A) 30.0%

B) 17.5%

C) 18.75%

D) 12.5%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paragas, Inc., is considering the purchase of a machine that would cost $370,000 and would last for 8 years. At the end of 8 years, the machine would have a salvage value of $52,000. The machine would reduce labor and other costs by $96,000 per year. Additional working capital of $4,000 would be needed immediately. All of this working capital would be recovered at the end of the life of the machine. The company requires a minimum pretax return of 19% on all investment projects. (Ignore income taxes.) Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided. The net present value of the proposed project is closest to:

A) $9,584

B) $78,530

C) $22,532

D) $19,528

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cabe Corporation uses a discount rate of 18% in its capital budgeting. Partial analysis of an investment in automated equipment with a useful life of 7 years has thus far yielded a net present value of -$155,606. This analysis did not include any estimates of the intangible benefits of automating this process nor did it include any estimate of the salvage value of the equipment. (Ignore income taxes.) Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided. Ignoring any cash flows from intangible benefits, to the nearest whole dollar how large would the salvage value of the automated equipment have to be to make the investment in the automated equipment financially attractive?

A) $495,561

B) $28,009

C) $155,606

D) $864,478

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The simple rate of return is computed by dividing the annual net operating income generated by a project by the initial investment in the project.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

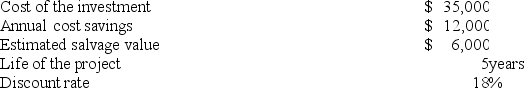

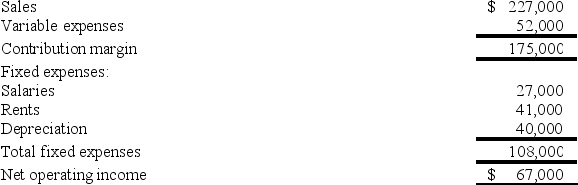

The following data pertain to an investment proposal (Ignore income taxes.) :  Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.

The net present value of the proposed investment is closest to:

Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.

The net present value of the proposed investment is closest to:

A) $2,622

B) $5,146

C) $2,524

D) $31,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

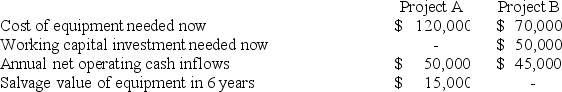

Lambert Manufacturing has $120,000 to invest in either Project A or Project B. The following data are available on these projects (Ignore income taxes.) :  Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.

Both projects have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Lambert's discount rate is 14%.

The net present value of Project B is closest to:

Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.

Both projects have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Lambert's discount rate is 14%.

The net present value of Project B is closest to:

A) $77,805

B) $127,805

C) $55,005

D) $105,005

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The internal rate of return method assumes that the cash flows generated by the project are immediately reinvested elsewhere at a rate of return that equals the company's cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

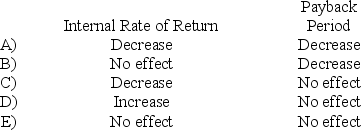

Rennin Dairy Corporation is considering a plant expansion decision that has an estimated useful life of 20 years. This project has an internal rate of return of 15% and a payback period of 9.6 years. How would a decrease in the expected salvage value from this project in 20 years affect the following for this project?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

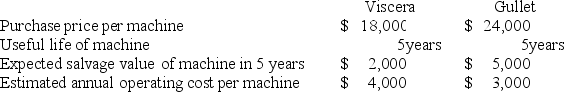

Cannula Vending Corporation is expanding operations and needs to purchase additional vending machines. There are currently two companies, Viscera, Inc. and Gullet International, that produce and sell machines that will do the job. Information related to the specifications of each company's machine are as follows (Ignore income taxes.) :  Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.

Cannula's discount rate is 18%. Cannula uses the straight-line method of depreciation. Using net present value analysis, which company's machine should Cannula purchase and what is the approximate difference between the net present values of the competing company's machines?

Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.

Cannula's discount rate is 18%. Cannula uses the straight-line method of depreciation. Using net present value analysis, which company's machine should Cannula purchase and what is the approximate difference between the net present values of the competing company's machines?

