A) $94,000 is recorded as a cash inflow from investing activities and no other sections of the statement are affected.

B) $94,000 is recorded as a cash inflow from investing activities and $6,000 is added to convert net income to net cash flow provided by operating activities.

C) $94,000 is recorded as a cash inflow from investing activities and $6,000 is subtracted to convert net income to net cash flow provided by operating activities.

D) $94,000 is recorded as a cash inflow from operating activities.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When preparing the operating activities section of the statement of cash flows using the indirect method,a decrease in accounts receivable is subtracted from net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be classified as an operating activity on the statement of cash flows using the direct method?

A) Cash dividends paid.

B) Cash received from selling equipment.

C) Cash paid to retire bonds payable at maturity.

D) Cash received from accounts receivable collections.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each term with the appropriate definition.Not all definitions will be used. -Net Income

A) Results from activities such as purchases of goods and assets,payment of debt,payment of cash dividends,and payment of taxes.

B) The starting point for calculating operating cash flows with the direct method.

C) The percent of a company's net cash flow that comes from investing and financing activities.

D) A balance sheet that shows the starting and ending balance of the different accounts;it is used to calculate the net cash flow provided by operating activities.

E) Purchases and sales of this are classified as operating activities.

F) Reported as supplement disclosures or in the notes section to the financial statements rather than within the body of the statement of cash flows.

G) Cash flows from operations in excess of amount paid to replace property,plant and equipment and to pay cash dividends to stockholders.

H) Cash flows in excess of net income.

I) Purchases and sales of this are classified as investing activities.

J) Results from activities such as sales of goods and assets,receipt of cash dividends,and receipts of interest.

K) A financial statement that tracks the flow of cash into and out of a company according to the three types of activities that generate the flows.

L) An adjustment made when using the indirect method of calculating cash flows from operating activities.

M) Cash a company receives that is not subject to income tax.

N) The starting point for calculating operating cash flows with the indirect method.

P) B) and I)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each term with the appropriate definition.Not all definitions will be used. -Statement of Cash Flows

A) Results from activities such as purchases of goods and assets,payment of debt,payment of cash dividends,and payment of taxes.

B) The starting point for calculating operating cash flows with the direct method.

C) The percent of a company's net cash flow that comes from investing and financing activities.

D) A balance sheet that shows the starting and ending balance of the different accounts;it is used to calculate the net cash flow provided by operating activities.

E) Purchases and sales of this are classified as operating activities.

F) Reported as supplement disclosures or in the notes section to the financial statements rather than within the body of the statement of cash flows.

G) Cash flows from operations in excess of amount paid to replace property,plant and equipment and to pay cash dividends to stockholders.

H) Cash flows in excess of net income.

I) Purchases and sales of this are classified as investing activities.

J) Results from activities such as sales of goods and assets,receipt of cash dividends,and receipts of interest.

K) A financial statement that tracks the flow of cash into and out of a company according to the three types of activities that generate the flows.

L) An adjustment made when using the indirect method of calculating cash flows from operating activities.

M) Cash a company receives that is not subject to income tax.

N) The starting point for calculating operating cash flows with the indirect method.

P) C) and G)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Patterson Co.'s Depreciation Expense is $56,000 and the beginning and ending Accumulated Depreciation balances are $420,000 and $434,000,respectively.What is the cash paid for depreciation?

A) $56,000

B) $14,000

C) $0

D) $70,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be added to net income in calculating cash flows from operating activities on a statement of cash flows prepared using the indirect method?

A) Amortization Expense.

B) A decrease in Accounts Receivable.

C) An increase in Salaries and Wages Payable.

D) A gain on sale of equipment.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounting records for the Fox Hollow Company show that its cost of goods sold for the year was $300,000.In addition,it had an increase in inventory of $5,000 and a decrease in accounts payable of $6,000.As a result under the direct method,the amount of cash paid to suppliers for the year was:

A) $301,000.

B) $305,000.

C) $306,000.

D) $311,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a company uses the indirect method to prepare its statement of cash flows.If Accounts Receivable decreases and Unearned Revenue increases during an accounting period,what does the company do with the changes in these accounts to calculate cash flows from operating activities?

A) Both are added to net income.

B) The change in accounts receivable is added to net income;the change in unearned revenue is subtracted.

C) Both are subtracted from net income.

D) The change in unearned revenue is added to net income;the change in accounts receivable is subtracted.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following classifications is not used on the statement of cash flows?

A) Operating

B) Investing

C) Financing

D) Spending

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the calculation of cash flows from operating activities starts with net income,the company:

A) is using the net income method.

B) will remove the effects of all noncash items included in the calculation of net income.

C) is using the direct method.

D) will add all noncash items not included in the calculation of net income.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cleveland Company paid cash to purchase equipment costing $957,600 this year.Also this year,the company sold for $196,000 cash,equipment that originally cost $644,000 five years ago.How should these transactions be listed in the statement of cash flows?

A) Braden can combine the transactions and show a decrease to cash for $313,600.

B) Braden can combine the transactions and show a decrease to cash for $761,600.

C) The purchases and the sales of equipment must be shown separately as a decrease to cash for $1,601,600 (purchase) and an increase of $196,000 (sale) .

