A) 2) 31 times

B) 1) 93 times

C) 2) 50 times

D) 2) 08 times

E) 1) 59 times

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

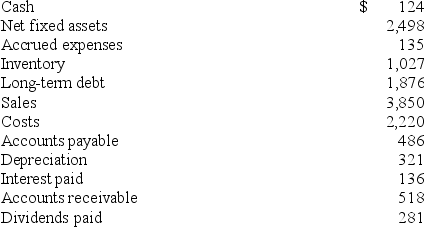

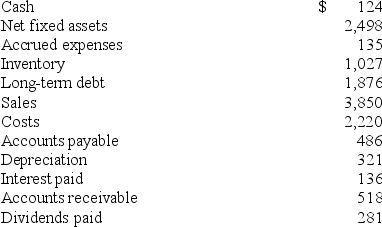

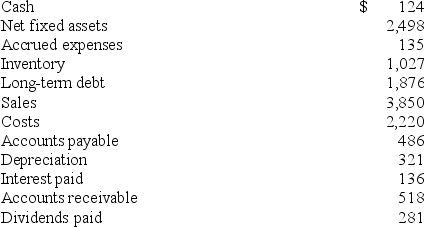

You have obtained the following information for Blue Bell Farms.The tax rate is 34 percent.  What is the cash coverage ratio?

What is the cash coverage ratio?

A) 7) 90 times

B) 12.04 times

C) 11.99 times

D) 9) 63 times

E) 13.67 times

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From a cash flow position,which one of the following ratios best measures a firm's ability to pay the interest on its debts?

A) Times interest earned ratio

B) Cash coverage ratio

C) Cash ratio

D) Quick ratio

E) Debt-equity ratio

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

EBITDA is the abbreviation for earnings before

A) insurance,taxes,depreciation,and accounting expenses.

B) interest,taxes,depreciation,and accrued expenses.

C) insurance,taxes,depreciation,and accrued expenses.

D) interest,taxes,depreciation,and amortization.

E) interest,taxes,and deferred accounting overhead.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Martin's Lumber has a profit margin of 7 percent and a dividend payout ratio of 30 percent.The total asset turnover is 0.90,and the debt-equity ratio is 0.45.What is the sustainable rate of growth?

A) 6) 33%

B) 6) 83%

C) 6) 67%

D) 6) 90%

E) 6) 99%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have obtained the following information for Blue Bell Farms.The tax rate is 34 percent.  What is the quick ratio?

What is the quick ratio?

A) 1) 03 times

B) 1) 26 times

C) 0) 96 times

D) 0) 82 times

E) 1) 08 times

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Golden Slipper has sales of $487,900,EBIT of $128,650,taxes of 35 percent,interest paid of $12,400,and a dividend payout ratio of 40 percent.What is the common-size ratio of the addition to retained earnings?

A) 10.31%

B) 9) 29%

C) 14.43%

D) 11.74%

E) 6) 87%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jessica's Boutique has cash of $687,accounts receivable of $1,419,accounts payable of $1,308,and inventory of $2,609.What is the value of the quick ratio?

A) .53 times

B) 3.60 times

C) .48 times

D) 1.84 times

E) 1.61 times

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The return on equity can be calculated as

A) Profit margin × 1 / Capital intensity ratio × Equity multiplier

B) Return on assets × b

C) Profit margin × Total asset turnover × Debt-equity ratio

D) Profit margin × 1 / Equity multiplier × (1 + Debt-equity ratio)

E) Return on assets × Debt-equity ratio

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct if a firm has an accounts receivable turnover measure of 10?

A) It takes the firm 36.5 days to pay its creditors.

B) It takes the firm 36.5 days to sell its inventory and collect payment from the sale.

C) It takes the firm 36.5 days to collect payment for a sale.

D) The firm has 10 times more in accounts receivable than it does in cash.

E) It takes an average of 10 days to collect payment from the firm's customers.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On a common-size income statement,depreciation will be

A) omitted since it is a noncash expense.

B) added back to convert net income to cash flows.

C) expressed as a percentage of total assets.

D) expressed as a percentage of sales.

E) expressed as a percentage of gross fixed assets.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The only difference between Joe's and Moe's is that Joe's has old,fully depreciated equipment.Moe's just purchased all new equipment that will be depreciated over 8 years.Assuming all else equal,

A) Joe's will have a lower profit margin.

B) Joe's will have a lower return on equity.

C) Moe's will have a higher net income.

D) Moe's will have a lower profit margin.

E) Moe's will have a higher return on assets.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have obtained the following information for Blue Bell Farms.The tax rate is 34 percent.  What is the debt-equity ratio?

What is the debt-equity ratio?

A) 0) 75 times

B) 1) 33 times

C) 1) 50 times

D) 0) 98 times

E) 1) 22 times

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Textile Cloth stockholders want to know how much net profit the firm is making on a percentage basis on their investment in that firm,the shareholders should refer to the

A) profit margin.

B) return on assets.

C) return on equity.

D) equity multiplier.

E) EV multiple.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Brewster's produces a return on assets of 14 percent and also a return on equity of 14 percent,then the firm

A) has no net working capital.

B) is using its assets as efficiently as possible.

C) has no debt of any kind.

D) also has a current ratio of 14.

E) has an equity multiplier of 1.4.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm has a debt-equity ratio of 0.36.What is the total debt ratio?

A) 0) 26

B) 0) 29

C) 0) 67

D) 0) 71

E) 0) 74

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A common-size balance sheet will express accounts receivable as a percentage of

A) sales.

B) current assets.

C) net working capital.

D) total assets.

E) total owners' equity.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vaun's Pet Store paid $24,300 in interest and $32,000 in dividends last year.The times interest earned ratio is 4.1,and the depreciation expense is $126,200.What is the value of the cash coverage ratio?

A) 8) 77 times

B) 5) 19 times

C) 7) 75 times

D) 9) 29 times

E) 8) 20 times

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When creating pro forma statements,the changes in the liabilities and owners' equity sections depend primarily on the firm's

A) financing policies.

B) interest rates and financing policies.

C) dividend and financing policies.

D) retained earnings policies.

E) rate of sales growth.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The lower a firm's inventory turnover,the

A) longer it takes the firm to collect payment on its sales.

B) faster the firm collects payment on its sales.

C) faster the firm sells its inventory.

D) longer inventory sits on the firm's shelves.

E) smaller the amount of inventory held by the firm.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 88

Related Exams