B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the MPC is 0.60. Assume there are no crowding out or investment accelerator effects. If the government increases expenditures by $200 billion, then by how much does aggregate demand shift to the right? If the government decreases taxes by $200 billion, then by how much does aggregate demand shift to the right?

A) $300 billion and $180 billion

B) $300 billion and $300 billion

C) $500 billion and $300 billion

D) $500 billion and $500 billion

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

The additional shifts in aggregate demand that result when there is an increase in government spending is known as the _____.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the stock market booms, then

A) aggregate demand increases, which the Fed could offset by increasing the money supply.

B) aggregate supply increases, which the Fed could offset by increasing the money supply.

C) aggregate demand increases, which the Fed could offset by decreasing the money supply.

D) aggregate supply increases, which the Fed could offset by decreasing the money supply.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

People hold money primarily because it

A) increases in value when there is inflation.

B) serves as a store of value.

C) serves as a medium of exchange.

D) functions as a unit of account.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the interest rate is above the equilibrium level,

A) the quantity of money that people want to hold is less than the quantity of money that the Federal Reserve has supplied.

B) people respond by buying interest-bearing bonds or by depositing money in interest-bearing bank accounts.

C) bond issuers and banks respond by lowering the interest rates they offer.

D) All of the above are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the interest rate is above the Fed's target, the Fed should

A) buy bonds to increase the money supply.

B) buy bonds to decrease the money supply.

C) sell bonds to increase the money supply.

D) sell bonds to decrease the money supply.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the money market is initially in equilibrium. If the price level increases, then according to liquidity preference theory there is an excess

A) supply of money until the interest rate increases.

B) supply of money until the interest rate decreases.

C) demand for money until the interest rate increases.

D) demand for money until the interest rate decreases.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If expected inflation is constant, then when the nominal interest rate falls, the real interest rate

A) falls by more than the change in the nominal interest rate.

B) falls by the change in the nominal interest rate.

C) rises by the change in the nominal interest rate.

D) rises by more than the change in the nominal interest rate.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fiscal policy affects the economy

A) only in the short run.

B) only in the long run.

C) in both the short and long run.

D) in neither the short nor the long run.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Employment Act of 1946 states that

A) the Fed should use monetary policy only to control the rate of inflation.

B) the government should promote full employment and production.

C) the government should periodically increase the minimum wage and unemployment insurance benefits.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The multiplier effect

A) and the crowding-out effect both amplify the effects of an increase in government expenditures.

B) and the crowding-out effect both diminish the effects of an increase in government expenditures.

C) diminishes the effects of an increase in government expenditures, while the crowding-out effect amplifies the effects.

D) amplifies the effects of an increase in government expenditures, while the crowding-out effect diminishes the effects.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed conducts open-market sales, the money supply

A) increases and aggregate demand shifts right.

B) increases and aggregate demand shifts left.

C) decreases and aggregate demand shifts right.

D) decreases and aggregate demand shifts left.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of an increase in government purchases?

A) The government builds new roads.

B) The Federal Reserve purchases government bonds.

C) The government decreases personal income taxes.

D) The government increases unemployment insurance benefit payments.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

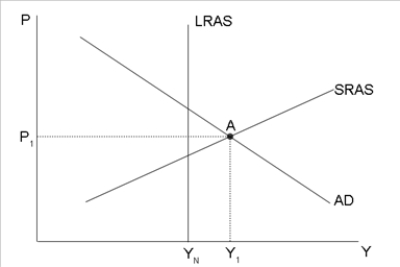

Figure 34-9  -Refer to Figure 34-9. Suppose the economy is currently at point A. To restore full employment, the appropriate fiscal response

-Refer to Figure 34-9. Suppose the economy is currently at point A. To restore full employment, the appropriate fiscal response

A) requires the central bank to purchase government bonds, which will increase the money supply.

B) is a reduction in government purchases.

C) is a reduction in taxes.

D) requires the central bank to sell government bonds, which will reduce the money supply.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monetary policy and fiscal policy influence

A) output and prices in the short run and the long run.

B) output and prices in the short run only.

C) output in the short run and the long run.

D) output in the short run only.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

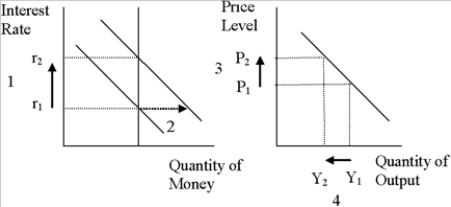

Figure 34-3  -Refer to Figure 34-3. What quantity is represented by the downward-sloping line on the left-hand graph?

-Refer to Figure 34-3. What quantity is represented by the downward-sloping line on the left-hand graph?

A) the supply of money

B) the demand for money

C) the rate of inflation

D) Aggregate Demand.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following shifts aggregate demand to the right?

A) The price level rises.

B) The price level falls.

C) The money supply falls.

D) None of the above is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The multiplier for changes in government spending is calculated as

A) 1/1+MPC) .

B) 1 - MPC) /MPC.

C) 1/MPC.

D) 1/1 - MPC) .

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate would fall and the quantity of money demanded would

A) increase if there were a surplus in the money market.

B) increase if there were a shortage in the money market.

C) decrease if there were a surplus in the money market.

D) decrease if there were a shortage in the money market.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 301 - 320 of 512

Related Exams