B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firm M is a mature company in a mature industry.Its annual net income and cash flows are consistently high and stable.However,M's growth prospects are quite limited,so its capital budget is small relative to its net income.Firm N is a relatively new company in a new and growing industry.Its markets and products have not stabilized,so its annual operating income fluctuates considerably.However,N has substantial growth opportunities,and its capital budget is expected to be large relative to its net income for the foreseeable future.Which of the following statements is CORRECT?

A) Firm M probably has a lower target debt ratio than Firm N.

B) Firm M probably has a higher target dividend payout ratio than Firm N.

C) If the corporate tax rate increases,the debt ratio of both firms is likely to decline.

D) The two firms are equally likely to pay high dividends.

E) Firm N is likely to have a clientele of shareholders who want a consistent,stable dividend income.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Some investors prefer dividends to retained earnings (and the capital gains retained earnings bring),while others prefer retained earnings to dividends.Other things held constant,it makes sense for a company to establish its dividend policy and stick to it,and then it will attract a clientele of investors who like that policy.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm declares a 20:1 stock split,and the pre-split price was $500,then we might expect the post-split price to be $25.However,it often turns out that the post-split price will be higher than $25.This higher price could be due to signaling effects investors believe that management split the stock because they think the firm is going to do better in the future.The higher price could also be because investors like lower-priced shares.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Torrence Inc.has the following data.If it uses the residual dividend model,how much total dividends,if any,will it pay out?

A) $213,150

B) $240,100

C) $262,150

D) $245,000

E) $284,200

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If on January 3 a company declares a dividend of $1.50 per share,payable on January 31 to holders of record on January 17,then the price of the stock should drop by approximately $1.50 on January 15,which is the ex-dividend date.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

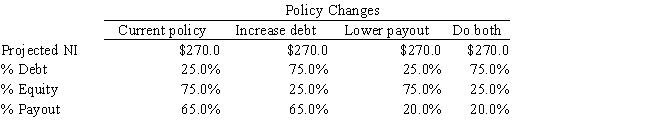

Del Grasso Fruit Company has more positive NPV projects than it can finance under its current policies without issuing new stock,but its board of directors had decreed that it cannot issue any new shares in the foreseeable future.Your boss,the CFO,wants to know how the capital budget would be affected by changes in capital structure policy and/or the target dividend payout policy.You obtained the following data,which shows the firm's projected net income (NI) ,its current capital structure and dividend payout policies,and three possible new policies.Projected net income for the coming year will not be affected by a policy change.How much larger could the capital budget be if (1) the target debt ratio were raised to the indicated amount,other things held constant, (2) the target payout ratio were lowered to the indicated amount,other things held constant,or (3) the debt ratio and dividend payout were both changed by the indicated amounts?

A) 252.0;162.0;738.0

B) 254.5;131.2;848.7

C) 209.2;187.9;590.4

D) 257.0;179.8;804.4

E) 259.6;142.6;752.8

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

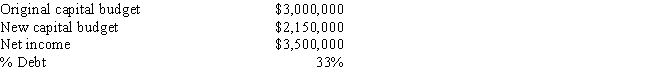

Whitman Antique Cars Inc.has the following data,and it follows the residual dividend model.Some Whitman family members would like more dividends,and they also think that the firm's capital budget includes too many projects whose NPVs are close to zero.If Whitman reduced its capital budget to the indicated level,by how much could dividends be increased,holding other things constant?

A) $438,515

B) $626,450

C) $694,790

D) $558,110

E) $569,500

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) When firms are deciding on the size of stock splits--say whether to declare a 2-for-1 split or a 3-for-1 split,it is best to declare the smaller one,in this case the 2-for-1 split,because then the after-split price will be higher than if the 3-for-1 split had been used.

B) Back before the SEC was created in the 1930s,companies would declare reverse splits in order to boost their stock prices.However,this was determined to be a deceptive practice,and reverse splits are illegal today.

