A) 35,037 direct labor-hours

B) 35,300 direct labor-hours

C) 36,200 direct labor-hours

D) 33,874 direct labor-hours

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

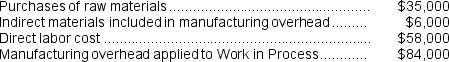

Bocchini Corporation has provided the following data concerning last month's operations.

How much is the unadjusted cost of goods sold on the Schedule of Cost of Goods Sold?

How much is the unadjusted cost of goods sold on the Schedule of Cost of Goods Sold?

A) $165,000

B) $163,000

C) $169,000

D) $202,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On November 1, Arvelo Corporation had $32,000 of raw materials on hand. During the month, the company purchased an additional $78,000 of raw materials. During November, $95,000 of raw materials were requisitioned from the storeroom for use in production. These raw materials included both direct and indirect materials. The indirect materials totaled $3,000. Prepare journal entries to record these events. Use those journal entries to answer the following questions: -The debits to the Manufacturing Overhead account as a consequence of the raw materials transactions in November total:

A) $95,000

B) $3,000

C) $0

D) $92,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When manufacturing overhead is applied to production,it is added to:

A) the Cost of Goods Sold account.

B) the Raw Materials account.

C) the Work in Process account.

D) the Finished Goods inventory account.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

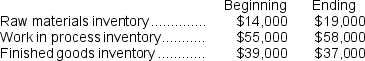

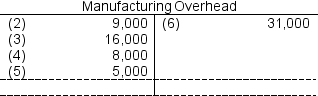

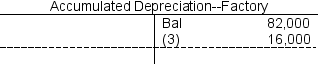

Refer to the T-account below:

Entry (4) could represent which of the following except?

Entry (4) could represent which of the following except?

A) Indirect labor cost incurred.

B) Factory insurance cost.

C) Overhead cost applied to Work in Process.

D) Depreciation on factory equipment.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In October,Raddatz Inc.incurred $73,000 of direct labor costs and $6,000 of indirect labor costs.The journal entry to record the accrual of these wages would include a:

A) debit to Manufacturing Overhead of $6,000

B) debit to Work in Process of $79,000

C) credit to Manufacturing Overhead of $6,000

D) credit to Work in Process of $79,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

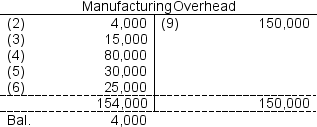

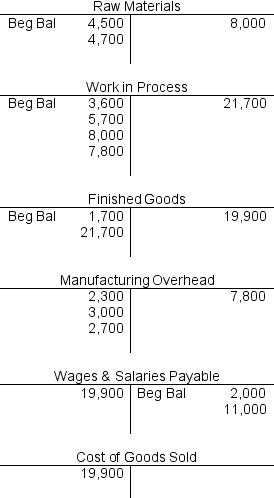

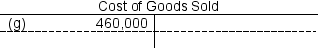

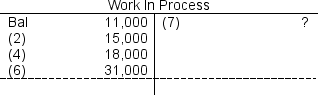

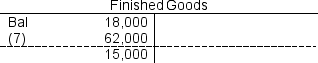

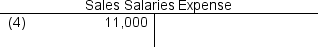

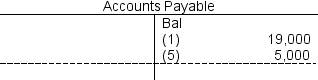

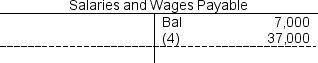

The following partially completed T-accounts summarize transactions for Faaberg Corporation during the year:

-The manufacturing overhead was:

-The manufacturing overhead was:

A) $200 overapplied

B) $2,700 overapplied

C) $200 underapplied

D) $2,700 underapplied

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following partially completed T-accounts summarize transactions for Faaberg Corporation during the year:

-The manufacturing overhead applied was:

-The manufacturing overhead applied was:

A) $2,700

B) $3,000

C) $7,800

D) $13,700

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

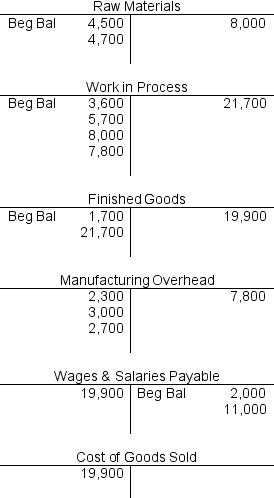

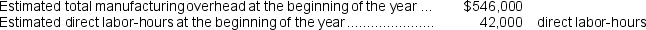

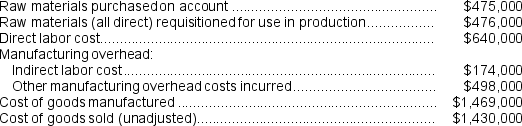

Heathcote Corporation is a manufacturer that uses job-order costing. The company closes out any overapplied or underapplied overhead to Cost of Goods Sold at the end of the year. The company has supplied the following data for the just completed year:

Results of operations:

Results of operations:

-The total amount of manufacturing overhead applied to production is:

-The total amount of manufacturing overhead applied to production is:

A) $1,755,000

B) $546,000

C) $606,000

D) $611,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

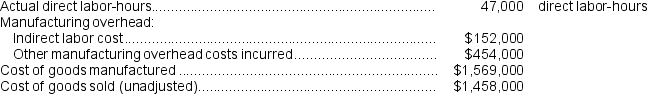

The Simkins Corporation uses a job-order costing system.The following activities took place during the month of May:

Required:

Prepare journal entries to record the information given above.Key your entries by the letters a through i.

