B) False

Correct Answer

verified

Correct Answer

verified

True/False

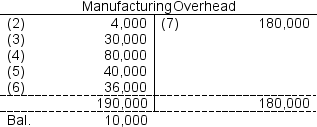

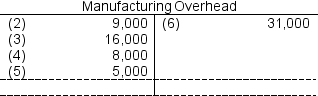

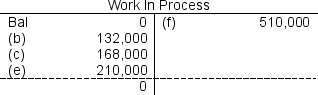

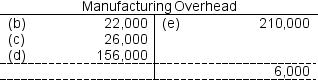

The $10,000 balance in the T-account below represents overapplied manufacturing overhead for the period.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

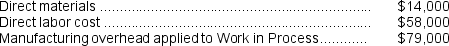

Dukes Corporation used a predetermined overhead rate this year of $2 per direct labor-hour,based on an estimate of 20,000 direct labor-hours to be worked during the year.Actual costs and activity during the year were:

The overapplied or underapplied manufacturing for the year was:

The overapplied or underapplied manufacturing for the year was:

A) $1,000 underapplied

B) $1,000 overapplied

C) $3,000 underapplied

D) $3,000 overapplied

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vogel Corporation's cost of goods manufactured last month was $136,000. The beginning finished goods inventory was $35,000 and the ending finished goods inventory was $48,000. Overhead was overapplied by $6,000. Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold. -How much is the unadjusted cost of goods sold on the Schedule of Cost of Goods Sold?

A) $171,000

B) $123,000

C) $117,000

D) $136,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

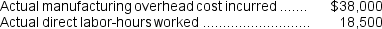

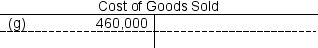

Refer to the T-account below:

Entry (8) could represent which of the following?

Entry (8) could represent which of the following?

A) Payment of insurance for the upcoming period.

B) Insurance cost incurred on the factory which is added to the Manufacturing Overhead account.

C) Overhead cost applied to Work in Process.

D) Overhead cost applied to Finished Goods.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

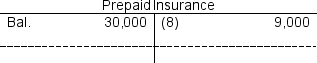

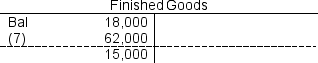

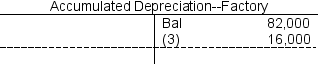

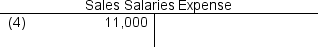

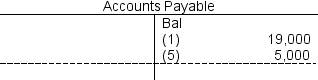

The following partially completed T-accounts are for Stanford Corporation:

-The cost of direct materials used is:

-The cost of direct materials used is:

A) $14,000

B) $15,000

C) $18,000

D) $24,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vogel Corporation's cost of goods manufactured last month was $136,000. The beginning finished goods inventory was $35,000 and the ending finished goods inventory was $48,000. Overhead was overapplied by $6,000. Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold. -How much is the adjusted cost of goods sold on the Schedule of Cost of Goods Sold?

A) $123,000

B) $171,000

C) $136,000

D) $117,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On November 1, Arvelo Corporation had $32,000 of raw materials on hand. During the month, the company purchased an additional $78,000 of raw materials. During November, $95,000 of raw materials were requisitioned from the storeroom for use in production. These raw materials included both direct and indirect materials. The indirect materials totaled $3,000. Prepare journal entries to record these events. Use those journal entries to answer the following questions: -The journal entry to record the incurrence of the actual Manufacturing Overhead costs would include a:

A) credit to Manufacturing Overhead of $60,000

B) credit to Work in Process of $62,000

C) debit to Work in Process of $62,000

D) debit to Manufacturing Overhead of $60,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

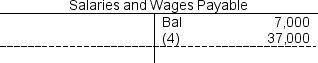

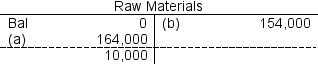

The following accounts are from last year's books of Sharp Manufacturing:

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs.What is the amount of direct materials used for the year?

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs.What is the amount of direct materials used for the year?

A) $164,000

B) $154,000

C) $132,000

D) $168,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

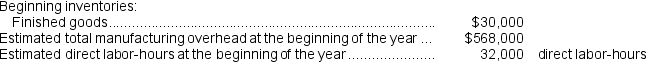

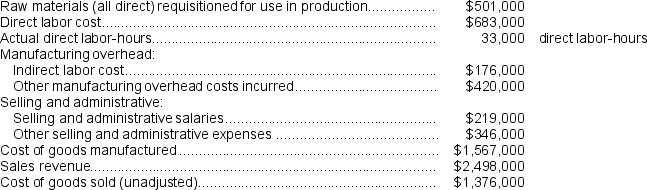

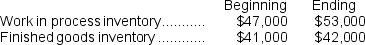

Tevebaugh Corporation is a manufacturer that uses job-order costing. The company closes out any overapplied or underapplied overhead to Cost of Goods Sold at the end of the year. The company has supplied the following data for the just completed year:

Results of operations:

Results of operations:

-How much is the total manufacturing cost added to work in process during the year?

