A) $93,000

B) $24,000

C) $94,000

D) $45,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

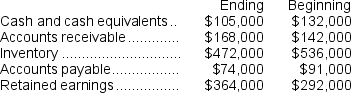

Wister Corporation had sales of $462,000 for the just completed year.Shown below are the beginning and ending balances of various Wister accounts:  Wister prepares its statement of cash flows using the direct method.On its statement of cash flows, what amount should Wister show for its sales adjusted to a cash basis (i.e., cash received from sales) ?

Wister prepares its statement of cash flows using the direct method.On its statement of cash flows, what amount should Wister show for its sales adjusted to a cash basis (i.e., cash received from sales) ?

A) $488,000

B) $436,000

C) $462,000

D) $445,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Under the direct method of determining the net cash provided by (used in)operating activities on the statement of cash flows, one step in adjusting selling and administrative expenses from an accrual to a cash basis is to subtract any increase in prepaid expenses.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

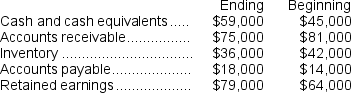

Kuma, Inc.had cost of goods sold of $106,000 for the just completed year.Shown below are the beginning and ending balances of various Kuma accounts:  Kuma prepares its statement of cash flows using the direct method.On its statement of cash flows, what amount should Kuma show for its cost of goods sold adjusted to a cash basis (i.e., cash paid to suppliers) ?

Kuma prepares its statement of cash flows using the direct method.On its statement of cash flows, what amount should Kuma show for its cost of goods sold adjusted to a cash basis (i.e., cash paid to suppliers) ?

A) $100,000

B) $96,000

C) $102,000

D) $116,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net cash provided by (used in) investing activities for the year was:

A) $(127)

B) $(138)

C) $138

D) $127

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

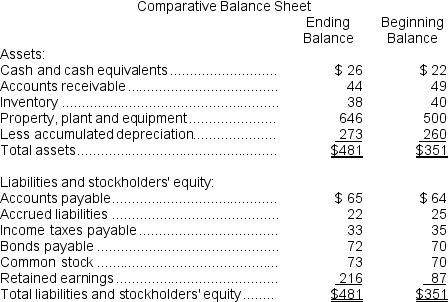

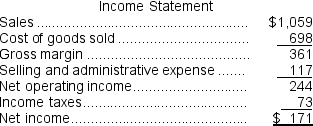

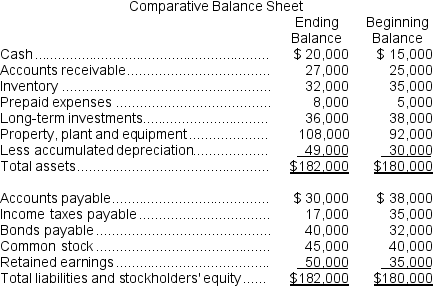

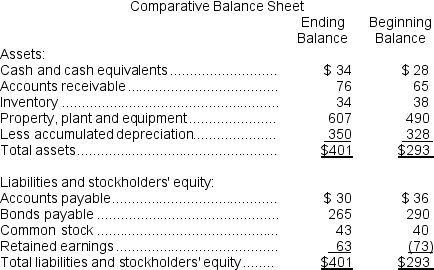

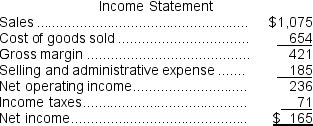

Maloney Corporation's balance sheet and income statement appear below:

Cash dividends were $42.The company did not dispose of any property, plant, and equipment during the year.

Required:

Prepare the operating activities section of the statement of cash flows using the direct method.

Cash dividends were $42.The company did not dispose of any property, plant, and equipment during the year.

