A) adverse selection and moral hazard

B) adverse selection,but not moral hazard

C) moral hazard,but not adverse selection

D) neither adverse selection nor moral hazard

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An index fund

A) holds only stocks and bonds that are indexed to inflation.

B) holds all the stocks in a given stock index.

C) guarantees a return that follows the index of leading economic indicators.

D) typically has a lower return than a managed fund.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Adverse selection is illustrated by people who take greater risks after they purchase insurance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) Managed funds typically have a higher return than indexed funds.This tends to refute the efficient market hypothesis.

B) Managed funds typically have a higher return than indexed funds.This tends to support the efficient market hypothesis.

C) Index funds typically have a higher rate of return than managed funds.This tends to refute the efficient market hypothesis.

D) Index funds typically have a higher rate of return than managed funds.This tends to support the efficient market hypothesis.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The present value of any future sum of money is the amount that would be needed today,at current interest rates,to produce that future sum.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

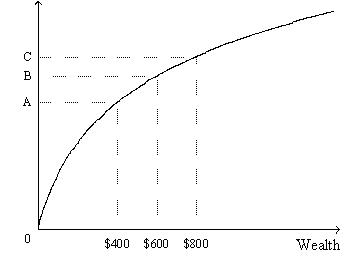

Figure 19-1.The figure shows a utility function.  -Refer to Figure 19-1.What is measured along the vertical axis?

-Refer to Figure 19-1.What is measured along the vertical axis?

A) risk aversion

B) marginal utility

C) utility

D) the number of units of a good that can be purchased

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Albert can buy a bond for $1,000 that matures in two years and pays Albert $1,102.5 with certainty.He is indifferent between this bond and one that has some risk but on which the interest rate is 3% higher.How much,to the nearest penny,does the riskier bond pay in two years?

A) $1,160.00

B) $1,166.40

C) $1,168.65

D) $1,169.64

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

According to the rule of 70,if you earn an interest rate of 3.5 percent,your savings will double about every 20 years.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The last $2,000 of Rolanda's wealth adds less to her utility than the previous $2,000.Based on this information,Rolanda has

A) increasing marginal utility of wealth and is risk averse.

B) increasing marginal utility of wealth and is not risk averse.

C) decreasing marginal utility of wealth and is risk averse.

D) decreasing marginal utility of wealth and is not risk averse.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From the standpoint of the economy as a whole,the role of

A) the interest rate is to make sure that the price of bonds increases over time.

B) diversification is to eliminate market risk.

C) insurance is to reduce the risks inherent in life.

D) insurance is to spread risks around more efficiently.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Research studies have shown that

A) the correlation between how well a stock does one year and how well it does the next is significantly greater than zero.

B) managed mutual funds generally outperform indexed mutual funds.

C) people tend to be overconfident when making investment decisions.

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Draw graphs showing the following three relationships. 1.The relation between utility and wealth for a risk averse consumer. 2.The relation between standard deviation and the number of stocks in a portfolio. 3.The relation between return and risk.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same,as the stocks of a greater number of corporations are held in a portfolio,

A) risk increases at an increasing rate.

B) risk increases at a decreasing rate.

C) risk decreases at an increasing rate.

D) risk decreases at a decreasing rate.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the future value of $375 at an interest rate of 3 percent one year from today?

A) $371.75

B) $386.25

C) $393.33

D) None of the above are correct to the nearest cent.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cleo promises to pay Jacques $1,000 in two years.If the interest rate is 6 percent,how much is this future payment worth today?

A) $883.60

B) $887.97

C) $890.00

D) None of the above are correct to the nearest cent.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The available evidence indicates that

A) about one-half of all managers of active mutual funds consistently outperform index funds.

B) outperforming the market on a consistent basis is extremely difficult to do.

C) there is little truth to the notion that there is a trade-off between risk and return.

D) there is little truth to the efficient markets hypothesis.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over the past two centuries,the average annual rates of return were about

A) 5 percent for stocks and about 1.5 percent for short-term government bonds.

B) 6 percent for stocks and about 2.5 percent for short-term government bonds.

C) 8 percent for stocks and about 3 percent for short-term government bonds.

D) None of the above is correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Robert put $15,000 into an account with a fixed interest rate two years ago and now the account balance is $16,695.38.What rate of interest did Robert earn?

A) 4.5 percent

B) 5.5 percent

C) 6.5 percent

D) 8.0 percent

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

There are many concerns for risk-averse lenders.Consider the following: 1.Lenders are concerned that borrowers with the greatest risk are the ones most likely to actively pursue loans.2.Lenders are concerned that real GDP will decline leading to reduced corporate profits.3.Lenders are concerned that products produced by certain corporations will become obsolete.

A) 1 is market risk; 2 is firm-specific risk

B) 2 is market risk; 3 is firm-specific risk

C) 3 is market risk; 1 is firm-specific risk

D) 2 is firm-specific risk; 3 is market risk

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct?

A) The higher average return on stocks than on bonds comes at the price of higher risk.

B) Risk-averse persons will take the risks involved in holding stocks if the average return is high enough to compensate for the risk.

C) Insurance markets reduce risk,but not by diversification.

D) Risk can be reduced by placing a large number of small bets,rather than a small number of large bets.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 401 - 420 of 421

Related Exams