B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company had a beginning balance in retained earnings of $430,000.It had net income of $60,000 and paid out cash dividends of $56,250 in the current period.The ending balance in retained earnings equals:

A) $546,250.

B) $426,250.

C) $116,250.

D) $433,750.

E) $490,000.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

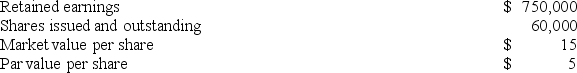

A corporation declared and issued a 15% stock dividend on October 1.The following information was available immediately prior to the dividend:  The amount that paid-in capital will increase (decrease) as a result of recording this stock dividend is:

The amount that paid-in capital will increase (decrease) as a result of recording this stock dividend is:

A) $45,000.

B) $135,000.

C) $(45,000) .

D) $(135,000) .

E) $0.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of income earned per share of a company's outstanding common stock is known as:

A) Restricted retained earnings per share.

B) Earnings per share.

C) Continuing operations per share.

D) Dividends per share.

E) Book value per share.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Treasury stock is classified as:

A) An asset account.

B) A contra asset account.

C) A revenue account.

D) A contra equity account.

E) A liability account.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

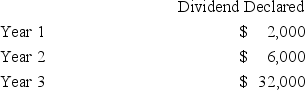

Sweet Company's outstanding stock consists of 1,000 shares of cumulative 5% preferred stock with a $100 par value and 5,000 shares of common stock with a $10 par value.During the first three years of operation,the corporation declared and paid the following total cash dividends.  The total amount of dividends paid to preferred and common shareholders over the three-year period is:

The total amount of dividends paid to preferred and common shareholders over the three-year period is:

A) $15,000 preferred; $25,000 common.

B) $11,000 preferred; $29,000 common.

C) $5,000 preferred; $35,000 common.

D) $12,000 preferred; $28,000 common.

E) $10,000 preferred; $30,000 common.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Prior period adjustments to financial statements can result from:

A) Changes in accounting estimates.

B) Unacceptable accounting practices.

C) Discontinued operations.

D) Changes in tax law.

E) Extraordinary items.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Stockholders' equity consists of paid-in capital and retained earnings.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The total number of shares outstanding is the authorized stock.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Common Stock Dividend Distributable is an equity account.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Stock not assigned a value per share by the corporate charter,allowing it to be issued at any price without the possibility of a minimum legal capital deficiency,is called ________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company issued 60 shares of $100 par value common stock for $7,000 cash.The journal entry to record the issuance is:

A) Debit Cash $7,000; credit Common Stock $7,000.

B) Debit Investment in Common Stock $7,000; credit Cash $7,000.

C) Debit Cash $7,000; credit Common Stock $6,000; credit Paid-in Capital in Excess of Par Value,Common Stock $1,000.

D) Debit Common Stock $6,000,debit Investment in Common Stock $1,000; credit Cash $7,000.

E) Debit Cash $7,000; credit Paid-in Capital in Excess of Par Value,Common Stock $6,000,credit Common Stock $1,000.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The dividend yield is computed by dividing:

A) Annual cash dividends per share by earnings per share.

B) Earnings per share by cash dividends per share.

C) Annual cash dividends per share by the market value per share.

D) Market price per share by cash dividends per share.

E) Cash dividends per share by retained earnings.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Cumulative preferred stock has a right to be paid prior periods' unpaid dividends after common shareholders receive an equal percentage dividend.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Dividend yield shows the annual amount of cash dividends distributed to common shares relative to the stock's market price.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the dividends account is not recorded as a reduction to Retained Earnings on the date of declaration,the dividends account is closed to Retained Earnings at the end of the accounting period.

B) False

Correct Answer

verified

Correct Answer

verified

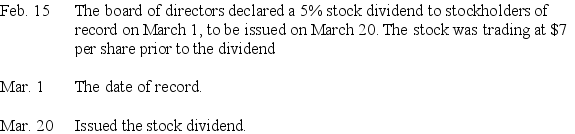

Essay

Dynasty Corporation had stockholders' equity on January 1 as follows: Common Stock,$5 par value,1,000,000 shares authorized,400,000 shares issued; Paid-in Capital in Excess of Par Value,Common Stock,$800,000; Retained Earnings,$3,600,000.Prepare journal entries to record the following transactions:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of annual cash dividends distributed to common shareholders relative to the common stock's market value is the:

A) Dividend payout ratio.

B) Dividend yield.

C) Price-earnings ratio.

D) Current yield.

E) Earnings per share.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Organization expenses of a corporation often include legal fees and promoter fees.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Achieving an increased return on common stock by paying dividends on preferred stock at a rate that is less than the rate of return earned with the assets invested from the preferred stock issuance is called:

A) Financial leverage.

B) Discount on stock.

C) Premium on stock.

D) Preemptive right.

E) Capital gain.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 245

Related Exams