-How much is the total manufacturing cost added to work in process during the year?

A) $1,268,750

B) $1,769,750

C) $1,567,000

D) $1,184,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Echher Corporation uses a job-order costing system and applies overhead to jobs using a predetermined overhead rate. During the year the company's Finished Goods inventory account was debited for $218,000 and credited for $218,500. The ending balance in the Finished Goods inventory account was $13,000. At the end of the year, manufacturing overhead was overapplied by $36,700. -If Job #461 contained 100 units,the unit product cost on the completed job cost sheet would be:

A) $61.75

B) $62.50

C) $63.10

D) $55.00

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

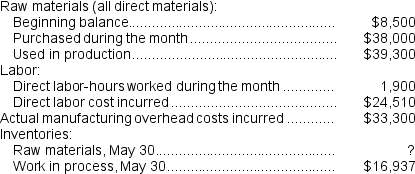

Dacosta Corporation had only one job in process on May 1. The job had been charged with $1,800 of direct materials, $6,966 of direct labor, and $9,936 of manufacturing overhead cost. The company assigns overhead cost to jobs using the predetermined overhead rate of $18.40 per direct labor-hour.

During May, the following activity was recorded:

Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.

-The entry to dispose of the underapplied or overapplied manufacturing overhead cost for the month would include a:

Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.

-The entry to dispose of the underapplied or overapplied manufacturing overhead cost for the month would include a:

A) credit of $5,336 to Manufacturing Overhead.

B) credit of $1,660 to Manufacturing Overhead.

C) debit of $5,336 to Manufacturing Overhead.

D) debit of $1,660 to Manufacturing Overhead.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In the Schedule of Cost of Goods Sold,Cost of goods available for sale = Ending finished goods inventory + Cost of goods manufactured.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bayest Manufacturing Corporation uses a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to jobs.Last year,the Corporation worked 56,000 actual direct labor-hours and incurred $352,000 of actual manufacturing overhead cost.The Corporation had estimated that it would work 60,000 direct labor-hours during the year and incur $330,000 of manufacturing overhead cost.The Corporation's manufacturing overhead cost for the year was:

A) overapplied by $44,000

B) underapplied by $44,000

C) overapplied by $22,000

D) underapplied by $22,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

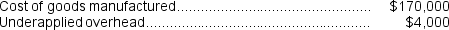

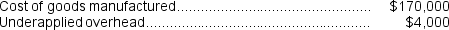

Gurtner Corporation has provided the following data concerning last month's operations.

Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold.

-How much is the adjusted cost of goods sold on the Schedule of Cost of Goods Sold?

Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold.

-How much is the adjusted cost of goods sold on the Schedule of Cost of Goods Sold?

A) $170,000

B) $167,000

C) $203,000

D) $163,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Caple Corporation applies manufacturing overhead on the basis of machine-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $16,660. Actual manufacturing overhead for the year amounted to $25,000 and actual machine-hours were 1,460. The company's predetermined overhead rate for the year was $11.90 per machine-hour. -The applied manufacturing overhead for the year was closest to:

A) $26,071

B) $18,119

C) $17,374

D) $16,660

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

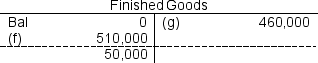

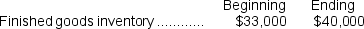

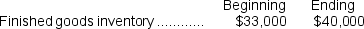

Holmstrom Corporation has provided the following data concerning last month's operations.

How much is the cost of goods available for sale on the Schedule of Cost of Goods Sold?

How much is the cost of goods available for sale on the Schedule of Cost of Goods Sold?

A) $186,000

B) $145,000

C) $144,000

D) $138,000

F) A) and D)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Echher Corporation uses a job-order costing system and applies overhead to jobs using a predetermined overhead rate. During the year the company's Finished Goods inventory account was debited for $218,000 and credited for $218,500. The ending balance in the Finished Goods inventory account was $13,000. At the end of the year, manufacturing overhead was overapplied by $36,700. -The balance in the Finished Goods inventory account at the beginning of the year was:

A) $13,500

B) $36,700

C) $500

D) $13,000

F) None of the above

Correct Answer

verified

A

Correct Answer

verified

Essay

During June,Briganti Corporation purchased $79,000 of raw materials on credit to add to its raw materials inventory.A total of $64,000 of raw materials was requisitioned from the storeroom for use in production.These requisitioned raw materials included $4,000 of indirect materials. Required: Prepare journal entries to record the purchase of materials and their use in production.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gurtner Corporation has provided the following data concerning last month's operations.

Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold.

-How much is the cost of goods available for sale on the Schedule of Cost of Goods Sold?

Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold.

-How much is the cost of goods available for sale on the Schedule of Cost of Goods Sold?

A) $203,000

B) $170,000

C) $167,000

D) $163,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 255

Related Exams