B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

The federal government sometimes taxes dividends and capital gains at different rates.Other things held constant,if the tax rate on dividends is high relative to that on capital gains,then individuals with low taxable incomes should favor stocks with low payouts and high-income individuals should favor high-payout companies.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Myron Gordon and John Lintner believe that the required return on equity increases as the dividend payout ratio is lowered.Their argument is based on the assumption that

A) investors are indifferent between dividends and capital gains.

B) investors require that the dividend yield plus the capital gains yield equal a constant.

C) capital gains are taxed at a higher rate than dividends.

D) investors view dividends as being less risky than potential future capital gains.

E) investors prefer a dollar of expected capital gains to a dollar of expected dividends because of the lower tax rate on capital gains.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Under the tax laws as they existed in 2014, a dollar received by an individual taxpayer as interest income is taxed at the same rate as a dollar received as dividends.

B) One nice feature of dividend reinvestment plans (DRIPs) is that they reduce the taxes investors would have to pay if they received cash dividends.

C) Empirical research indicates that, in general, companies send a negative signal to the marketplace when they announce an increase in the dividend. As a result, share prices fall when dividend increases are announced because investors interpret the increase as a signal that the firm expects fewer good investment opportunities in the future.

D) If a company needs to raise new equity capital, a new-stock dividend reinvestment plan would make sense. However, if the firm does not need new equity, then an open market purchase dividend reinvestment plan would probably make more sense.

E) Dividend reinvestment plans have not caught on in most industries, and today over 99% of all DRIPs are offered by utilities.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be most likely to lead to a decrease in a firm's dividend payout ratio?

A) Its earnings become more stable.

B) Its access to the capital markets increases.

C) Its research and development efforts pay off, and it now has more high-return investment opportunities.

D) Its accounts receivable decrease due to a change in its credit policy.

E) Its stock price has increased over the last year by a greater percentage than the increase in the broad stock market averages.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Suppose a firm that has been earning $2 and paying a dividend of $1.00,or a 50% dividend payout,announces that it is increasing the dividend to $1.50.The stock price then jumps from $20 to $30.Some people would argue that this is proof that investors prefer dividends to retained earnings.Miller and Modigliani would agree with this argument.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Mid-State BankCorp recently declared a 7-for-2 stock split.Prior to the split,the stock sold for $80 per share.If the firm's total market value is unchanged by the split,what will the stock price be following the split?

A) $20.63

B) $21.71

C) $22.86

D) $24.00

E) $25.20

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm uses the residual dividend model to set dividend policy,then dividends are determined as a residual after providing for the equity required to fund the capital budget.Under this model,the better the firm's investment opportunities,the lower its payout ratio will be,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm follows the residual dividend model, then a sudden increase in the number of profitable projects would be likely to lead to a reduction of the firm's dividend payout ratio.

B) The clientele effect explains why so many firms change their dividend policies so often.

C) One advantage of adopting the residual dividend model is that this policy makes it easier for a corporation to attract a specific and well-identified dividend clientele.

D) New-stock dividend reinvestment plans are similar to stock dividends because they both increase the number of shares outstanding but don't change the firm's total amount of book equity.

E) Investors who receive stock dividends must pay taxes on the value of the new shares in the year the stock dividends are received.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) One advantage of dividend reinvestment plans is that they enable investors to avoid paying taxes on the dividends they receive.

B) If a company has an established clientele of investors who prefer a high dividend payout, and if management wants to keep stockholders happy, it should not adhere strictly to the residual dividend model.

C) If a firm adheres strictly to the residual dividend model, then, holding all else constant, its dividend payout ratio will tend to rise whenever its investment opportunities improve.

D) If Congress eliminates taxes on capital gains but leaves the personal tax rate on dividends unchanged, this would motivate companies to increase their dividend payout ratios.

E) Despite its drawbacks, following the residual dividend model will tend to stabilize actual cash dividends, and this will make it easier for firms to attract a clientele that prefers high dividends, such as retirees.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about dividend policies is CORRECT?

