A) $2,230

B) $2,207

C) $1,957

D) $2,639

E) $2,275

G) A) and B)

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

Last year,Stewart-Stern Inc.reported $11,250 of sales,$4,500 of operating costs other than depreciation,and $1,250 of depreciation.The company had $3,500 of bonds outstanding that carry a 6.50% interest rate,and its federal-plus-state income tax rate was 25.00%.During last year,the firm had expenditures on fixed assets and net operating working capital that totaled $2,000.These expenditures were necessary for it to sustain operations and generate future sales and cash flows.This year's data are expected to remain unchanged except for one item,depreciation,which is expected to increase by $1,250.By how much will the depreciation change cause (1) the firm's net income and (2) its free cash flow to change? Note that the company uses the same depreciation for tax and stockholder reporting purposes.Do not round the intermediate calculations.

A) -$937.50;$312.50

B) -$731.25;$337.50

C) -$1,106.25;$253.13

D) -$956.25;$306.25

E) -$1,143.75;$234.38

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

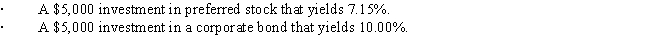

Mantle Corporation is considering two equally risky investments: What is the breakeven corporate tax rate that makes the company indifferent between the two investments? Assume a 50.00% dividend exclusion for tax on dividends.(Do not round your intermediate answer and round your final answer to two decimal places. )

A) 39.48%

B) 43.47%

C) 42.58%

D) 44.36%

E) 33.27%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

C.F.Lee Inc.has the following income statement.How much after-tax operating income does the firm have?

A) $714.99

B) $1,103.38

C) $829.74

D) $882.70

E) $891.53

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brown Office Supplies recently reported $15,500 of sales,$8,250 of operating costs other than depreciation,and $1,750 of depreciation.It had $9,000 of bonds outstanding that carry a 7.0% interest rate,and its federal-plus-state income tax rate was 25%.How much was the firm's earnings before taxes (EBT) ?

A) $3,799

B) $5,211

C) $4,870

D) $5,649

E) $5,065

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Emery Mining Inc.recently reported $147,500 of sales,$75,500 of operating costs other than depreciation,and $10,200 of depreciation.The company had $16,500 of outstanding bonds that carry a 7.25% interest rate,and its federal-plus-state income tax rate was 25%.How much was the firm's net income? The firm uses the same depreciation expense for tax and stockholder reporting purposes.(Round your intermediate and final answers to two decimal places. )

A) $38,604.59

B) $36,634.97

C) $35,847.12

D) $47,664.85

E) $45,452.81

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

To estimate the cash flow from operations,depreciation must be added back to net income because depreciation is a non-cash charge that has been deducted from revenue in the net income calculation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Retained earnings,as reported on the balance sheet,represent the amount of cash a company has available to pay out as dividends to shareholders.

B) 50% of the interest received by corporations is excluded from taxable income.

C) 50% of the dividends received by corporations is excluded from taxable income.

D) Because taxes on long-term capital gains are not paid until the gain is realized,investors must pay the top individual tax rate on that gain.

E) The corporate tax system favors equity financing,as dividends paid are deductible from corporate taxes.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Actions that increase reported net income will always increase cash flow.

B) One way to increase EVA is to generate the same level of operating income but with less total invested capital.

C) One drawback of EVA as a performance measure is that it mistakenly assumes that equity capital is free.

D) One way to increase EVA is to achieve the same level of operating income but with more total invested capital obtained at a higher cost of capital.

E) If a firm reports positive net income,its EVA must also be positive.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Free cash flow (FCF) is,essentially,the cash flow that is available for interest and dividends after the company has made the investments in current and fixed assets that are necessary to sustain ongoing operations.

B) After-tax operating income is calculated as EBIT(1 - T) + Depreciation.

C) Two firms with identical sales and operating costs but with different amounts of debt and tax rates will have different operating incomes by definition.

D) If a firm is reporting its income in accordance with generally accepted accounting principles,then its net income as reported on the income statement should be equal to its free cash flow.

