A) Under variable costing, the units in the ending inventory will be costed at $4.00 each.

B) The net operating income under absorption costing for the year will be $900 lower than the net operating income under variable costing.

C) The ending inventory under variable costing will be $900 lower than the ending inventory under absorption costing.

D) Under absorption costing, the units in ending inventory will be costed at $2.50 each.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The company's overall break-even sales is closest to:

A) $412,564

B) $506,409

C) $518,750

D) $106,186

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

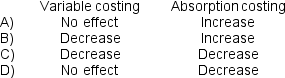

In its first year of operations, Bronfren Corporation produced 800,000 sets and sold 780,000 sets of artificial tan lines.What would have happened to net operating income in this first year under the following costing methods if Bronfren had produced 20,000 fewer sets? (Assume that Bronfren has both variable and fixed production costs.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

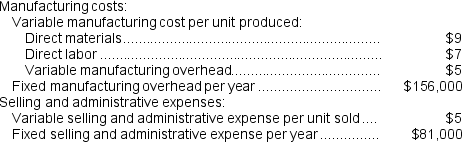

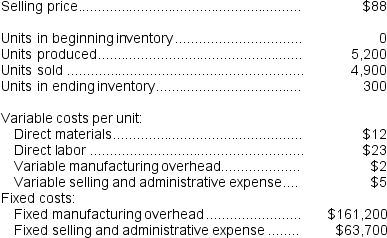

Bitonti Corporation has provided the following data for its most recent year of operation:

The unit product cost under absorption costing is closest to:

The unit product cost under absorption costing is closest to:

A) $34.00

B) $21.00

C) $13.00

D) $39.00

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

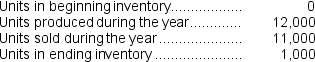

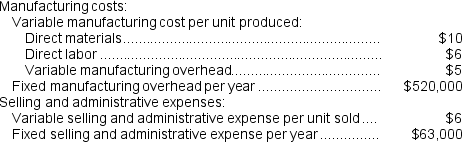

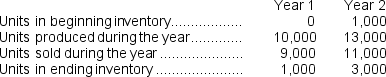

Foggs Corporation has provided the following data for its two most recent years of operation:

The unit product cost under absorption costing in Year 2 is closest to:

The unit product cost under absorption costing in Year 2 is closest to:

A) $40.00

B) $21.00

C) $67.00

D) $61.00

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The unit product cost under variable costing is closest to:

A) $21.00

B) $31.00

C) $35.00

D) $25.00

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company produces a single product.Variable production costs are $21 per unit and variable selling and administrative expenses are $4 per unit.Fixed manufacturing overhead totals $30.000 and fixed selling and administration expenses total $36.000.Assuming a beginning inventory of zero, production of 6,000 units and sales of 5,600 units, the dollar value of the ending inventory under variable costing would be:

A) $10,000

B) $8,400

C) $12,000

D) $14,400

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a cost must be arbitrarily allocated in order to be assigned to a particular segment, then that cost should be considered a common cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following costs at a manufacturing company would be treated as a product cost under variable costing?

A) direct material cost

B) property taxes on the factory building

C) sales manager's salary

D) sales commissions

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

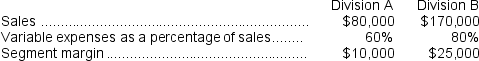

Eyestone Corporation has two divisions, A and B.The following data pertain to operations in October:  If common fixed expenses were $17,000, total fixed expenses were:

If common fixed expenses were $17,000, total fixed expenses were:

A) $48,000

B) $13,000

C) $31,000

D) $53,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the unit product cost for the month under variable costing?

A) $99 per unit

B) $110 per unit

C) $82 per unit

D) $93 per unit

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total contribution margin for the month under variable costing is:

A) $27,100

B) $59,400

C) $48,600

D) $79,200

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  The total contribution margin for the month under variable costing is:

The total contribution margin for the month under variable costing is:

A) $64,200

B) $249,900

C) $225,400

D) $98,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true for Year 1?

A) The amount of fixed manufacturing overhead deferred in inventories is $48,000

B) The amount of fixed manufacturing overhead released from inventories is $560,000

C) The amount of fixed manufacturing overhead deferred in inventories is $560,000

D) The amount of fixed manufacturing overhead released from inventories is $48,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Generally speaking, net operating income under variable and absorption costing will:

A) always be equal.

B) never be equal.

C) be equal only when production and sales are equal.

D) be equal only when production exceeds sales.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true for Year 1?

A) The amount of fixed manufacturing overhead released from inventories is $108,000

B) The amount of fixed manufacturing overhead deferred in inventories is $513,000

C) The amount of fixed manufacturing overhead released from inventories is $513,000

D) The amount of fixed manufacturing overhead deferred in inventories is $108,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bellue Inc.manufactures a single product.Variable costing net operating income was $96,300 last year and its inventory decreased by 2,600 units.Fixed manufacturing overhead cost was $1 per unit for both units in beginning and in ending inventory.What was the absorption costing net operating income last year?

A) $2,600

B) $93,700

C) $96,300

D) $98,900

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

Fausnaught Corporation has two major business segments--Retail and Wholesale.In October, the Retail business segment had sales revenues of $730,000, variable expenses of $409,000, and traceable fixed expenses of $117,000.During the same month, the Wholesale business segment had sales revenues of $400,000, variable expenses of $220,000, and traceable fixed expenses of $48,000.Common fixed expenses totaled $218,000 and were allocated as follows: $122,000 to the Retail business segment and $96,000 to the Wholesale business segment. Required: Prepare a segmented income statement in the contribution format for the company.Omit percentages; show only dollar amounts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The unit product cost under variable costing in Year 1 is closest to:

A) $20.00

B) $26.00

C) $46.00

D) $40.00

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The company's overall break-even sales is closest to:

A) $153,526

B) $431,289

C) $526,014

D) $584,815

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 291

Related Exams