A) Since debt capital can cause a company to go bankrupt but equity capital cannot, debt is riskier than equity, and thus the after-tax cost of debt is always greater than the cost of equity.

B) The tax-adjusted cost of debt is always greater than the interest rate on debt, provided the company does in fact pay taxes.

C) If a company assigns the same cost of capital to all of its projects regardless of each project's risk, then the company is likely to reject some safe projects that it actually should accept and to accept some risky projects that it should reject.

D) Because no flotation costs are required to obtain capital as retained earnings, the cost of retained earnings is generally lower than the after-tax cost of debt.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

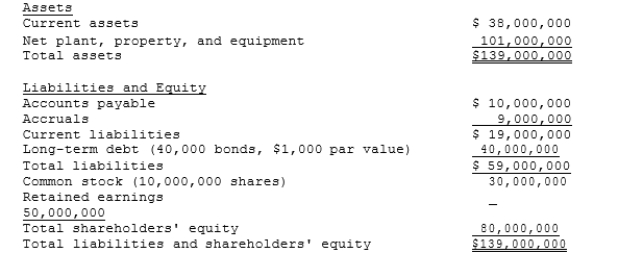

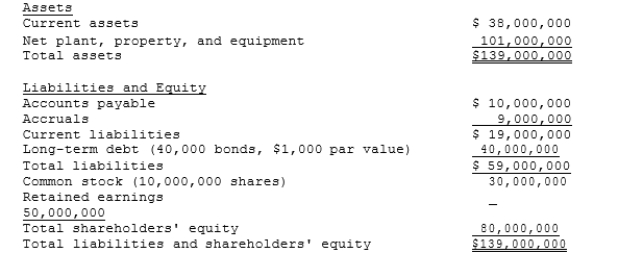

(The following information applies to Problems 89, 90, 91, and 92.)

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable

$1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-What is the best estimate of the firm's WACC?

The stock is currently selling for $15.25 per share, and its noncallable

$1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-What is the best estimate of the firm's WACC?

A) 10.85%

B) 11.19%

C) 11.53%

D) 11.88%

E) 12.24

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

LaPango Inc. estimates that its average-risk projects have a WACC of 10%, its below-average risk projects have a WACC of 8%, and its above- average risk projects have a WACC of 12%. Which of the following projects (A, B, and C) should the company accept?

A) Project B, which is of below-average risk and has a return of 8.5%.

B) Project C, which is of above-average risk and has a return of 11%.

C) Project A, which is of average risk and has a return of 9%.

D) None of the projects should be accepted.

E) All of the projects should be accepted.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

O'Brien Inc. has the following data: rRF = 5.00%; RPM = 6.00%; and b = 1.05. What is the firm's cost of common from retained earnings based on the CAPM?

A) 11.30%

B) 11.64%

C) 11.99%

D) 12.35%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The text identifies three methods for estimating the cost of common stock from retained earnings: the CAPM method, the DCF method, and the bond-yield-plus-risk-premium method. However, only the DCF method is widely used in practice.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When working with the CAPM, which of the following factors can be determined with the most precision?

A) The market risk premium (RPM) .

B) The beta coefficient, bi, of a relatively safe stock.

C) The most appropriate risk-free rate, rRF.

D) The expected rate of return on the market, rM.

E) The beta coefficient of "the market," which is the same as the beta of an average stock.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

For capital budgeting and cost of capital purposes, the firm should always consider retained earnings as the first source of capital--i.e., use these funds first--because retained earnings have no cost to the firm.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Suppose you are the president of a small, publicly-traded corporation. Since you believe that your firm's stock price is temporarily depressed, all additional capital funds required during the current year will be raised using debt. In this case, the appropriate marginal cost of capital for use in capital budgeting during the current year is the after-tax cost of debt.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Eakins Inc.'s common stock currently sells for $45.00 per share, the company expects to earn $2.75 per share during the current year, its expected payout ratio is 70%, and its expected constant growth rate is 6.00%. New stock can be sold to the public at the current price, but a flotation cost of 8% would be incurred. By how much would the cost of new stock exceed the cost of common from retained earnings?