D) The purchases and the sales of equipment must be shown separately as a decrease to cash for $957,600 (purchase) and an increase of $196,000 (sale) .

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The company would report net cash provided by (used in) financing activities of:

A) $(5,000) .

B) $4,000.

C) $10,000.

D) $12,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be included in cash flows from investing activities?

A) Cash collected from customers.

B) Cash received from an issuance of bonds.

C) Cash dividends paid.

D) Cash used to purchase equipment.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be classified as an investing activity on the statement of cash flows?

A) Cash received from sale of land.

B) Cash paid for interest.

C) Cash received from stock issuance.

D) Cash dividends paid.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

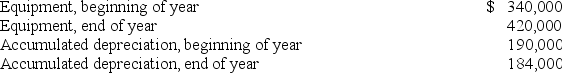

Equipment with a cost of $20,000 and a book value of $6,000 was sold during the year for cash of $18,000.Additional equipment was purchased during the year for cash.

What was the amount of cash paid for purchases of equipment during the year?

Equipment with a cost of $20,000 and a book value of $6,000 was sold during the year for cash of $18,000.Additional equipment was purchased during the year for cash.

What was the amount of cash paid for purchases of equipment during the year?

A) $80,000

B) $86,000

C) $100,000

D) $62,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The information below was obtained from the financial statements of Faraday Corp.Based on this information,what was the amount of the net cash provided by operating activities during the current year?

A) $713,000

B) $721,000

C) $661,000

D) $637,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each term with the appropriate definition.Not all definitions will be used. -Investing Activities

A) A measure of the amount by which current assets exceed current liabilities.

B) Cash inflows and outflows related to the sale or purchase of investments and long-lived assets.

C) Include assets that are very liquid and are purchased by the entity within three months of maturity.

D) These activities include only purchases made with borrowed funds.

E) Must include cash paid for interest and income tax in a separate schedule.

F) Measures the ability of a company to finance its interest payments with its operating cash flow before taxes and interest.

G) Cash inflows and outflows related to financing sources external to the company (owners and lenders) .

H) These activities include money lent by a company as well as money borrowed by a company.

I) Reports the components of cash flows from operating activities as gross receipts and gross payments.

J) This ratio uses net income instead of operating cash flow to analyze a company's ability to finance the cost of its debt.

K) Cash inflows and outflows related to components of net income.

L) Presents the operating activities section of the cash flow statement by adjusting net income to compute cash flows from operating activities.

N) H) and L)

Correct Answer

verified

Correct Answer

verified

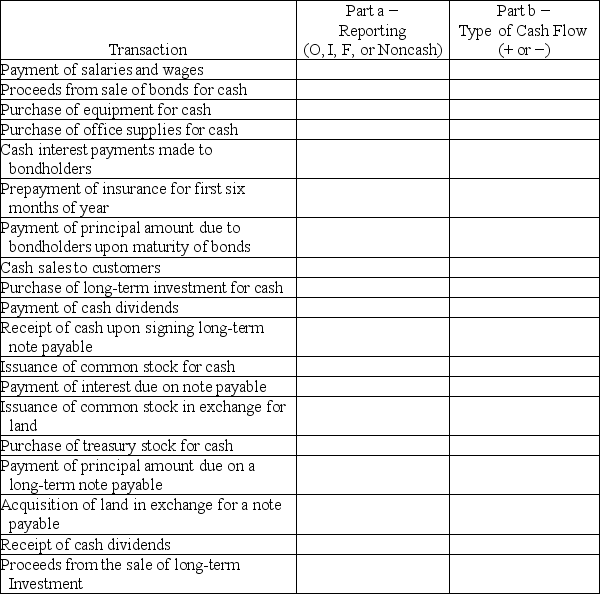

Essay

Complete the last two columns in the following table by indicating whether each transaction would be reported:

Part a.In the operating (O),investing (I),or financing (F)activities section of the statement of cash flows or if the transaction would be reported instead as a noncash investing and/or financing transaction (Noncash).

Part b.As a cash inflow (+)or a cash outflow (−)on the statement of ash flows.(Leave this cell blank if you entered "Noncash" for part a. )

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each term with the appropriate definition.Not all definitions will be used. -Property,Plant,and Equipment

A) Results from activities such as purchases of goods and assets,payment of debt,payment of cash dividends,and payment of taxes.

B) The starting point for calculating operating cash flows with the direct method.

C) The percent of a company's net cash flow that comes from investing and financing activities.

D) A balance sheet that shows the starting and ending balance of the different accounts;it is used to calculate the net cash flow provided by operating activities.

E) Purchases and sales of this are classified as operating activities.

F) Reported as supplement disclosures or in the notes section to the financial statements rather than within the body of the statement of cash flows.

G) Cash flows from operations in excess of amount paid to replace property,plant and equipment and to pay cash dividends to stockholders.

H) Cash flows in excess of net income.

I) Purchases and sales of this are classified as investing activities.

J) Results from activities such as sales of goods and assets,receipt of cash dividends,and receipts of interest.

K) A financial statement that tracks the flow of cash into and out of a company according to the three types of activities that generate the flows.

L) An adjustment made when using the indirect method of calculating cash flows from operating activities.

M) Cash a company receives that is not subject to income tax.

N) The starting point for calculating operating cash flows with the indirect method.

P) A) and H)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 222

Related Exams