286,032. The company pays for 40% of its raw materials purchases in the month of purchase and 60% in the following month. The budgeted accounts payable balance at the end of November is closest to:

A) $114,413

B) $140,333

C) $171,619

D) $286,032

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bentsen Corporation makes one product.  The ending finished goods inventory equals 40% of the following month's sales. The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit of finished goods requires 6 pounds of raw materials. The raw materials cost $2.00 per pound. If 76,680 pounds of raw materials are required for production in September, then the budgeted cost of raw material purchases for August is closest to:

The ending finished goods inventory equals 40% of the following month's sales. The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit of finished goods requires 6 pounds of raw materials. The raw materials cost $2.00 per pound. If 76,680 pounds of raw materials are required for production in September, then the budgeted cost of raw material purchases for August is closest to:

A) $133,704

B) $131,520

C) $160,008

D) $146,856

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The manufacturing overhead budget at Foshay Corporation is based on budgeted direct labor-hours. The direct labor budget indicates that 5,800 direct labor-hours will be required in May. The variable overhead rate is $9.10 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $104,400 per month, which includes depreciation of $8,120. All other fixed manufacturing overhead costs represent current cash flows. The company recomputes its predetermined overhead rate every month. The predetermined overhead rate for May should be:

A) $9.10

B) $27.10

C) $18.00

D) $25.70

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The usual starting point for a master budget is:

A) the direct materials purchase budget.

B) the budgeted income statement.

C) the sales forecast or sales budget.

D) the production budget.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 236

Related Exams