Required:

Prepare the operating activities section of the statement of cash flows using the direct method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net cash provided by (used in) investing activities would be:

A) $15,000

B) $(10,000)

C) $(8,000)

D) $5,000

F) B) and C)

Correct Answer

verified

D

Correct Answer

verified

Essay

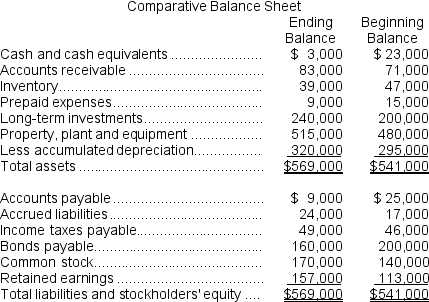

Carson Corporation's comparative balance sheet and income statement for last year appear below:

Carson did not dispose of any property, plant, and equipment during the year.It constructs its statement of cash flows using the direct method.

Required:

Using the direct method, prepare in good form the operating activities section of the statement of cash flows.

Carson did not dispose of any property, plant, and equipment during the year.It constructs its statement of cash flows using the direct method.

Required:

Using the direct method, prepare in good form the operating activities section of the statement of cash flows.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net cash provided by (used in) financing activities for the year was:

A) $(42)

B) $3

C) $11

D) $(28)

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the year the balance in the Prepaid Expenses account increased by $6,000.In order to adjust the company's net income to a cash basis using the direct method on the statement of cash flows, it would be necessary to:

A) subtract the $6,000 from the selling and administrative expenses reported on the income statement.

B) add the $6,000 to the selling and administrative expenses reported on the income statement.

C) subtract the $6,000 from the cost of goods sold reported on the income statement.

D) add the $6,000 to the cost of goods sold reported on the income statement.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

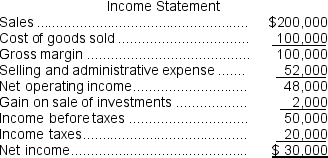

Carr Corporation's comparative balance sheet and income statement for last year appear below:

The company declared and paid $47,000 in cash dividends during the year.It did not dispose of any property, plant, and equipment during the year.

Required:

Construct in good form the operating activities section of the company's statement of cash flows for the year using the direct method.

The company declared and paid $47,000 in cash dividends during the year.It did not dispose of any property, plant, and equipment during the year.

Required:

Construct in good form the operating activities section of the company's statement of cash flows for the year using the direct method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows, the income tax expense adjusted to a cash basis would be:

A) $39,000

B) $69,000

C) $9,000

D) $25,000

F) A) and C)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

On its statement of cash flows, what amount should Howard show for its cost of goods sold adjusted to a cash basis (i.e., cash paid to suppliers) ?

A) $345,000

B) $366,000

C) $379,000

D) $373,000

F) C) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Under the direct method, cost of goods sold adjusted to a cash basis would be:

A) $105,000

B) $125,000

C) $175,000

D) $155,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows, the selling and administrative expense adjusted to a cash basis would be:

A) $304,000

B) $384,000

C) $310,000

D) $236,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net cash provided by (used in) investing activities for the year was:

A) $19

B) $(118)

C) $(137)

D) $118

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

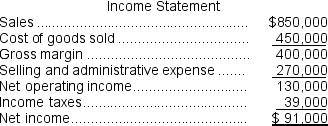

Digby Corporation's balance sheet and income statement appear below:

Cash dividends were $29.The company did not dispose of any property, plant, and equipment during the year.

Required:

Prepare the operating activities section of the statement of cash flows in good form using the direct method.

Cash dividends were $29.The company did not dispose of any property, plant, and equipment during the year.

Required:

Prepare the operating activities section of the statement of cash flows in good form using the direct method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Evita Corporation prepares its statement of cash flows using the indirect method.Evita's statement showed "Net cash provided by (used in) operating activities" of $46,000.Under the direct method, this number would have been:

A) $0.

B) $46,000.

C) greater than $46,000.

D) less than $46,000 but greater than $0.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Under the direct method of determining the net cash provided by (used in)operating activities on the statement of cash flows, an increase in accounts receivable would be added to sales revenue to convert revenue to a cash basis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net cash provided by (used in) operating activities for the year was:

A) $187

B) $231

C) $257

D) $201

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 56

Related Exams