A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How much is the unadjusted cost of goods sold on the Schedule of Cost of Goods Sold?

A) $136,000

B) $141,000

C) $144,000

D) $185,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ending balance in the Raw Materials account is closest to:

A) $22,000

B) $5,000

C) $74,000

D) $27,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

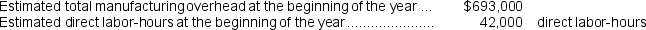

Brendal Corporation is a manufacturer that uses job-order costing.The company has supplied the following data for the just completed year:  Results of operations:

Results of operations:  How much is the total manufacturing cost added to Work in Process during the year?

How much is the total manufacturing cost added to Work in Process during the year?

A) $1,215,000

B) $1,803,000

C) $1,498,500

D) $2,023,500

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Matthias Corporation has provided data concerning the Corporation's Manufacturing Overhead account for the month of May.Prior to the closing of the overapplied or underapplied balance to Cost of Goods Sold, the total of the debits to the Manufacturing Overhead account was $53,000 and the total of the credits to the account was $69,000.Which of the following statements is true?

A) Manufacturing overhead applied to Work in Process for the month was $69,000.

B) Manufacturing overhead for the month was underapplied by $16,000.

C) Manufacturing overhead transferred from Finished Goods to Cost of Goods Sold during the month was $53,000.

D) Actual manufacturing overhead incurred during the month was $69,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The schedule of cost of goods manufactured contains three elements of product costs-direct materials, direct labor, and manufacturing overhead-and it summarizes the portions of those costs that remain in ending Work in Process inventory and that are transferred out of Work in Process into Finished Goods.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Two of the reasons why manufacturing overhead may be underapplied are: (1)the estimated total manufacturing overhead cost may have been too high; and (2)the estimated total amount of the allocation base may have been too low.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When manufacturing overhead is applied to production, it is added to:

A) the Cost of Goods Sold account.

B) the Raw Materials account.

C) the Work in Process account.

D) the Finished Goods inventory account.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The actual direct labor-hours worked during May totaled:

A) 2,800 hours

B) 3,500 hours

C) 3,300 hours

D) 3,600 hours

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The adjusted cost of goods sold that appears on the income statement for May is:

A) $206,000

B) $214,000

C) $208,000

D) $210,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry to record the allocation of any underapplied or overapplied manufacturing overhead for June would include the following:

A) credit to Work in Process of $21,450

B) credit to Work in Process of $70

C) debit to Work in Process of $21,450

D) dedit to Work in Process of $70

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How much is the adjusted cost of goods sold on the Schedule of Cost of Goods Sold?

A) $170,000

B) $167,000

C) $203,000

D) $163,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

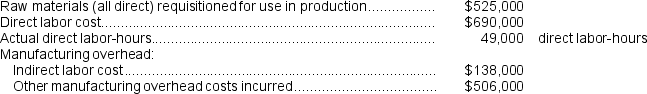

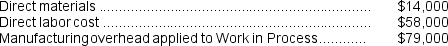

Holmstrom Corporation has provided the following data concerning last month's operations.

How much is the cost of goods available for sale on the Schedule of Cost of Goods Sold?

How much is the cost of goods available for sale on the Schedule of Cost of Goods Sold?

A) $186,000

B) $145,000

C) $144,000

D) $138,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

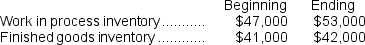

The total amount of manufacturing overhead actually incurred was:

A) $200,000

B) $284,000

C) $219,000

D) $242,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total amount of manufacturing overhead applied to production is:

A) $1,755,000

B) $546,000

C) $606,000

D) $611,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

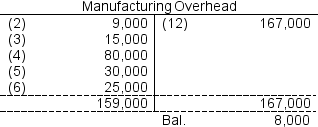

Refer to the T-account below:  The ending balance of $8,000 represents which of the following?

The ending balance of $8,000 represents which of the following?

A) Underapplied overhead.

B) Manufacturing overhead that will be carried over to the next period.

C) Overapplied overhead.

D) A bookkeeping error.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The direct materials cost was:

A) $8,000

B) $5,700

C) $3,600

D) $4,700

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

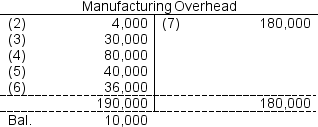

The $10,000 balance in the T-account below represents overapplied manufacturing overhead for the period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the applied manufacturing overhead was $223,900, the actual manufacturing overhead cost for the year was:

A) $200,700

B) $260,600

C) $200,200

D) $187,200

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Luebke Inc.has provided the following data for the month of November.The balance in the Finished Goods inventory account at the beginning of the month was $52,000 and at the end of the month was $30,000.The cost of goods manufactured for the month was $212,000.The actual manufacturing overhead cost incurred was $55,000 and the manufacturing overhead cost applied to Work in Process was $58,000.The company closes out any underapplied or overapplied manufacturing overhead to cost of goods sold.The adjusted cost of goods sold that would appear on the income statement for November is:

A) $231,000

B) $190,000

C) $234,000

D) $212,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 256

Related Exams