Filters

Question type

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 172

Multiple Choice

Kovack Corporation's net operating income in Year 2 was $66,571, net income before taxes was $46,571, and the net income was $32,600. Total common stock was $120,000 at the end of both Year 2 and Year 1. The par value of common stock is $2 per share. The company's total stockholders' equity at the end of Year 2 amounted to $962,000 and at the end of Year 1 to $930,000. The company declared and paid $600 dividends on common stock. The market price per share was $4.37. The company's dividend yield ratio for Year 2 is closest to:

A) 0.2%

B) 1.3%

C) 1.9%

D) 0.5%

E) B) and C)

F) A) and D)

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Question 173

Multiple Choice

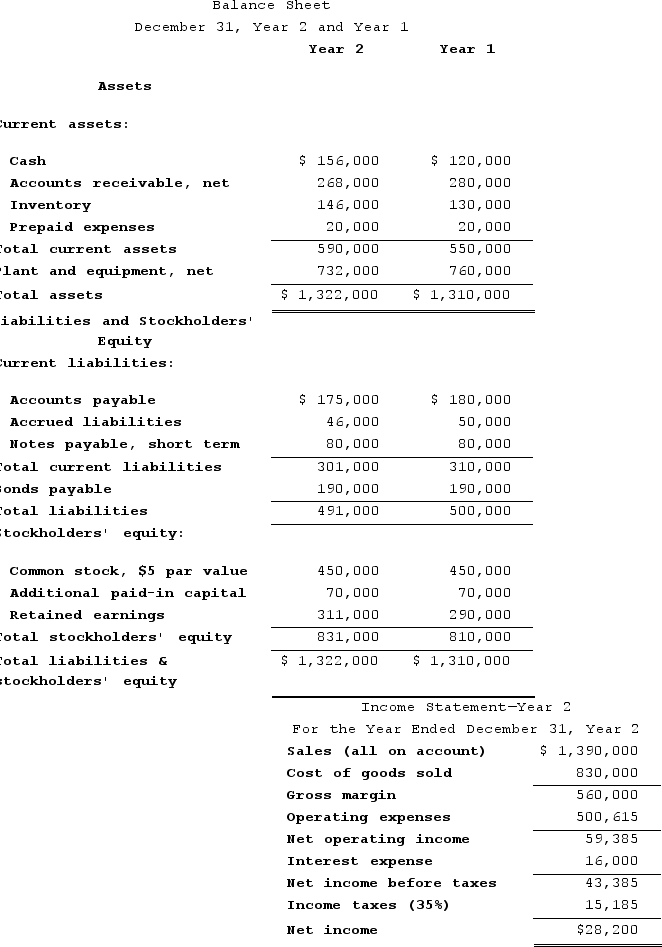

Macmillan Corporation has provided the following financial data:  Dividends on common stock during Year 2 totaled $7,200. The market price of common stock at the end of Year 2 was $3.69 per share.The company's acid-test (quick) ratio at the end of Year 2 is closest to:

Dividends on common stock during Year 2 totaled $7,200. The market price of common stock at the end of Year 2 was $3.69 per share.The company's acid-test (quick) ratio at the end of Year 2 is closest to:

A) 1.96

B) 1.41

C) 1.20

D) 1.48

E) B) and C)

F) C) and D)

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Question 174

Multiple Choice

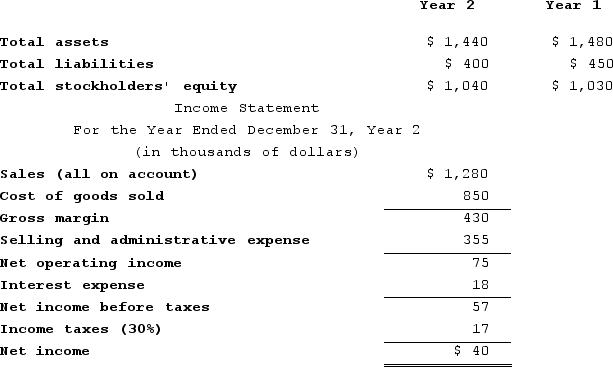

Data from Lheureux Corporation's most recent balance sheet and the company's income statement appear below:  The debt-to-equity ratio at the end of Year 2 is closest to:

The debt-to-equity ratio at the end of Year 2 is closest to:

A) 0.38

B) 0.13

C) 0.16

D) 0.43

E) B) and C)

F) B) and D)

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Question 175

True/False

In determining whether a company's financial condition is improving or deteriorating over time, horizontal analysis of financial statement data would be more useful than vertical analysis.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 176

Multiple Choice

The Seabury Corporation has a current ratio of 4.2 and an acid-test ratio of 3.9. The corporation's current assets consist of cash, marketable securities, accounts receivable, and inventories. Inventory equals $18,000. Seabury Corporation's current liabilities must be: (Round your intermediate calculations to 1 decimal place.)

A) $18,000

B) $234,000

C) $60,000

D) $5,400

E) C) and D)

F) A) and C)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Question 177

Multiple Choice

Recher Corporation's common stock has a par value of $3 per share and has been stable at a total value of $270,000 on the company's balance sheet for several years. The total stockholders' equity at the end of this year was $1,023,000 and at the beginning of the year was $1,010,000. Net income for the year was $17,500. Dividends on common stock during the year totaled $4,500. The market price of common stock at the end of the year was $3.76 per share.The company's price-earnings ratio is closest to: (Round your intermediate calculations to 2 decimal places.)

A) 19.79

B) 0.51

C) 8.36

D) 12.53

E) A) and D)

F) All of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 321 - 327 of 327

Related Exams