B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Giant Corporation owns all of the stock of Junior Corporation,a Delaware passive investment company.Giant operates strictly in nonunitary State B,which levies a 9% income tax.This year,Junior earned $200,000 of portfolio interest income and paid a $150,000 dividend to Giant.In which state(s) will the interest income create an income tax liability?

A) In neither state.

B) Only in Delaware.

C) Only in B.

D) In both B and Delaware,according to the apportionment formulas of each.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Allocation is a method under which a corporation's _________________________ income is directly assigned to the specific states where the income is derived.

Correct Answer

verified

Correct Answer

verified

Short Answer

____________________ describe(s)the degree of business activity that must be present before a taxing jurisdiction has the right to impose a tax on an entity's income.

Correct Answer

verified

Correct Answer

verified

Essay

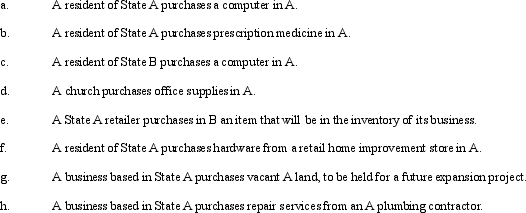

Indicate for each transaction whether a sales (S)or use (U)applies,or whether the transaction is nontaxable (N).Where the laws vary among various states,assume that the most common rules apply.All taxpayers are individuals.

Correct Answer

verified

11ea86f8_676b_a326_8b27_97418c59f1fb_TB4128_00

Correct Answer

verified

True/False

Almost all of the states assess some form of consumer-level sales/use tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A state sales tax usually falls upon:

A) Sales of groceries.

B) Sales of widgets made to out-of-state customers.

C) Sales of widgets made to the ultimate consumer of the product or service.

D) Sales of real estate.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

By making a water's edge election,the multinational taxpayer can limit the reach of unitary principles to the apportionment factors and income of its U.S.and E.U.affiliates.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Property taxes generally are collected by local taxing jurisdictions,not the state or Federal governments.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the taxpayer operates in one or more unitary states:

A) Apportionment factors are computed on a group-wide basis.

B) The tax incentive of creating nexus in a low-tax state is enhanced.

C) The tax benefit of a passive investment subsidiary holding company is neutralized.

D) The use of a water's edge election should be considered.

E) All of the above are true.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

The ____________________ tax levied by a state usually is based on the book value of a corporation's "net worth."

Correct Answer

verified

Correct Answer

verified

True/False

State and local politicians tend to apply new and increased taxes to taxpayers who are visitors to the jurisdiction,such as a tax on auto rentals,because the taxpayer cannot vote to reelect the lawmaker.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

A ____________________ tax is designed to complement the local sales tax structure,to prevent the consumer from making purchases in a lower-tax state or online,and then bringing the asset into the state.

Correct Answer

verified

use

Correct Answer

verified

True/False

S corporations flow-through income amounts to its shareholders,and most states require a withholding of shareholder taxes on the allocated amounts.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

A taxpayer wishing to reduce the negative tax effects of the application of the unitary theory might:

A) Affiliate with a service division that shows an operating loss,like one in research and development.

B) Acquire a unitary affiliate in a country with a high wage structure.

C) Add a profitable entity to the unitary group.

D) a.and b.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

An LLC apportions and allocates its annual taxable income in the same manner used by any other business operating in the state.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The use tax is designed to complement the sales tax.A use tax typically covers purchases made out of state and brought into the jurisdiction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Roughly five percent of all taxes paid by businesses in the U.S.are to state,local,and municipal jurisdictions.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Nonbusiness income receives tax-exempt treatment under all state corporate income taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

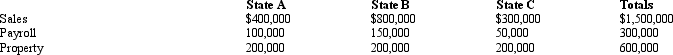

Helene Corporation owns manufacturing facilities in States A,B,and C.A uses a three-factor apportionment formula under which the sales,property and payroll factors are equally weighted.B uses a three-factor apportionment formula under which sales are double-weighted.C employs a single-factor apportionment factor,based solely on sales.

Helene's operations generated $1,000,000 of apportionable income,and its sales and payroll activity and average property owned in each of the three states is as follows.

Helene's apportionable income assigned to A is:

Helene's apportionable income assigned to A is:

A) $0.

B) $266,667.

C) $311,100.

D) $1,000,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 145

Related Exams