A) the horizontal equity principle.

B) the benefits principle.

C) a regressive tax argument.

D) the ability-to-pay principle.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lump-sum tax

A) is most frequently used to tax real property.

B) does not distort incentives.

C) distorts incentives more than any other type of tax.

D) is the most fair tax.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The federal government decides to impose a 15% excise tax on luxury yachts. An economist would suggest that:

A) this is an effective way to indirectly tax the wealthy

B) the tax incidence will fall largely on those who buy luxury yachts

C) if prospective buyers decide to purchase other luxury goods instead, the tax incidence will largely fall on those who build and sell luxury yachts

D) the price of luxury yachts will rise by 15%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If we want to gauge the sacrifice made by a taxpayer, we should use the

A) average tax rate.

B) marginal tax rate.

C) lump-sum tax rate.

D) sales tax rate.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following tax systems could not be structured to satisfy conditions of vertical equity?

A) a proportional tax

B) a regressive tax

C) a progressive tax

D) a lump-sum tax

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

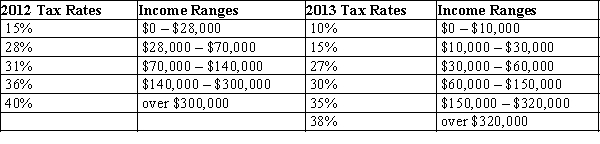

Table 12-9

United States Income Tax Rates for a Single Individual, 2012 and 2013.  -Refer to Table 12-9. Jake is a single person whose taxable income is $20,000 a year. What happened to his average tax rate between 2012 and 2013?

-Refer to Table 12-9. Jake is a single person whose taxable income is $20,000 a year. What happened to his average tax rate between 2012 and 2013?

A) It increased.

B) It decreased.

C) It did not change.

D) We do not have enough information to answer this question.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deadweight losses are associated with

A) taxes that distort the incentives that people face.

B) taxes that target expenditures on survivor's benefits for Social Security.

C) taxes that have no efficiency losses.

D) lump-sum taxes.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following tax structures is potentially consistent with the concept of vertical equity?

A) A proportional tax

B) A progressive tax

C) A regressive tax

D) Any of these tax structures are potentially consistent with vertical equity

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If revenue from a gasoline tax is used to build and maintain public roads, the gasoline tax may be justified on the basis of

A) the benefits principle.

B) the ability-to-pay principle.

C) vertical equity.

D) horizontal equity.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The principle that people should pay taxes based on the benefits they receive from government services is called the

A) pay principle.

B) tax-benefit principle.

C) government services principle.

D) benefits principle.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the United States, the marginal tax rate on individual federal income tax

A) decreases as income increases.

B) increases as income increases.

C) is constant at all income levels.

D) applies only to payroll taxes.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a tax generates a reduction in surplus that is exactly offset by the tax revenue collected by the government, the tax does not have a deadweight loss.

B) False

Correct Answer

verified

Correct Answer

verified

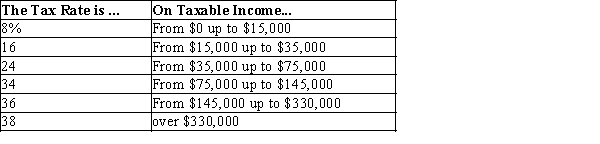

Multiple Choice

Table 12-11  -Refer to Table 12-11. If Peggy has taxable income of $43,000, her average tax rate is

-Refer to Table 12-11. If Peggy has taxable income of $43,000, her average tax rate is

A) 14.7%.

B) 16.3%.

C) 20.8%.

D) 24.0%.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a tax of 20 percent on the first $50,000 of income and 30 percent on all income above $50,000. What is the average tax rate when income is $60,000?

A) 21.7 percent

B) 25.0 percent

C) 46.7 percent

D) 50.0 percent

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose New York City passes a local "big gulp" tax that taxes carbonated beverages larger than 20 ounces if they contain sugar or high fructose corn syrup. If the revenue from the "big gulp" tax is earmarked for diabetes research, the "big gulp" tax may be justified

A) on the basis of the ability-to-pay principle.

B) because it is an example of a lump-sum tax and thus is the most efficient tax.

C) on the basis of the benefits principle.

D) because it is an example of a progressive tax and thus is the most equitable tax.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

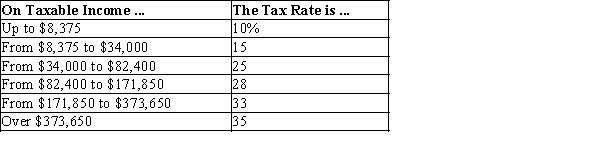

Table 12-10  -Refer to Table 12-10. If Willie has $170,000 in taxable income, his marginal tax rate is

-Refer to Table 12-10. If Willie has $170,000 in taxable income, his marginal tax rate is

A) 25%.

B) 28%.

C) 33%.

D) 35%.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

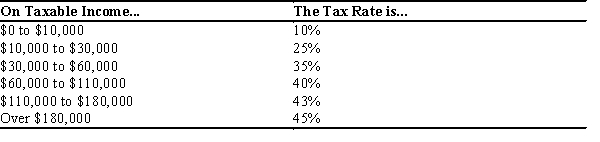

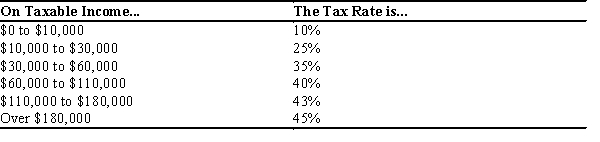

Table 12-6

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.  -Refer to Table 12-6. For this tax schedule, what is the total tax liability for an individual with $280,000 in taxable income?

-Refer to Table 12-6. For this tax schedule, what is the total tax liability for an individual with $280,000 in taxable income?

A) $105,700

B) $108,900

C) $111,600

D) $117,300

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-6

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.  -Refer to Table 12-6. For this tax schedule, what is the average tax rate for an individual with $280,000 in taxable income?

-Refer to Table 12-6. For this tax schedule, what is the average tax rate for an individual with $280,000 in taxable income?

A) 39.9%

B) 40.2%

C) 42.7%

D) 44.8%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

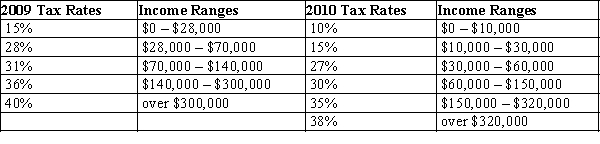

Table 12-18

United States Income Tax Rates for a Single Individual, 2009 and 2010.  -Refer to Table 12-18. What type of tax structure does the United States have in 2010 for single individuals?

-Refer to Table 12-18. What type of tax structure does the United States have in 2010 for single individuals?

A) a proportional tax structure

B) a regressive tax structure

C) a progressive tax structure

D) a lump-sum tax structure

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a tax of 10 percent on the first $40,000 of income and 20 percent on all income above $40,000. What are the tax liability and the marginal tax rate for a person whose income is $50,000?

A) 12 percent and 20 percent, respectively

B) 12 percent and $50,000, respectively

C) $6,000 and 12 percent, respectively

D) $6,000 and 20 percent, respectively

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 481 - 500 of 563

Related Exams