A) $29,000 favorable.

B) $29,000 unfavorable.

C) $22,500 unfavorable.

D) $52,500 favorable.

E) $52,500 unfavorable.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company uses the following standard costs to produce a single unit of output. During the latest month, the company purchased and used 58,000 pounds of direct materials at a price of $1.00 per pound to produce 10,000 units of output. Direct labor costs for the month totaled $56,350 based on 4,900 direct labor hours worked. Variable manufacturing overhead costs incurred totaled $15,000 and fixed manufacturing overhead incurred was $10,400. Based on this information, the direct labor rate variance for the month was:

A) $1,200 favorable

B) $3,650 favorable

C) $2,450 favorable

D) $3,650 unfavorable

E) $1,200 unfavorable

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A budget based on several different levels of activity, often including both a best-case and worst-case scenario, is called a:

A) Rolling budget.

B) Production budget.

C) Flexible budget.

D) Merchandise purchases budget.

E) Fixed budget.

G) All of the above

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Standard costs are used in the calculation of:

A) Price and quantity variances.

B) Price variances only.

C) Quantity variances only.

D) Price, quantity, and sales variances.

E) Quantity and sales variances.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

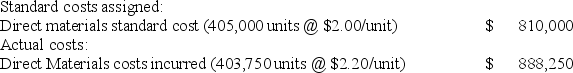

A company provided the following direct materials cost information. Compute the direct materials price variance.

A) $81,000 Favorable.

B) $81,000 Unfavorable.

C) $80,750 Unfavorable.

D) $80,750 Favorable.

E) $78,250 Favorable.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between actual price per unit of input and the standard price per unit of input results in a:

A) Standard variance.

B) Quantity variance.

C) Volume variance.

D) Controllable variance.

E) Price variance.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's flexible budget for the range of 35,000 units to 45,000 units of production showed variable overhead costs of $2 per unit and fixed overhead costs of $72,000. The company incurred total overhead costs of $148,800 while operating at a volume of 40,000 units. The total controllable cost variance is:

A) $6,800 favorable.

B) $6,800 unfavorable.

C) $3,200 favorable.

D) $3,200 unfavorable.

E) $10,000 favorable.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company uses the following standard costs to produce a single unit of output. During the latest month, the company purchased and used 58,000 pounds of direct materials at a price of $1.00 per pound to produce 10,000 units of output. Direct labor costs for the month totaled $56,350 based on 4,900 direct labor hours worked. Variable manufacturing overhead costs incurred totaled $15,000 and fixed manufacturing overhead incurred was $10,400. Based on this information, the direct labor efficiency variance for the month was:

A) $3,650 favorable

B) $2,450 favorable

C) $1,200 unfavorable

D) $1,200 favorable

E) $2,450 unfavorable

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Essay

Ransom, Inc. budgets direct materials cost at $1.10/liter and each product requires 4 liters per unit of finished product. April's activities show usage of 832 liters to complete 196 units at a cost of $798.72. Compute the direct materials price and quantity variances. Indicate if the variance is favorable or unfavorable.

Correct Answer

verified

\(\begin{array}{c}

\begin{array}{|l|}

\hline \text {A Q* A P}\\

\hline \text {A Q* S P}\\

\hline\\

\hline\\

\hline

\end{array}

\begin{array}{l|}

\hline \text {832 liters \( * \$ 0.96 / \) liter*}\\

\hline \text {832 liters \( * \) * \( \$ 1.10 \) lliter}\\

\hline \text { Direct materials price variance }\\

\hline\\

\hline

\end{array}

\begin{array}{ll|}

\hline\$798.72\\

\hline\underline{915.20}\\

\hline\underline{\$116,48 F}\\

\hline\\

\hline

\end{array}

\end{array}\)

* $798.72/832 liters = $0.96/liter

\(\begin{array}{c}

\begin{array}{|l|}

\hline \text {A Q* S P}\\

\hline \text {A Q* S P}\\

\hline\\

\hline\\

\hline

\end{array}

\begin{array}{l|}

\hline \text {832 liters \( * \$ 1.10 / \) liter*}\\

\hline \text {832 liters \( * \) * \( \$ 1.10 \) lliter}\\

\hline \text { Direct materials quantity variance }\\

\hline\\

\hline

\end{array}

\begin{array}{ll|}

\hline\$915.20\\

\hline\underline{862.40}\\

\hline\underline{\$52.80 U}\\

\hline\\

\hline

\end{array}

\end{array}\)

* 196 units * 4 liters/unit = 784 liters

Correct Answer

verified

Multiple Choice

Which department is often responsible for the direct materials price variance?

A) The accounting department.

B) The production department.

C) The purchasing department.

D) The finance department.

E) The budgeting department.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Management by exception means that managers focus on the most significant differences between actual costs and standard costs.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

LJ Co. produces picture frames. It takes 3 hours of direct labor to produce a frame. LJ's standard labor cost is $11.00 per hour. During March, LJ produced 4,000 frames and used 12,400 hours at a total cost of $133,920. What is LJ's labor rate variance for March?

Correct Answer

verified

Correct Answer

verified

True/False

A fixed budget performance report never provides useful information for evaluating variances.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A budget performance report shows budgeted amounts, actual amounts, and differences between budgeted and actual amounts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Georgia, Inc. has collected the following data on one of its products. The direct materials price variance is:

A) $13,750 unfavorable.

B) $16,250 unfavorable.

C) $16,250 favorable.

D) $30,000 unfavorable.

E) $33,000 favorable.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In sales variance analysis, the budgeted amount of unit sales is the predicted activity level and the budgeted cost of the goods sold can be treated as a "standard" price.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

A flexible budget is based on a single predicted amount of sales or other activity measure.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When standard costs are used, factory overhead is assigned to products with a predetermined standard overhead rate.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Naches Co. assigned direct labor cost to its products in May for 1,300 standard hours of direct labor at the standard $8 per hour rate. The direct labor rate variance for the month was $200 favorable and the direct labor efficiency variance was $150 favorable. Prepare the journal entry to charge Work in Process Inventory for the standard labor cost of the goods manufactured in May and to record the direct labor variances. Assuming that the direct labor variances are immaterial, prepare the journal entry that Naches would make to close the variance accounts.

Correct Answer

verified

Correct Answer

verified

Essay

Lavoie Company planned to use 18,500 pounds of material costing $2.50 per pound to make 4,000 units of its product. In actually making 4,000 units, the company used 18,800 pounds that cost $2.54 per pound. Calculate the direct materials price variance.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 222

Related Exams