A) $660,000

B) $700,000

C) $180,000

D) $140,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wofril Corporation uses the cost formula Y = $5,300 + $0.60X for the maintenance cost,where X is machine-hours.The August budget is based on 8,000 hours of planned machine time.Maintenance cost expected to be incurred during August is:

A) $10,100

B) $4,800

C) $500

D) $5,300

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Contribution margin is:

A) Sales less cost of goods sold.

B) Sales less variable production, variable selling, and variable administrative expenses.

C) Sales less variable production expense.

D) Sales less all variable and fixed expenses.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

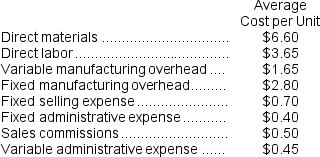

Barredo Corporation's relevant range of activity is 3,000 units to 7,000 units. When it produces and sells 5,000 units, its average costs per unit are as follows:

-If 4,000 units are sold,the variable cost per unit sold is closest to:

-If 4,000 units are sold,the variable cost per unit sold is closest to:

A) $16.75

B) $12.85

C) $11.90

D) $14.70

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

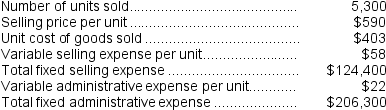

Fanelli Corporation,a merchandising company,reported the following results for July:

Cost of goods sold is a variable cost in this company.

Required:

a.Prepare a traditional format income statement for July.

b.Prepare a contribution format income statement for July.

Cost of goods sold is a variable cost in this company.

Required:

a.Prepare a traditional format income statement for July.

b.Prepare a contribution format income statement for July.

Correct Answer

verified

a.Traditional Format Income Statement

11ea7761_19b7_08ad_81a5_d1f7a2300f9d_TB2580_00 b.Contribution Format Income Statement

11ea7761_19b7_08ae_81a5_9326ed055189_TB2580_00

Correct Answer

verified

Multiple Choice

To the nearest whole dollar,what should be the total property taxes at a sales volume of 37,200 units? (Assume that this sales volume is within the relevant range.)

A) $725,680

B) $733,400

C) $749,172

D) $717,960

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At an activity level of 7,200 machine-hours in a month,Falks Corporation's total variable production engineering cost is $556,416 and its total fixed production engineering cost is $226,008.What would be the total production engineering cost per unit,both fixed and variable,at an activity level of 7,300 machine-hours in a month? Assume that this level of activity is within the relevant range.

A) $107.93

B) $107.18

C) $108.67

D) $108.24

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Differential costs can:

A) only be fixed costs.

B) only be variable costs.

C) be either fixed or variable.

D) be sunk costs.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dizzy employees a certified operator for each of its 35 rides.Each operator is paid $20 per hour.The cost of the certified operators would best be described as a:

A) fixed cost

B) mixed cost

C) step-variable cost

D) true variable cost

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following costs is classified as both a prime cost and a conversion cost?

A) Direct materials.

B) Direct labor.

C) Variable overhead.

D) Fixed overhead.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A decrease in production will ordinarily result in a decrease in fixed production costs per unit.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Which of the following is an example of a period cost in a company that makes clothing?

A) Fabric used to produce men's pants.

B) Advertising cost for a new line of clothing.

C) Factory supervisor's salary.

D) Monthly depreciation on production equipment.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

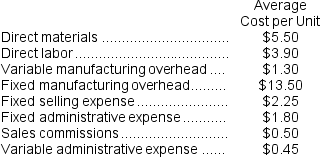

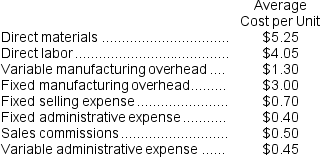

Fasheh Corporation's relevant range of activity is 7,000 units to 11,000 units. When it produces and sells 9,000 units, its average costs per unit are as follows:

-If 10,000 units are produced,the total amount of manufacturing overhead cost is closest to:

