A) the consumers who still choose to consume the commodity but pay a higher price that reflects the tax.

B) the consumers who choose to not consume the commodity that is taxed.

C) all citizens who are able to use services provided by government.

D) the consumers who are unable to avoid paying the tax.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the following countries,which country's government collects the least amount of tax revenue as a percentage of that country's total income?

A) France

B) United States

C) Canada

D) Sweden

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Horizontal equity can be difficult to assess because it is difficult to compare the similarity of tax payers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Skip places a $20 value on a bottle of wine, and Walt places a $17 value on it. The equilibrium price for a bottle of wine is $15. -Refer to Scenario 12-1.Suppose the government levies a tax of $1 on each bottle of wine,and the equilibrium price of a bottle of wine increases to $16.What is total consumer surplus after the tax is levied?

A) $2

B) $3

C) $4

D) $5

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an important reason for the projected increase in government spending as a percentage of GDP over the next several decades?

A) the increase in life expectancy resulting from advances in healthcare

B) an increase in the average number of children per family.

C) the increase in the number of jobs lost each year to foreign countries as a result of outsourcing

D) the reduction in the number of high-cost medical procedures

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The marginal tax rate serves as a measure of the extent to which the tax system discourages people from working.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A budget surplus occurs when government receipts exceed government spending.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a government simplified its tax system the likeliest result would be

A) a decrease in consumer surplus.

B) a decrease in producer surplus.

C) a decrease in deadweight loss.

D) a decrease in tax revenues.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an advantage of a lump-sum tax in comparison to other types of taxes?

A) It would not cause deadweight loss.

B) It imposes a minimal administrative burden on taxpayers.

C) It is more equitable.

D) It is more efficient.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

An advantage of a consumption tax is that it does not distort the incentive to save.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

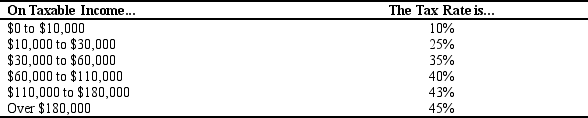

Scenario 12-4. A taxpayer faces the following tax rates on her income:

-Refer to Scenario 12-4.The taxpayer faces

-Refer to Scenario 12-4.The taxpayer faces

A) an average tax rate of 22.5 percent when her income is $30,000.

B) an average tax rate of 22.0 percent when her income is $50,000.

C) a marginal tax rate of 10 percent when her income rises from $40,000 to $40,001.

D) a marginal tax rate of 50 percent when her income rises from $60,000 to $60,001.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Individual Retirement Accounts and 401(k) plans make the current U.S.tax system

A) more like a consumption tax and so more like the tax system of many European countries.

B) more like a consumption tax and so less like the tax system of many European countries.

C) less like a consumption tax and so more like the tax system of many European countries.

D) less like a consumption tax and so less like the tax system of many European countries.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

According to the benefits principle,it is fair for people to pay taxes based on their ability to shoulder the tax burden.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-9

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-9.For this tax schedule,what is the average tax rate for an individual with $49,000 in taxable income?

-Refer to Table 12-9.For this tax schedule,what is the average tax rate for an individual with $49,000 in taxable income?

A) 25.8%

B) 27.5%.

C) 40.0%

D) 43.7%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A person's tax liability refers to

A) the percentage of income that a person must pay in taxes.

B) the amount of tax a person owes to the government.

C) the amount of tax the government is required to refund to each person.

D) deductions that can be legally subtracted from a person's income each year.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government taxes 30 percent of the first $70,000 and 50 percent of all income above $70,000.For a person earning $100,000,the marginal tax rate is

A) 30 percent, and the average tax rate is 50 percent.

B) 30 percent, and the average tax rate is 36 percent.

C) 50 percent, and the average tax rate is 40 percent.

D) 50 percent, and the average tax rate is 36 percent.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Vertical equity refers to a tax system in which individuals with similar incomes pay similar taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Individual Retirement Accounts and 401(k) plans make the current U.S.tax system

A) less like European tax systems than it otherwise would be.

B) more like a payroll tax than it otherwise would be.

C) more like an income tax than it otherwise would be.

D) more like a consumption tax than it otherwise would be.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

According to the ability-to-pay principle,it is fair for people to pay taxes based on the amount of government services that they receive.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to long-run projections,under current law,

A) federal government spending as a percentage of GDP will rise gradually but substantially in the next several decades.

B) federal taxes as a percentage of GDP will rise gradually but substantially in the next several decades.

C) the federal government's budget deficit will gradually be eliminated in the next several decades.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 478

Related Exams