A) Gullet, $127

B) Viscera, $1,562

C) Viscera, $1,749

D) Viscera, $3,438

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If investment funds are limited, the net present value of one project should not be compared directly to the net present value of another project unless the initial investments in these projects are equal.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In the payback method, depreciation is added back to net operating income when computing the annual net cash flow.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

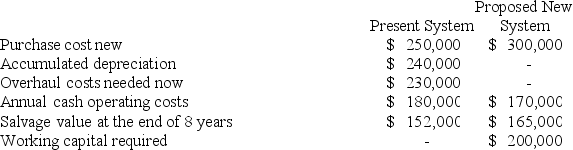

Westland College has a telephone system that is in poor condition. The system either can be overhauled or replaced with a new system. The following data have been gathered concerning these two alternatives (Ignore income taxes.) :  Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.Westland College uses a 10% discount rate and the total cost approach to capital budgeting analysis. Both alternatives are expected to have a useful life of eight years.

The working capital would be released for use elsewhere when the project is completed.

The net present value of the alternative of overhauling the present system is closest to:

Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.Westland College uses a 10% discount rate and the total cost approach to capital budgeting analysis. Both alternatives are expected to have a useful life of eight years.

The working capital would be released for use elsewhere when the project is completed.

The net present value of the alternative of overhauling the present system is closest to:

A) $(1,279,316)

B) $(1,119,316)

C) $801,284

D) $(1,194,036)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

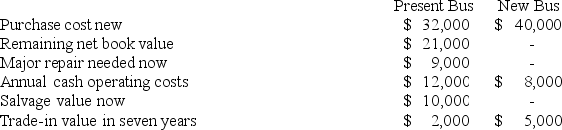

Morrel University has a small shuttle bus that is in poor mechanical condition. The bus can be either overhauled now or replaced with a new shuttle bus. The following data have been gathered concerning these two alternatives (Ignore income taxes.) :  Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.

The University could continue to use the present bus for the next seven years. Whether the present bus is used or a new bus is purchased, the bus would be traded in for another bus at the end of seven years. The University uses a discount rate of 12% and the total cost approach to net present value analysis.

If the present bus is repaired, the present value of the salvage received on sale of the bus seven years from now is closest to:

Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.

The University could continue to use the present bus for the next seven years. Whether the present bus is used or a new bus is purchased, the bus would be traded in for another bus at the end of seven years. The University uses a discount rate of 12% and the total cost approach to net present value analysis.

If the present bus is repaired, the present value of the salvage received on sale of the bus seven years from now is closest to:

A) $(2,260)

B) $2,260

C) $904

D) $(904)

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

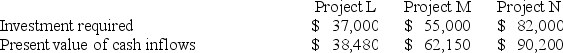

The management of Solar Corporation is considering the following three investment projects (Ignore income taxes.) :  Rank the projects according to the profitability index, from most profitable to least profitable.

Rank the projects according to the profitability index, from most profitable to least profitable.

A) M, N, L

B) L, N, M

C) N, L, M

D) N, M, L

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anthony operates a part time auto repair service. He estimates that a new diagnostic computer system will result in increased cash inflows of $1,500 in Year 1, $2,100 in Year 2, and $3,200 in Year 3. If Anthony's required rate of return is 10%, then the most he would be willing to pay for the new diagnostic computer system would be (Ignore income taxes.) : Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.

A) $4,599

B) $5,501

C) $5,638

D) $5,107

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

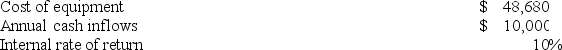

Given the following data (Ignore income taxes.) :  Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.

The life of the equipment must be:

Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.

The life of the equipment must be:

A) It is impossible to determine from the data given

B) 5 years

C) 6 years

D) 7 years

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the salvage value of equipment at the end of a project is highly uncertain, the salvage value should be ignored in capital budgeting decisions.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When the net cash inflow is the same every year for a project after the initial investment, the internal rate of return of a project can be determined by dividing the initial investment required in the project by the annual net cash inflow. This computation yields a factor that can be looked up in a table of present values of annuities to find the internal rate of return.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The management of Byrge Corporation is investigating buying a small used aircraft to use in making airborne inspections of its above-ground pipelines. The aircraft would have a useful life of 8 years. The company uses a discount rate of 10% in its capital budgeting. The net present value of the investment, excluding the intangible benefits, is −$448,460. To the nearest whole dollar how large would the annual intangible benefit have to be to make the investment in the aircraft financially attractive? (Ignore income taxes.) Use Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided.

A) $44,846

B) $56,058

C) $84,060

D) $448,460

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Olinick Corporation is considering a project that would require an investment of $343,000 and would last for 8 years. The incremental annual revenues and expenses generated by the project during those 8 years would be as follows (Ignore income taxes.) :  The scrap value of the project's assets at the end of the project would be $23,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to:

The scrap value of the project's assets at the end of the project would be $23,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to:

A) 3.0 years

B) 5.1 years

C) 3.2 years

D) 4.8 years

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 179

Related Exams