A) Estates can be shareholders.

B) Losses flow through immediately to the shareholders.

C) Section 1202 treatment (Qualified Small Business Stock) is not available.

D) Tax-exempt income flows through as excludible to shareholders.

E) None of the above is a disadvantage of the S election.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

An S election made before becoming a corporation is valid only beginning with the first 12-month tax year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which transaction affects the Other Adjustments Account on an S corporation's Schedule M-2?

A) Payroll penalty.

B) Unreasonable compensation.

C) Life insurance proceeds (nontaxable to the recipient S corporation) .

D) Taxable interest.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Liabilities affect the owner's basis differently in an S corporation than they do in a partnership.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Depreciation recapture income is a ___________________ (separately, nonseparately) computed amount.

Correct Answer

verified

Correct Answer

verified

True/False

A per-day, per-share allocation of flow-through S corporation items must be used.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

In the case of a complete termination of an S corporation interest, __________________ a tax year may occur.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

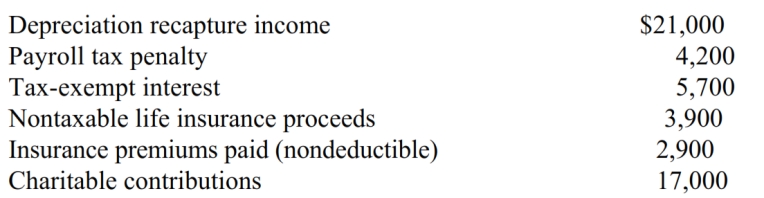

If the beginning balance in OAA is zero, and the following transactions occur, what is the ending OAA balance?

A) $1,300.

B) $6,700.

C) $23,300.

D) $27,500.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

Stock basis first is increased by income items, then by distributions, and finally decreased by ____________________.

Correct Answer

verified

Correct Answer

verified

True/False

An S shareholder's basis is decreased by distributions treated as being paid from AAA.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Several individuals acquire assets on behalf of Skip Corporation on May 28, purchased assets on June 3 and began business on June 11. They subscribe to shares of stock, file articles of incorporation for Skip, and become shareholders on June 21. The S election must be filed no later than 2 1/2 months after:

A) May 28.

B) June 3.

C) June 11.

D) June 21.

E) December 31.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, Bobby and Alice own equally all of the stock of an electing S corporation called Prairie Dirt Delight. The entity incurs a $60,000 loss for a non-leap year. On the 200th day of the year (not a leap year) , Bobby sells his one-half of the stock to his son, Saul. How much of the $60,000 loss, if any, is allocated to Bobby?

A) $0

B) $13,562

C) $16,438

D) $32,877

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Compensation for services rendered to an S corporation is subject to FICA taxes.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

A cash basis calendar year C corporation reports $100,000 of accounts receivable on the date of its conversion to S status on February 14. By the end of the year, $60,000 of these receivables are collected. Calculate any built-in gains tax, assuming that there is sufficient taxable income.

A) $0

B) $12,600

C) $21,000

D) $35,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

NOL carryovers from C years can be used in an S corporation year against ordinary income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which corporation is eligible to make the S election?

A) Non-U.S. corporation.

B) One-person limited liability company.

C) Insurance company.

D) U.S. bank.

E) None of the above can select S status.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A calendar year C corporation reports a $41,000 NOL in 2018, but it elects S status for 2019 and generates an NOL of $30,000 in that year. At all times during 2019, the stock of the corporation was owned by the same 10 shareholders, each of whom owned 10% of the stock. Kris, one of the 10 shareholders, holds an S stock basis of $2,300 at the beginning of 2019. How much of the 2019 loss, if any, is deductible by Kris?

A) $0

B) $2,300

C) $3,000

D) $7,100

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which, if any, of the following items has no effect on the stock basis of an S corporation shareholder?

A) Operating income.

B) Short-term capital gain.

C) Advertising expenses.

D) Long-term capital loss.

E) The 20% QBI deduction.

G) B) and E)

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

Mock Corporation converts to S corporation status in 2019. Mock used the LIFO inventory method in 2018 and had a LIFO inventory of $435,000 (FIFO value of $550,000) on the date of the S election. How much tax must be added to Mock's 2018 corporate tax liability, assuming that Mock is subject to a 21% tax rate.

A) $0

B) $6,038

C) $24,150

D) $115,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

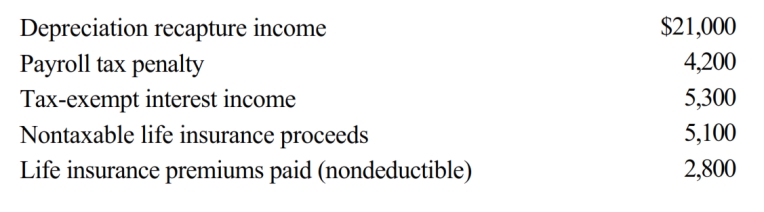

If an S corporation's beginning balance in OAA is zero, and the following transactions occur, what is the ending OAA balance?

A) $1,300

B) $7,600

C) $23,300

D) $27,500

E) None of the above

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 129

Related Exams