A) Miller and Modigliani argued that investors prefer dividends to capital gains because dividends are more certain than capital gains. They call this the "bird-in-the-hand" effect.

B) One reason that companies tend to favor distributing excess cash as dividends rather than by repurchasing stock is that dividends are normally taxed at a lower rate than gains on repurchased stock.

C) One advantage of dividend reinvestment plans is that they allow shareholders to delay paying taxes on the dividends that they choose to reinvest.

D) One key advantage of the residual dividend model is that it enables a company to follow a stable dividend policy.

E) The clientele effect suggests that companies should follow a stable dividend policy.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Banerjee Inc.wants to maintain a target capital structure with 30% debt and 70% equity.Its forecasted net income is $550,000,and its board of directors has decreed that no new stock can be issued during the coming year.If the firm follows the residual dividend model,what is the maximum capital budget that is consistent with maintaining the target capital structure?

A) $673,652

B) $709,107

C) $746,429

D) $785,714

E) $825,000

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

There are two types of dividend reinvestment plans.Under one type of plan,the firm uses the cash that would have been paid as dividends to buy stock on the open market.Under the other type,the company issues new stock,keeps the cash that would have been paid out,and in effect sells new stock to those investors who choose to reinvest their dividends.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm repurchases some of its stock in the open market, then shareholders who sell their stock for more than they paid for it will be subject to capital gains taxes.

B) An open-market dividend reinvestment plan will be most attractive to companies that need new equity and would otherwise have to issue additional shares of common stock through investment bankers.

C) Stock repurchases tend to reduce financial leverage.

D) If a company declares a 2-for-1 stock split, its stock price should roughly double.

E) One advantage of adopting the residual dividend model is that this makes it easier for corporations to meet the requirements of Modigliani and Miller's dividend clientele theory.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ross-Jordan Financial has suffered losses in recent years,and its stock currently sells for only $0.50 per share.Management wants to use a reverse split to get the price up to a more "reasonable" level,which it thinks is $25 per share.How many of the old shares must be given up for one new share to achieve the $25 price,assuming this transaction has no effect on total market value?

A) 47.50

B) 49.88

C) 50.00

D) 52.50

E) 55.13

G) A) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Your firm adheres strictly to the residual dividend model.All else equal,which of the following factors would be most likely to lead to an increase in the firm's dividend per share?

A) The firm's net income increases.

B) The company increases the percentage of equity in its target capital structure.

C) The number of profitable potential projects increases.

D) Congress lowers the tax rate on capital gains, leaving the rest of the tax code unchanged.

E) Earnings are unchanged, but the firm issues new shares of common stock.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If investors prefer firms that retain most of their earnings,then a firm that wants to maximize its stock price should set a low payout ratio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The federal government sometimes taxes dividends and capital gains at different rates.Other things held constant,an increase in the tax rate on dividends relative to that on capital gains would logically lead to an increase in dividend payout ratios.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

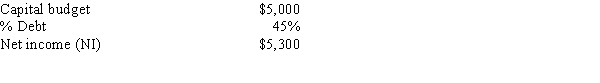

Chicago Brewing has the following data,dollars in thousands.If it follows the residual dividend model,what will its dividend payout ratio be?

A) 48.11%

B) 50.52%

C) 55.57%

D) 61.13%

E) 67.24%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You own 100 shares of Troll Brothers' stock,which currently sells for $120 a share.The company is about to declare a 2-for-1 stock split.Which of the following best describes your likely position after the split?

A) You will have 200 shares of stock, and the stock will trade at or near $120 a share.

B) You will have 200 shares of stock, and the stock will trade at or near $60 a share.

C) You will have 100 shares of stock, and the stock will trade at or near $60 a share.

D) You will have 50 shares of stock, and the stock will trade at or near $120 a share.

E) You will have 50 shares of stock, and the stock will trade at or near $600 a share.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 75

Related Exams