B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pleasant Hills Properties is developing a golf course subdivision that includes 250 home lots; 100 lots are golf course lots and will sell for $95,000 each; 150 are street frontage lots and will sell for $65,000.The developer acquired the land for $1,800,000 and spent another $1,400,000 on street and utilities improvement.Compute the amount of joint cost to be allocated to the street frontage lots using value basis.(Round your intermediate percentages to 2 decimal places.)

A) $1,920,000.

B) $720,000.

C) $1,620,800.

D) $1,579,200.

E) $1,080,000.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

No standard rule identifies the best basis of allocating expenses across departments,so it is impossible to allocate costs in a manner that will be perceived as fair.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company reports profit margin of 31.6% and investment turnover of 1.30 for one of its investment centers,the return on investment must be:

A) 24.3%.

B) 41.1%.

C) 32.9%.

D) 30.3%.

E) 4.11%.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kragle Corporation reported the following financial data for one of its divisions for the year; average invested assets of $470,000; sales of $930,000; and income of $105,000.The investment turnover is:

A) 22.3.

B) 50.5.

C) 1.98.

D) 447.6.

E) 11.3.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A system of performance measures,including nonfinancial measures,used to assess company and division manager performance is:

A) Hurdle rate.

B) Return on investment.

C) Balanced scorecard.

D) Residual income.

E) Investment turnover.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company pays $15,000 per period to rent a small building that has 10,000 square feet of space.This cost is allocated to the company's three departments on the basis of the amount of the space occupied by each.Department One occupies 2,000 square feet of floor space,Department Two occupies 3,000 square feet of floor space,and Department Three occupies 5,000 square feet of floor space.If the rent is allocated based on the total square footage of the space,Department One should be charged rent expense for the period of:

A) $4,400.

B) $3,000.

C) $4,000.

D) $2,200.

E) $2,000.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

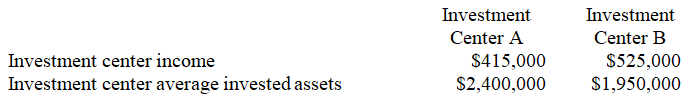

Two investment centers at Marshman Corporation have the following current-year income and asset data:

The return on investment (ROI) for Investment Center A is:

The return on investment (ROI) for Investment Center A is:

A) 578.3%

B) 24.1%

C) 17.3%

D) 39.2%

E) 19.1%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Departmental contribution to overhead is the amount of sales for that department,less its direct expenses.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

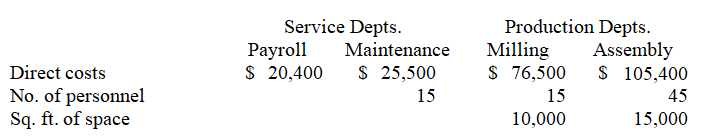

Brownley Company has two service departments and two operating (production) departments.The Payroll Department services all three of the other departments in proportion to the number of employees in each.The Maintenance Department costs are allocated to the two operating departments in proportion to the floor space used by each.Listed below are the operating data for the current period:  -The total cost of operating the Maintenance Department for the current period is:

-The total cost of operating the Maintenance Department for the current period is:

A) $14,280.

B) $15,912.

C) $25,500.

D) $29,580.

E) $22,412.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Holo Company reported the following financial numbers for one of its divisions for the year; average total assets of $5,800,000; sales of $5,375,000; cost of goods sold of $3,225,000; and operating expenses of $1,147,000.Compute the division's return on investment:

A) 18.6%.

B) 21.3%.

C) 17.3%.

D) 10.4%.

E) 14.7%.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In regard to joint cost allocation,the "split-off point" is:

A) A physical basis method to allocate costs based on ratio of some physical characteristic.

B) The difference between the actual and market value of joint costs.

C) The point at which some products are sold and some remain in inventory.

D) The point at which separate products can be identified.

E) Not acceptable when using the value basis for allocating joint costs.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

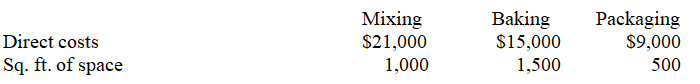

CakeCo,Inc.has three operating departments.Information about these departments is listed below.Maintenance is service department at CakeCo that incurred $12,000 of costs during the period.If allocated maintenance cost is based on floor space occupied by each of the operating departments,compute the amount of maintenance cost allocated to the Baking Department.

A) $400.

B) $1,200.

C) $4,000.

D) $7,500.

E) $6,000.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Departmental contribution to overhead is the same as gross profit generated by that department.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount by which a department's sales exceed its direct expenses is:

A) Net sales.

B) Gross profit.

C) Departmental profit.

D) Contribution margin.

E) Departmental contribution to overhead.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

No standard rule identifies the best basis of allocating expenses across departments.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Investment center is another name for profit center.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

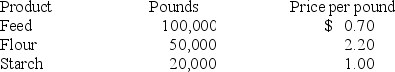

A granary allocates the cost of unprocessed wheat to the production of feed,flour,and starch.For the current period,unprocessed wheat was purchased for $120,000,and the following quantities of product and sales revenues were produced.  How much of the $120,000 cost should be allocated to flour if the value basis is used?

How much of the $120,000 cost should be allocated to flour if the value basis is used?

A) $24,500.

B) $84,000.

C) $66,000.

D) $70,000.

E) $200,000.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In producing oat bran,the joint cost of milling the oats into bran,oatmeal,and animal feed is considered a direct cost to the oat bran,because the oat bran cannot be produced without incurring the joint cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Division P of Launch Corporation has the capacity for making 75,000 wheel sets per year and regularly sells 60,000 each year on the outside market.The regular sales price is $100 per wheel set,and the variable production cost per unit is $65.Division Q of Launch Corporation currently buys 30,000 wheel sets (of the kind made by Division P) yearly from an outside supplier at a price of $90 per wheel set.If Division Q were to buy the 30,000 wheel sets it needs annually from Division P at $87 per wheel set,the change in annual net operating income for the company as a whole,compared to what it is currently,would be:

A) $600,000

B) $225,000

C) $750,000

D) $135,000

E) $700,000

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 210

Related Exams