A) Less than three percent of families are categorized as poor for eight years or more.

B) In the United States, the grandson of a millionaire is much more likely to be rich than the grandson of an average-income person.

C) The majority of millionaires in the United States inherited their wealth.

D) Most workers have about the same income (adjusted for inflation) when they are young as when they are middle-aged.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Since 1959 when the official data on the poverty rate began, the poverty rate was at its highest in

A) 1959.

B) 1968.

C) 1977.

D) 1986.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

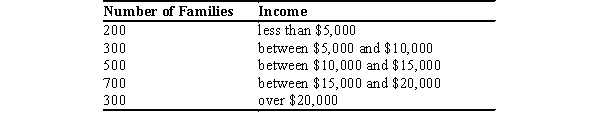

The distribution of income for Inequalia is as follows:  If the poverty rate in Inequalia is 25 percent, what is the poverty line in Inequalia?

If the poverty rate in Inequalia is 25 percent, what is the poverty line in Inequalia?

A) $5,000

B) $10,000

C) $15,000

D) $20,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Critics of the minimum wage argue that

A) labor demand is inelastic so firms can adjust production.

B) too many older employees benefit at the expense of teenage workers.

C) many minimum-wage earners are teenagers from middle-class families.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When we compare the income distribution of the United States to those of other countries, we find that the U.S. has

A) an income distribution similar to Japan's.

B) an income distribution similar to South Africa's.

C) one of the most unequal income distributions.

D) a bit more inequality than the typical country.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A common criticism of government programs that are designed to assist the poor is that

A) those who receive assistance rarely meet the criterion for eligibility.

B) the majority of those below the poverty line refuse to accept government assistance.

C) they create incentives for people to become "needy."

D) they typically account for a majority of annual government expenditures.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following groups has the lowest poverty rate?

A) blacks

B) Asians

C) children (under age 18)

D) female households, no spouse present

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the U.S. economy, labor earnings make up about

A) one-half of total income.

B) two-thirds of total income.

C) three-fourths of total income.

D) nine-tenths of total income.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

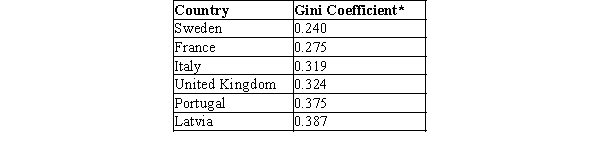

Table 20-10  *A Gini coefficient is a commonly used measure of income inequality, with values between 0 and 1 (0 corresponds to perfect equality whereby everyone has exactly the same income, and 1 corresponds to perfect inequality where one person has all the income, while everyone else has zero income) .

Source: The World Bank

-Refer to Table 20-10. Which country has the most unequal income distribution?

*A Gini coefficient is a commonly used measure of income inequality, with values between 0 and 1 (0 corresponds to perfect equality whereby everyone has exactly the same income, and 1 corresponds to perfect inequality where one person has all the income, while everyone else has zero income) .

Source: The World Bank

-Refer to Table 20-10. Which country has the most unequal income distribution?

A) Latvia

B) Italy

C) France

D) Sweden

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Standard measurements of the degree of income inequality take both money income and in-kind transfers into account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a welfare program?

A) Temporary Assistance for Needy Families (TANF) .

B) Capital Gains Tax (CGT) .

C) Life Cycle Transfers (LCT) .

D) North American Free Trade Agreement (NAFTA) .

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economic mobility refers to the

A) government's attempt to distribute monetary assistance to areas most in need.

B) ability of families to freely relocate to find good jobs.

C) movement of people among income classes.

D) movement of resources from one country to another.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

John Rawls, who developed the way of thinking called liberalism, argued that government policies should be aimed at maximizing the sum of utility of everyone in society.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the U.S. government determines that the cost of feeding an urban family of four is $5,200 per year, then the official poverty line for a family of that type is

A) $10,400.

B) $15,600.

C) $20,800.

D) $26,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-5 Suppose the government implemented a negative income tax and used the following formula to compute a family's tax liability: Taxes owed = (1/4 of income) - $10,000 -Refer to Scenario 20-5. Below what level of income would families start to receive a subsidy from this negative income tax?

A) $10,000

B) $25,000

C) $40,000

D) $50,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The invisible hand of the marketplace acts to allocate resources

A) efficiently but does not necessarily ensure that resources are allocated fairly.

B) both fairly and efficiently.

C) fairly but does not necessarily ensure that resources are allocated efficiently.

D) neither fairly nor efficiently.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

People can borrow and lend money to smooth out short term variations in income known as what kind of changes?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The 2011 U.S. distribution of income shows that the top 5 percent of families have approximately what share of income?

A) 4 percent

B) 9 percent

C) 21 percent

D) 49 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anti-poverty programs

A) encourage saving among recipient groups.

B) impose a very low marginal tax rate on income.

C) are only made available to those with no other source of income.

D) may discourage the poor from escaping poverty on their own.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

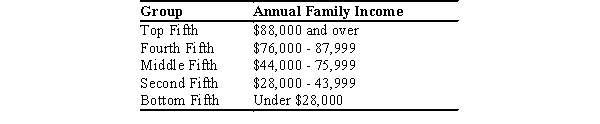

Table 20-3

The Distribution of Income in Edgerton  -Refer to Table 20-3. According to the table, what percent of families in Edgerton have income levels below $76,000?

-Refer to Table 20-3. According to the table, what percent of families in Edgerton have income levels below $76,000?

A) 20 percent.

B) 40 percent.

C) 60 percent.

D) 80 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 478

Related Exams