-If 10,000 units are produced,the total amount of manufacturing overhead cost is closest to:

A) $180,500

B) $134,500

C) $157,500

D) $146,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

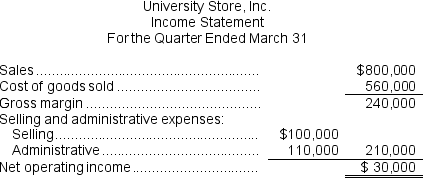

The University Store, Inc. is the major bookseller for four nearby colleges. An income statement for the first quarter of the year is presented below:

On average, a book sells for $40.00. Variable selling expenses are $3.00 per book; the remaining selling expenses are fixed. The variable administrative expenses are 5% of sales; the remainder of the administrative expenses are fixed.

-If 25,000 books are sold during the second quarter and this activity is within the relevant range,the company's expected contribution margin would be:

On average, a book sells for $40.00. Variable selling expenses are $3.00 per book; the remaining selling expenses are fixed. The variable administrative expenses are 5% of sales; the remainder of the administrative expenses are fixed.

-If 25,000 books are sold during the second quarter and this activity is within the relevant range,the company's expected contribution margin would be:

A) $875,000

B) $300,000

C) $175,000

D) $65,000

F) A) and D)

Correct Answer

verified

C

Correct Answer

verified

Essay

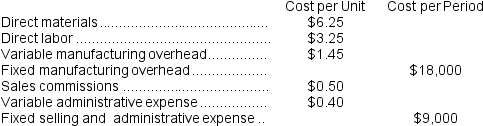

Menk Corporation has provided the following information:

Required:

a.If 5,000 units are sold,what is the variable cost per unit sold?

b.If 5,000 units are sold,what is the total amount of variable costs related to the units sold?

c.If 5,000 units are produced,what is the total amount of manufacturing overhead cost incurred?

Required:

a.If 5,000 units are sold,what is the variable cost per unit sold?

b.If 5,000 units are sold,what is the total amount of variable costs related to the units sold?

c.If 5,000 units are produced,what is the total amount of manufacturing overhead cost incurred?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Lonnie were to sell 50,000 units,the total expected cost per unit would be:

A) $2.20

B) $2.30

C) $2.50

D) $2.00

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

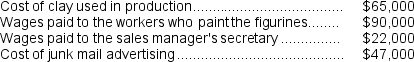

Vignana Corporation manufactures and sells hand-painted clay figurines of popular sports heroes. Shown below are some of the costs incurred by Vignana for last year:

-What is the total of the direct costs above?

-What is the total of the direct costs above?

A) $65,000

B) $112,000

C) $155,000

D) $202,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about product costs is true?

A) Product costs are deducted from revenue when the production process is completed.

B) Product costs are deducted from revenue as expenditures are made.

C) Product costs associated with unsold finished goods and work in process appear on the balance sheet as assets.

D) Product costs appear on financial statements only when products are sold.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

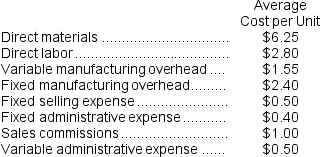

Ouelette Corporation's relevant range of activity is 3,000 units to 7,000 units.When it produces and sells 5,000 units,its average costs per unit are as follows:

If 6,000 units are produced,the total amount of indirect manufacturing cost incurred is closest to:

If 6,000 units are produced,the total amount of indirect manufacturing cost incurred is closest to:

A) $15,000

B) $22,800

C) $7,800

D) $25,800

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adens Corporation's relevant range of activity is 2,000 units to 6,000 units. When it produces and sells 4,000 units, its average costs per unit are as follows:

-If 5,000 units are sold,the variable cost per unit sold is closest to:

-If 5,000 units are sold,the variable cost per unit sold is closest to:

A) $13.00

B) $10.60

C) $12.10

D) $15.40

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 299

Related Exams