A) 7,896

B) 12,769

C) 6,578

D) 4,341

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the company's sales increase by 19%, its net operating income should increase by about:

A) 10%

B) 19%

C) 83%

D) 186%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The degree of operating leverage is closest to:

A) 0.23

B) 0.10

C) 4.35

D) 9.76

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the company's target profit is $16,000.The dollar sales to attain that target profit is closest to:

A) $564,328

B) $1,710,085

C) $1,038,898

D) $842,281

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the company's sales increase by 7%, its net operating income should increase by about:

A) 26%

B) 7%

C) 66%

D) 11%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The break-even point for the entire company is closest to:

A) $41,160

B) $17,840

C) $53,455

D) $54,730

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the selling price increases by $3 per unit and the sales volume decreases by 600 units, the net operating income would be closest to:

A) $24,800

B) $35,000

C) $19,200

D) $32,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

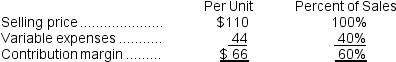

The company's contribution margin ratio is closest to:

A) 42.7%

B) 57.3%

C) 45.8%

D) 21.0%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

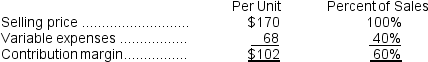

Multiple Choice

Chovanec Corporation produces and sells a single product.Data concerning that product appear below:  Fixed expenses are $521,000 per month.The company is currently selling 7,000 units per month.Management is considering using a new component that would increase the unit variable cost by $6.Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 500 units.What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $521,000 per month.The company is currently selling 7,000 units per month.Management is considering using a new component that would increase the unit variable cost by $6.Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 500 units.What should be the overall effect on the company's monthly net operating income of this change?

A) decrease of $48,000

B) decrease of $6,000

C) increase of $48,000

D) increase of $6,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the company's target profit is $8,000.The dollar sales to attain that target profit is closest to:

A) $596,111

B) $1,532,857

C) $852,723

D) $429,200

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

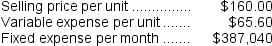

Data concerning Bedwell Enterprises Corporation's single product appear below:  The unit sales to attain the company's monthly target profit of $17,000 is closest to:

The unit sales to attain the company's monthly target profit of $17,000 is closest to:

A) 6,159

B) 4,280

C) 2,525

D) 4,321

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

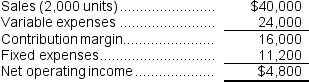

The margin of safety in dollars is closest to:

A) $86,100

B) $8,400

C) $24,000

D) $94,500

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Incremental analysis is an analytical approach that focuses only on those revenues and costs that will not change as a result of a decision.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

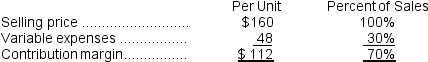

Cobble Corporation produces and sells a single product.Data concerning that product appear below:  Fixed expenses are $499,000 per month.The company is currently selling 5,000 units per month.The marketing manager would like to cut the selling price by $13 and increase the advertising budget by $33,000 per month.The marketing manager predicts that these two changes would increase monthly sales by 900 units.What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $499,000 per month.The company is currently selling 5,000 units per month.The marketing manager would like to cut the selling price by $13 and increase the advertising budget by $33,000 per month.The marketing manager predicts that these two changes would increase monthly sales by 900 units.What should be the overall effect on the company's monthly net operating income of this change?

A) increase of $56,100

B) decrease of $8,900

C) increase of $99,300

D) decrease of $56,100

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Escareno Corporation has provided its contribution format income statement for June.The company produces and sells a single product.  If the company sells 8,200 units, its total contribution margin should be closest to:

If the company sells 8,200 units, its total contribution margin should be closest to:

A) $301,000

B) $311,600

C) $319,200

D) $66,674

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

Data concerning Cavaluzzi Corporation's single product appear below:  Fixed expenses are $440,000 per month.The company is currently selling 8,000 units per month.

Required:

The marketing manager believes that an $8,000 increase in the monthly advertising budget would result in a 150 unit increase in monthly sales.What should be the overall effect on the company's monthly net operating income of this change? Show your work!

Fixed expenses are $440,000 per month.The company is currently selling 8,000 units per month.

Required:

The marketing manager believes that an $8,000 increase in the monthly advertising budget would result in a 150 unit increase in monthly sales.What should be the overall effect on the company's monthly net operating income of this change? Show your work!

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The break-even in monthly dollar sales is closest to:

A) $191,400

B) $249,810

C) $426,030

D) $132,110

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Variable expenses for Alpha Corporation are 40% of sales.What are sales at the break-even point, assuming that fixed expenses total $150,000 per year:

A) $250,000

B) $375,000

C) $600,000

D) $150,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ferkil Corporation manufacturers a single product that has a selling price of $100 per unit.Fixed expenses total $225,000 per year, and the company must sell 5,000 units to break even.If the company has a target profit of $67,500, sales in units must be:

A) 6,000 units

B) 5,750 units

C) 7,925 units

D) 6,500 units

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

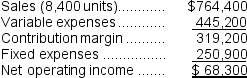

Duve Corporation has provided the following contribution format income statement.All questions concern situations that are within the relevant range.  If the selling price increases by $4 per unit and the sales volume decreases by 200 units, the net operating income would be closest to:

If the selling price increases by $4 per unit and the sales volume decreases by 200 units, the net operating income would be closest to:

A) $7,200

B) $12,800

C) $10,400

D) $11,520

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 260

Related Exams