E) Retained earnings as reported on the balance sheet represent cash and are therefore available to distribute to stockholders as dividends or any other required cash payments to creditors and suppliers.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The fact that interest income received by corporations is excluded from its taxable income encourages firms to finance with more debt than they would in the absence of this tax law provision.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Since companies can deduct dividends paid but not interest paid,our tax system favors the use of equity financing over debt financing,and this causes companies' debt ratios to be lower than they would be if interest and dividends were both deductible.

B) Interest paid to an individual is counted as income for federal tax purposes and taxed at the individual's regular tax rate,which in 2018 could go up to 37%,but qualified dividends received are taxed at a maximum rate of 15% for most individuals.

C) The maximum federal tax rate on corporate income in 2018 was 50%.

D) Corporations obtain capital for use in their operations by borrowing and by raising equity capital,either by selling new common stock or by retaining earnings.The cost of debt capital is the interest paid on the debt,and the cost of the equity is the dividends paid on the stock.Both of these costs are deductible from income when calculating income for tax purposes.

E) The maximum federal tax rate on personal income in 2018 was 50%.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The statement of cash flows reflects cash flows from operations,but it does not reflect the effects of buying or selling fixed assets.

B) The statement of cash flows shows where the firm's cash is located;indeed,it provides a listing of all banks and brokerage houses where cash is on deposit.

C) The statement of cash flows reflects cash flows from continuing operations,but it does not reflect the effects of changes in working capital.

D) The statement of cash flows reflects cash flows from operations and from borrowings,but it does not reflect cash obtained by selling new common stock.

E) The statement of cash flows shows how much the firm's cash--the total of currency,bank deposits,and short-term liquid securities (or cash equivalents) --increased or decreased during a given year.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In finance,we are generally more interested in cash flows than in accounting profits.Free cash flow (FCF)is calculated as after-tax operating income plus depreciation less the sum of capital expenditures and changes in net operating working capital.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

On the balance sheet,total assets must always equal the sum of total liabilities and equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brown Fashions Inc.'s December 31,2018 balance sheet showed total common equity of $4,050,000 and 165,000 shares of stock outstanding.During 2019,the firm had $450,000 of net income,and it paid out $100,000 as dividends.What was the book value per share at 12/31/19,assuming no common stock was either issued or retired during 2019? (Round your final answer to two decimal places. )

A) $32.80

B) $20.00

C) $22.93

D) $23.47

E) $26.67

G) B) and C)

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

In 2018,Appalachian Airlines had taxable income of -$3,000,000.In 2019,the company has taxable income of $5,000,000 and its corporate tax rate is 25%. Assume that the company takes full advantage of the Tax Code's carry-forward provision.How much will the company pay in taxes in 2019?

A) $1,452,000

B) $500,000

C) $950,000

D) $1,600,000

E) $200,500

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Typically,a firm's DPS should exceed its EPS.

B) Typically,a firm's net income should exceed its EBIT.

C) If a firm is more profitable than average,we would normally expect to see its stock price exceed its book value per share.

D) If a firm is more profitable than most other firms,we would normally expect to see its book value per share exceed its stock price,especially after several years of high inflation.

E) The more depreciation a firm has in a given year,the higher its EPS,other things held constant.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Van Dyke Corporation has a corporate tax rate equal to 25%.The company recently purchased preferred stock in another company.The preferred stock has an 8% before-tax yield.What is Van Dyke's after-tax yield on the preferred stock? Assume a 50% dividend exclusion for tax on dividends.(Round your final answer to two decimal places. )

A) 6.51%

B) 8.12%

C) 7.56%

D) 7.00%

E) 5.46%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A start-up firm is making an initial investment in a new plant and equipment.Assume that currently its equipment must be depreciated on a straight-line basis over 10 years,but Congress is considering legislation that would require the firm to depreciate the equipment over 7 years.If the legislation becomes law,which of the following would occur in the year following the change?

A) The firm's operating income (EBIT) would increase.

B) The firm's taxable income would increase.

C) The firm's cash flow would increase.

D) The firm's tax payments would increase.

E) The firm's reported net income would increase.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 138

Related Exams