A) The receivables turnover ratio is 12.9.

B) On average, it takes 12.9 days to collect payment from credit customers.

C) The receivables turnover ratio is 28.3.

D) On average, the company sells its inventory every 28.3 days.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compute the quality of income ratio for the current year.

A) 1.38

B) 0.97

C) 1.03

D) 0.73

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Company X has net sales revenue of $780,000, cost of goods sold of $343,200, and all other expenses of $327,600. The net profit margin is:

A) 0.32

B) 0.56

C) 0.86

D) 0.14

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A current ratio of less than one is not so much of a concern when the company has a:

A) low fixed asset turnover ratio.

B) high days to collect number.

C) high inventory turnover ratio.

D) high debt-to-equity ratio.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has a debt to assets ratio of .45 and a return on equity ratio of 10%. If the company then issues common stock, which of the following is a true statement?

A) The debt to assets ratio will decrease and the return on equity ratio will decrease.

B) The debt to assets ratio will increase and the return on equity ratio will increase.

C) The debt to assets ratio will not change and the return on equity ratio will not change.

D) The debt to assets ratio will decrease and the return on equity ratio will increase.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Trend analysis is a form of horizontal analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compute the quality of income ratio.

A) 2.57

B) 4.09

C) 16.4

D) 2.13

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A ratio that may be used to evaluate solvency is the:

A) Asset turnover ratio

B) Quick ratio

C) Current ratio

D) Times interest earned ratio

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ratio that measures the percentage of different sources of financing is the:

A) Current ratio.

B) Times interest earned ratio.

C) Debt to assets ratio.

D) Price/earnings ratio.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compute the net profit margin for the current year.

A) 33.33%

B) 44.45%

C) 32.22%

D) 43.33%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Solvency ratio data are primarily concerned with the ability of a company to:

A) produce profits.

B) handle its debt.

C) manage its cash flow.

D) provide income for stockholders.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios is used to evaluate a company's liquidity?

A) Debt to assets ratio.

B) Asset turnover ratio.

C) Return on equity ratio.

D) Current ratio.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the company's inventory turnover ratio for the current year?

A) 4.61

B) 3.44

C) 21.69

D) 13.76

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compute the return on equity (ROE) ratio for the current year.

A) 60.61%

B) 151%

C) 50.42%

D) 80.81%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following nonfinancial factors is most likely to be a cause of a going- concern problem?

A) Hiring a new CEO.

B) Loss of a key patent.

C) Announcing a new stock issue.

D) Replacing an old product line.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

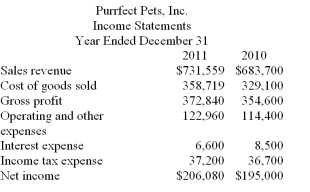

The income statements for 2011 and 2010 for Purrfect Pets, Inc.are presented below:

Correct Answer

verified

Purrfect Pets had 1,588,000, 1,662,000 a...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

Which of the following is calculated by dividing net sales by average accounts receivable?

A) Days to sell ratio

B) Current ratio

C) Profit margin

D) Accounts receivable turnover ratio

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following measures would assist in assessing the profitability of a company?

A) Debt-to-assets ratio

B) Fixed asset turnover ratio

C) Receivables turnover ratio

D) Current ratio

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios is calculated by dividing current assets by current liabilities?

A) Quick ratio

B) Solvency ratio

C) Debt ratio

D) Current ratio

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compute the debt to assets ratio for the current year.

A) 20

B) 67

C) 17

D) 33

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 143

Related Exams