B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-3 Suppose that a society is made up of five families whose incomes are as follows: $120,000; $90,000; $30,000; $30,000; and $18,000. The federal government is considering two potential income tax plans: Plan A is a negative income tax plan where the taxes owed equal 1/3 of income minus $20,000. Plan B is a two-tiered plan where families earning less than $35,000 pay no income tax and families earning more than $35,000 pay 10% of their income in taxes. The income tax revenue collected from those families earning over $35,000 is then redistributed equally to those families earning less than $35,000. -Refer to Scenario 20-3. Assuming that utility is directly proportional to the cash value of after-tax income, which government policy would an advocate of libertarianism prefer?

A) Plan A

B) Plan B

C) either Plan A or Plan B

D) neither Plan A nor Plan B because any plan that forcibly redistributes income is against the philosophy

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The poverty line is an absolute standard and is based on the cost of providing an adequate diet.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A follower of liberalism would not support a redistribution of income but rather would focus on equalizing opportunities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

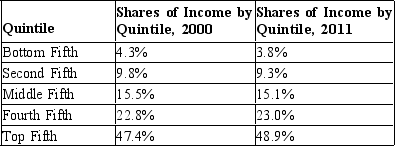

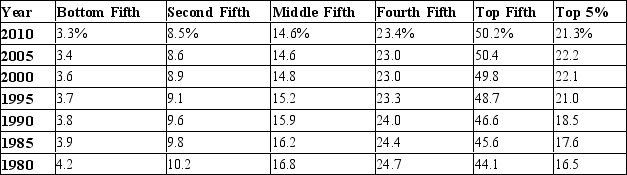

Table 20-8  Source: U.S. Bureau of Census

-Refer to Table 20-8. In 2011, the bottom 40% of families has

Source: U.S. Bureau of Census

-Refer to Table 20-8. In 2011, the bottom 40% of families has

A) about 13% of total income in the U.S.

B) about 28% of total income in the U.S.

C) about 51% of total income in the U.S.

D) about 72% of total income in the U.S.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

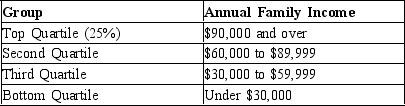

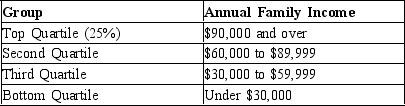

Table 20-1

The following table shows the distribution of income in Marysville.  -Refer to Table 20-1. If the poverty line was $31,852, what would be the poverty rate?

-Refer to Table 20-1. If the poverty line was $31,852, what would be the poverty rate?

A) less than 25%

B) between 25% and 50%

C) between 50% and 75%

D) There is insufficient information to answer this question.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 20-1

The following table shows the distribution of income in Marysville.  -Refer to Table 20-1. If the poverty line were $23,021, what would be the poverty rate?

-Refer to Table 20-1. If the poverty line were $23,021, what would be the poverty rate?

A) less than 25%

B) between 25% and 50%

C) between 50% and 75%

D) There is insufficient information to answer this question.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The 2011 U.S. distribution of income shows that the top 20 percent of families have approximately what share of income?

A) 20 percent

B) 35 percent

C) 50 percent

D) 80 percent

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government used the following formula to compute a family's tax liability: Taxes owed = 28% of income - $8,000. How much would a family that earned $150,000 owe?

A) $34,000

B) $42,000

C) $50,000

D) $68,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

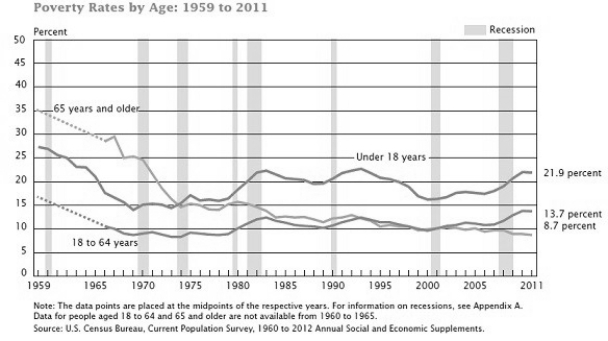

Figure 20-3  -Refer to Figure 20-3. In 1968, the percent of adults aged 18 to 64 years in poverty is

-Refer to Figure 20-3. In 1968, the percent of adults aged 18 to 64 years in poverty is

A) higher than both the percentage of children under age 18 and the percentage of elderly aged 65 and over in poverty.

B) higher than the percentage of children under age 18 but is lower than the percentage of elderly aged 65 and over in poverty.

C) lower than both the percentage of children under age 18 and the percentage of elderly aged 65 and over in poverty.

D) lower than the percentage of children under age 18 but is higher than the percentage of elderly aged 65 and over in poverty.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Many Democrats support raising the U.S. minimum wage. Critics of raising the minimum wage argue that minimum-wage laws are

A) too expensive for local governments to fund.

B) too expensive for local governments to administer.

C) imprecise in their ability to help the working poor.

D) easy for businesses to pay.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Robert Nozick criticizes Rawls's concept of justice by using an example of

A) minimum wage laws.

B) the grade distribution in a class.

C) a leaky bucket.

D) the price of tea in China.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 20-5 Suppose the government implemented a negative income tax and used the following formula to compute a family's tax liability: Taxes owed = (1/4 of income) - $10,000 -Refer to Scenario 20-5. A family earning $70,000 before taxes would have how much after-tax income?

A) $7,500

B) $52,500

C) $62,500

D) $77,500

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Table 20-14

Income Inequality in the United States

The values in the table reflect the percentages of pre-tax-and transfer income.  Source: US Census Bureau

-Refer to Table 20-14. The trend in income inequality from 1980 to 2010 is .

Source: US Census Bureau

-Refer to Table 20-14. The trend in income inequality from 1980 to 2010 is .

Correct Answer

verified

Correct Answer

verified

Short Answer

The percentage of the population whose family income falls below an absolute level is call the

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the government redistributes income to achieve greater equality, it

A) distorts incentives.

B) improves efficiency.

C) focuses on middle income brackets.

D) relies on foreign aid to help balance the budget.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The poverty rate is the percentage of the population whose family income falls below the poverty line.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Less than three percent of families are categorized as poor for eight years or more.

B) In the United States, the grandson of a millionaire is much more likely to be rich than the grandson of an average-income person.

C) The majority of millionaires in the United States inherited their wealth.

D) Most workers have about the same income (adjusted for inflation) when they are young as when they are middle-aged.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a society consists of only two people, John and Jane. A utilitarian would say that the proper role of government in this society is to

A) equalize the incomes of John and Jane.

B) equalize John's utility and Jane's utility.

C) equalize John's marginal utility and Jane's marginal utility.

D) maximize the sum of John's utility and Jane's utility.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) An advantage of an in-kind transfer is that it prevents an alcoholic from spending a cash benefit on alcohol.

B) An advantage of the Supplemental Security Income (SSI) program is that it benefits the sick and disabled.

C) An advantage of a negative income tax program is that the poor must work to be eligible.

D) Minimum wage laws result in higher unemployment among those groups of workers affected by the minimum wage.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 241 - 260 of 455

Related Exams