Required:

Prepare journal entries to record the information given above.Key your entries by the letters a through i.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Verrett Corporation is a manufacturer that uses job-order costing. The company has supplied the following data for the just completed year:

-What is the journal entry to record raw materials used in production?

-What is the journal entry to record raw materials used in production?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

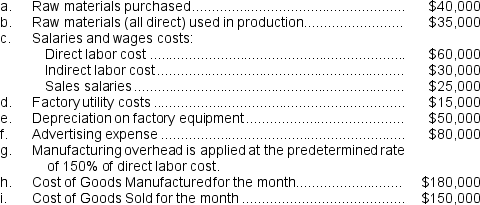

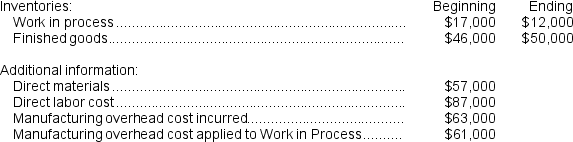

Koczela Inc. has provided the following data for the month of May:

Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold.

-The adjusted cost of goods sold that appears on the income statement for May is:

Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold.

-The adjusted cost of goods sold that appears on the income statement for May is:

A) $206,000

B) $214,000

C) $208,000

D) $210,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

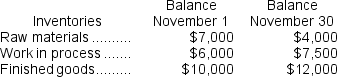

Compute the amount of raw materials used during November if $30,000 of raw materials were purchased during the month and if the inventories were as follows:

A) $31,500

B) $29,500

C) $27,000

D) $33,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

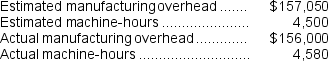

Acheson Corporation, which applies manufacturing overhead on the basis of machine-hours, has provided the following data for its most recent year of operations.

The estimates of the manufacturing overhead and of machine-hours were made at the beginning of the year for the purpose of computing the company's predetermined overhead rate for the year.

-The predetermined overhead rate is closest to:

The estimates of the manufacturing overhead and of machine-hours were made at the beginning of the year for the purpose of computing the company's predetermined overhead rate for the year.

-The predetermined overhead rate is closest to:

A) $34.06

B) $34.90

C) $34.67

D) $35.52

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Caple Corporation applies manufacturing overhead on the basis of machine-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $16,660. Actual manufacturing overhead for the year amounted to $25,000 and actual machine-hours were 1,460. The company's predetermined overhead rate for the year was $11.90 per machine-hour. -The predetermined overhead rate was based on how many estimated machine-hours?

A) 1,400

B) 2,101

C) 2,742

D) 1,460

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

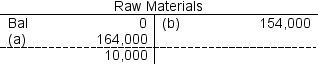

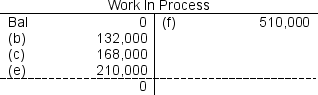

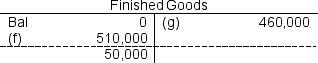

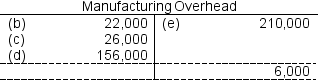

The following accounts are from last year's books at Sharp Manufacturing:

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs.What is the manufacturing overapplied or underapplied for the year?

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs.What is the manufacturing overapplied or underapplied for the year?

A) $6,000 underapplied

B) $6,000 overapplied

C) $26,000 underapplied

D) $26,000 overapplied

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following partially completed T-accounts are for Stanford Corporation:

-The ending Work in Process account balance would be:

-The ending Work in Process account balance would be:

A) $13,000

B) $75,000

C) $20,000

D) $64,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During June,Buttrey Corporation incurred $67,000 of direct labor costs and $7,000 of indirect labor costs.The journal entry to record the accrual of these wages would include a:

A) debit to Work in Process of $67,000

B) credit to Work in Process of $74,000

C) debit to Work in Process of $74,000

D) credit to Work in Process of $67,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the Schedule of Cost of Goods Manufactured and Cost of Goods Sold,the cost of goods manufactured is computed according to which of the following equations?

A) Cost of goods manufactured = Total manufacturing costs + Ending work in process inventory - Beginning work in process inventory

B) Cost of goods manufactured = Total manufacturing costs + Beginning work in process inventory - Ending work in process inventory

C) Cost of goods manufactured = Total manufacturing costs + Beginning finished goods inventory - Ending finished goods inventory

D) Cost of goods manufactured = Total manufacturing costs + Ending finished goods inventory - Beginning finished goods inventory

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Caple Corporation applies manufacturing overhead on the basis of machine-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $16,660. Actual manufacturing overhead for the year amounted to $25,000 and actual machine-hours were 1,460. The company's predetermined overhead rate for the year was $11.90 per machine-hour. -The overhead for the year was:

A) $714 overapplied

B) $7,626 underapplied

C) $714 underapplied

D) $7,626 overapplied

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 221 - 240 of 255

Related Exams