A) currency

B) demand deposits

C) other checkable deposits

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

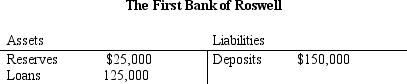

Table 11-5.

-Refer to Table 11-5. From the table it follows that the Bank of Pleasantville operates in a

-Refer to Table 11-5. From the table it follows that the Bank of Pleasantville operates in a

A) fractional-reserve banking system, since its reserves are less than its deposits.

B) fractional-reserve banking system, since its reserves are less than its loans.

C) 100-percent-reserve banking system, since its assets are equal to its liabilities.

D) 100-percent-reserve banking system if the Fed's reserve requirement is 10 percent; otherwise, it operates in a fractional-reserve banking system.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over one time horizon or another, Fed policy decisions influence

A) inflation and employment.

B) inflation but not employment.

C) employment but not inflation.

D) neither inflation nor employment.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A double coincidence of wants

A) is required when there is no item in an economy that is widely accepted in exchange for goods and services.

B) is required in an economy that relies on barter.

C) is a hindrance to the allocation of resources when it is required for trade.

D) All of the above are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 11-4.

-Refer to Table 11-4. If the bank is holding $4,000 in excess reserves, then the reserve requirement with which it must comply is

-Refer to Table 11-4. If the bank is holding $4,000 in excess reserves, then the reserve requirement with which it must comply is

A) 4 percent.

B) 6 percent.

C) 12 percent.

D) 14 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If $300 of new reserves generates $800 of new money in the economy, then the reserve ratio is

A) 2.7 percent.

B) 12.5 percent.

C) 37.5 percent.

D) 40 percent.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items is included in M2?

A) credit cards

B) money market mutual funds

C) corporate bonds

D) large time deposits

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the U.S., the average adult holds about $3,700 in

A) currency.

B) wealth.

C) M1.

D) M2.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The Federal Reserve can alter the size of the money supply by changing reserves or changing reserve requirements.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that in a country people gain more confidence in the banking system and so hold relatively less currency and more deposits. As a result, bank reserves will

A) decrease and the money supply will eventually decrease.

B) decrease and the money supply will eventually increase.

C) increase and the money supply will eventually decrease.

D) increase and the money supply will eventually increase.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate that the Fed charges banks that borrow reserves from it is the

A) federal funds rate.

B) discount rate.

C) reserve requirement.

D) prime rate.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is included in M2 but not in M1?

A) demand deposits

B) corporate bonds

C) large time deposits

D) money market mutual funds

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 11-1. The monetary policy of Namdian is determined by the Namdian Central Bank. The local currency is the dia. Namdian banks collectively hold 100 million dias of required reserves, 25 million dias of excess reserves, 250 million dias of Namdian Treasury Bonds, and their customers hold 1,000 million dias of deposits. Namdians prefer to use only demand deposits and so the money supply consists of demand deposits. -Refer to Scenario 11-1. Assuming the only other item Namdian banks have on their balance sheets is loans, what is the value of existing loans made by Namdian banks?

A) 625 million dias

B) 875 million dias

C) 1,125 million dias

D) None of the above is correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most financial assets other than money function as

A) a medium of exchange, a unit of account, and a store of value.

B) a medium of exchange and a store of value, but not a unit of account.

C) a store of value and a unit of account, but not a mediuim of exchange.

D) a store of value, but not a unit of account nor a medium of exchange

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The New York Federal Reserve Bank

A) president always gets to vote at the FOMC meetings.

B) conducts open market transactions.

C) is one of 12 regional Federal Reserve Banks.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The banking system currently has $50 billion of reserves, none of which are excess. People hold only deposits and no currency, and the reserve requirement is 10 percent. If the Fed raises the reserve requirement to 12.5 percent and at the same time sells $10 billion worth of bonds, then by how much does the money supply change?

A) It falls by $20 billion.

B) It falls by $110 billion.

C) It falls by $180 billion.

D) None of the above is correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If R represents the reserve ratio for all banks in the economy, then the money multiplier is

A) 1/(1-R) .

B) 1/R.

C) 1/(1+R) .

D) (1+R) /R.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose banks decide to hold fewer excess reserves relative to deposits. Other things the same, this action will cause the

A) money supply to fall. To reduce the impact of this the Fed could sell Treasury bonds.

B) money supply to fall. To reduce the impact of this the Fed could buy Treasury bonds.

C) money supply to rise. To reduce the impact of this the Fed could sell Treasury bonds.

D) money supply to rise. To reduce the impact of this the Fed could buy Treasury bonds.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Credit cards are

A) a medium of exchange.

B) counted as part of M2 but not as part of M1.

C) important for analyzing the monetary system.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The president of each regional Federal Reserve Bank is appointed by

A) the U.S. president with the approval of the Senate.

B) the Board of Governors.

C) the voting members of the Federal Open Market Committee.

D) the board of directors of that regional Federal Reserve Bank.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 421

Related Exams