A) 0.09%

B) 0.19%

C) 0.37%

D) 0.56%

E) 0.84%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bosio Inc.'s perpetual preferred stock sells for $97.50 per share, and it pays an $8.50 annual dividend. If the company were to sell a new preferred issue, it would incur a flotation cost of 4.00% of the price paid by investors. What is the company's cost of preferred stock for use in calculating the WACC?

A) 8.72%

B) 9.08%

C) 9.44%

D) 9.82%

E) 10.22%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To help finance a major expansion, Castro Chemical Company sold a noncallable bond several years ago that now has 20 years to maturity. This bond has a 9.25% annual coupon, paid semiannually, sells at a price of $1,075, and has a par value of $1,000. If the firm's tax rate is 40%, what is the component cost of debt for use in the WACC calculation?

A) 4.35%

B) 4.58%

C) 4.83%

D) 5.08%

E) 5.33%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The cost of common equity obtained by retaining earnings is the rate of return the marginal stockholder requires on the firm's common stock.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The before-tax cost of debt, which is lower than the after-tax cost, is used as the component cost of debt for purposes of developing the firm's WACC.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rivoli Inc. hired you as a consultant to help estimate its cost of common equity. You have been provided with the following data: D0 = $0.80; P0 = $22.50; and g = 8.00% (constant) . Based on the DCF approach, what is the cost of common from retained earnings?

A) 10.69%

B) 11.25%

C) 11.84%

D) 12.43%

E) 13.05%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

S. Bouchard and Company hired you as a consultant to help estimate its cost of common equity. You have obtained the following data: D0 = $0.85; P0 = $22.00; and g = 6.00% (constant) . The CEO thinks, however, that the stock price is temporarily depressed, and that it will soon rise to $40.00. Based on the DCF approach, by how much would the cost of common from retained earnings change if the stock price changes as the CEO expects?

A) -1.49%

B) -1.66%

C) -1.84%

D) -2.03%

E) -2.23%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(The following information applies to Problems 89, 90, 91, and 92.)

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable

$1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-What is the best estimate of the after-tax cost of debt?

The stock is currently selling for $15.25 per share, and its noncallable

$1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-What is the best estimate of the after-tax cost of debt?

A) 4.64%

B) 4.88%

C) 5.14%

D) 5.40%

E) 5.67%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You were recently hired by Scheuer Media Inc. to estimate its cost of common equity. You obtained the following data: D1 = $1.75; P0 = $42.50; g = 7.00% (constant) ; and F = 5.00%. What is the cost of equity raised by selling new common stock?

A) 10.77%

B) 11.33%

C) 11.90%

D) 12.50%

E) 13.12%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The cost of capital used in capital budgeting should reflect the average cost of the various sources of long-term funds a firm uses to acquire assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sapp Trucking's balance sheet shows a total of noncallable $45 million long-term debt with a coupon rate of 7.00% and a yield to maturity of 6.00%. This debt currently has a market value of $50 million. The balance sheet also shows that the company has 10 million shares of common stock, and the book value of the common equity (common stock plus retained earnings) is $65 million. The current stock price is $22.50 per share; stockholders' required return, rs, is 14.00%; and the firm's tax rate is 40%. The CFO thinks the WACC should be based on market value weights, but the president thinks book weights are more appropriate. What is the difference between these two WACCs?

A) 1.55%

B) 1.72%

C) 1.91%

D) 2.13%

E) 2.36%

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a firm is privately owned, and its stock is not traded in public markets, then we cannot measure its beta for use in the CAPM model, we cannot observe its stock price for use in the DCF model, and we don't know what the risk premium is for use in the bond-yield-plus-risk- premium method. All this makes it especially difficult to estimate the cost of equity for a private company.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 90

Related Exams