A) less than $1.

B) $1.

C) between $1 and $2.

D) $2.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the 1970s,long lines at gas stations in the United States were primarily a result of the fact that

A) OPEC raised the price of crude oil in world markets.

B) U.S. gasoline producers raised the price of gasoline.

C) the U.S. government maintained a price ceiling on gasoline.

D) Americans typically commuted long distances.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

One common example of a price ceiling is rent control.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a binding price ceiling is imposed on a market for a good,some people who want to buy the good cannot do so.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

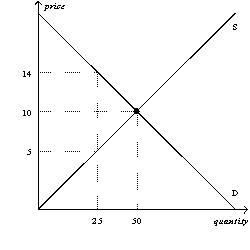

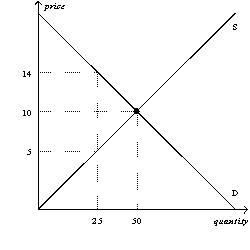

Figure 6-16

-Refer to Figure 6-16.Suppose a tax of $5 per unit is imposed on this market.What will be the new equilibrium quantity in this market?

-Refer to Figure 6-16.Suppose a tax of $5 per unit is imposed on this market.What will be the new equilibrium quantity in this market?

A) less than 25 units

B) 25 units

C) between 25 units and 50 units

D) greater than 50 units

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A tax on buyers increases the size of a market.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Price floors are typically imposed to benefit buyers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

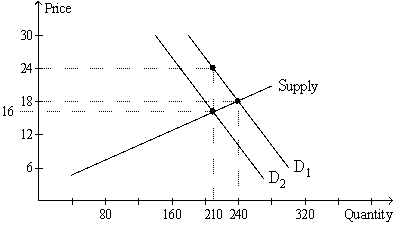

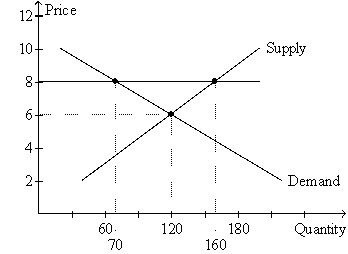

Figure 6-20

-Refer to Figure 6-20.In the after-tax equilibrium,government collects

-Refer to Figure 6-20.In the after-tax equilibrium,government collects

A) $1,440 in tax revenue; of this amount, $960 represents a burden on buyers and $480 represents a burden on sellers.

B) $1,440 in tax revenue; of this amount, $720 represents a burden on buyers and $720 represents a burden on sellers.

C) $1,680 in tax revenue; of this amount, $1,260 represents a burden on buyers and $420 represents a burden on sellers.

D) $1,680 in tax revenue; of this amount, $840 represents a burden on buyers and $840 represents a burden on sellers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

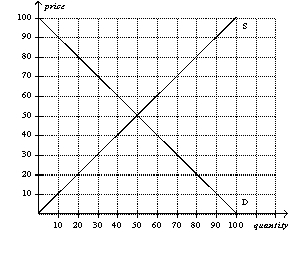

Figure 6-26

-Refer to Figure 6-26.A price ceiling set at $70 would create a shortage of 40 units.

-Refer to Figure 6-26.A price ceiling set at $70 would create a shortage of 40 units.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

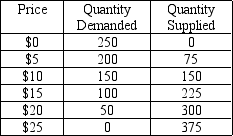

Table 6-2

-Refer to Table 6-2.A price ceiling set at $5 will

-Refer to Table 6-2.A price ceiling set at $5 will

A) be binding and will result in a shortage of 50 units.

B) be binding and will result in a shortage of 75 units.

C) be binding and will result in a shortage of 125 units.

D) not be binding.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.Congress first instituted a minimum wage in

A) 1776.

B) 1812.

C) 1938.

D) 1975.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A surplus results when a

A) nonbinding price floor is imposed on a market.

B) nonbinding price floor is removed from a market.

C) binding price floor is imposed on a market.

D) binding price floor is removed from a market.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on the sellers of coffee mugs

A) increases the size of the coffee mug market.

B) decreases the size of the coffee mug market.

C) has no effect on the size of the coffee mug market.

D) may increase, decrease, or have no effect on the size of the coffee mug market.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the buyers of a product,then the supply curve will

A) not shift.

B) shift up.

C) shift down.

D) become flatter.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One economist has argued that rent control is "the best way to destroy a city,other than bombing." Why would an economist say this?

A) He fears that low rents will cause low-income people to move into the city, reducing the quality of life for other people.

B) He fears that rent control will benefit landlords at the expense of tenants, increasing inequality in the city.

C) He fears that rent controls will cause a construction boom, which will make the city crowded and more polluted.

D) He fears that rent control will eliminate the incentive to maintain buildings, leading to a deterioration of the city.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax imposed on the buyers of a good will

A) raise both the price buyers pay and the effective price sellers receive.

B) raise the price buyers pay and lower the effective price sellers receive.

C) lower the price buyers pay and raise the effective price sellers receive.

D) lower both the price buyers pay and the effective price sellers receive.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-16

-Refer to Figure 6-16.Suppose a tax of $5 per unit is imposed on this market.How much will buyers pay per unit after the tax is imposed?

-Refer to Figure 6-16.Suppose a tax of $5 per unit is imposed on this market.How much will buyers pay per unit after the tax is imposed?

A) $5

B) between $5 and $10

C) between $10 and $14

D) $14

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Because the supply and demand of housing are inelastic in the short run,the initial shortage caused by rent control is large.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-5

-Refer to Figure 6-5.Suppose the market is initially in equilibrium.Then the government imposes a price control,as represented by the horizontal line on the graph.If the price control is a price floor,then the price control

-Refer to Figure 6-5.Suppose the market is initially in equilibrium.Then the government imposes a price control,as represented by the horizontal line on the graph.If the price control is a price floor,then the price control

A) causes the quantity demanded to decrease by 50 units, relative to the initial equilibrium.

B) causes the quantity supplied to increase by 40 units, relative to the initial equilibrium.

C) results in some firms being more successful than others in selling their goods.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The wedge between the buyers' price and the sellers' price is the same,regardless of whether the tax is levied on buyers or sellers.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 441 - 460 of 557

Related Exams