C) Stock splits create more administrative problems for investors than stock dividends,especially determining the tax basis of their shares when they decide to sell them,so today stock dividends are used far more often than stock splits.

D) When a company declares a stock split,the price of the stock typically declines--for example,by about 50% after a 2-for-1 split--and this necessarily reduces the total market value of the firm's equity.

E) If a firm's stock price is quite high relative to most stocks--say $500 per share--then it can declare a stock split of say 20-for-1 so as to bring the price down to something close to $25.Moreover,if the price is relatively low--say $2 per share--then it can declare a "reverse split" of say 1-for-10 so as to bring the price up to somewhere around $20 per share.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

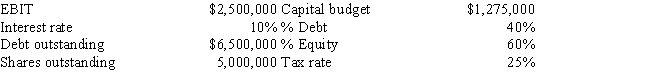

New Orleans Builders Inc.has the following data.If it follows the residual dividend model,what is its forecasted dividend payout ratio?

A) 39.60%

B) 37.20%

C) 49.20%

D) 31.60%

E) 40.00%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You own 100 shares of Troll Brothers' stock,which currently sells for $120 a share.The company is about to declare a 2-for-1 stock split.Which of the following best describes your likely position after the split?

A) You will have 200 shares of stock,and the stock will trade at or near $120 a share.

B) You will have 200 shares of stock,and the stock will trade at or near $60 a share.

C) You will have 100 shares of stock,and the stock will trade at or near $60 a share.

D) You will have 50 shares of stock,and the stock will trade at or near $120 a share.

E) You will have 50 shares of stock,and the stock will trade at or near $600 a share.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm adheres strictly to the residual dividend model,the issuance of new common stock would suggest that

A) the dividend payout ratio has remained constant.

B) the dividend payout ratio is increasing.

C) no dividends will be paid during the year.

D) the dividend payout ratio is decreasing.

E) the dollar amount of capital investments had decreased.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Grullon Co.is considering a 8-for-4 stock split.The current stock price is $75.00 per share,and the firm believes that its total market value would increase by 6% as a result of the improved liquidity that should follow the split.What is the stock's expected price following the split?

A) $47.30

B) $41.34

C) $40.15

D) $39.75

E) $31.40

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The federal government sometimes taxes dividends and capital gains at different rates.Other things held constant,if the tax rate on dividends is high relative to that on capital gains,then individuals with low taxable incomes should favor stocks with low payouts and high-income individuals should favor high-payout companies.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm repurchases some of its stock in the open market,then shareholders who sell their stock for more than they paid for it will be subject to capital gains taxes.

B) An open-market dividend reinvestment plan will be most attractive to companies that need new equity and would otherwise have to issue additional shares of common stock through investment bankers.

C) Stock repurchases tend to reduce financial leverage.

D) If a company declares a 2-for-1 stock split,its stock price should roughly double.

E) One advantage of adopting the residual dividend model is that this makes it easier for corporations to meet the requirements of Modigliani and Miller's dividend clientele theory.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A "reverse split" reduces the number of shares outstanding.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

There are two types of dividend reinvestment plans.Under one type of plan,the firm uses the cash that would have been paid as dividends to buy stock on the open market.Under the other type,the company issues new stock,keeps the cash that would have been paid out,and in effect sells new stock to those investors who choose to reinvest their dividends.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Miller and Modigliani's dividend irrelevance theory says that the percentage of its earnings a firm pays out in dividends has no effect on its cost of capital,but it does affect its stock price.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dentaltech Inc.projects the following data for the coming year.If the firm follows the residual dividend model and also maintains its target capital structure,what will its dividend payout ratio be?

A) 44.9%

B) 52.9%

C) 52.5%

D) 39.5%

E) 38.1%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

One implication of the bird-in-the-hand theory of dividends is that a given reduction in dividend yield must be offset by a more than proportionate increase in growth in order to keep a firm's required return constant,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 75

Related Exams